Key Takeaways

- Vietnam’s virtual office market in 2025 is thriving, driven by hybrid work trends, FDI inflows, and demand for cost-efficient office solutions.

- Top providers like Regus, Dreamplex, Saigon Office, and Cekindo offer flexible packages, value-added services, and strategic locations.

- Businesses can benefit from professional addresses, mail handling, coworking access, and tailored support at highly competitive rates.

In 2025, Vietnam’s virtual office market is experiencing an unprecedented wave of growth, fueled by a dynamic economic landscape, a flourishing startup ecosystem, and a nationwide embrace of hybrid and remote work models. As businesses increasingly seek cost-effective, flexible, and professional alternatives to traditional office spaces, virtual office solutions have emerged as a strategic necessity—not merely a convenience. For entrepreneurs, foreign investors, freelancers, and SMEs alike, choosing the right virtual office provider can be the difference between operational agility and missed opportunities.

The concept of a virtual office is no longer limited to a prestigious mailing address. Today’s top providers in Vietnam deliver a comprehensive suite of services that often include call answering by professional receptionists, mail and package handling, access to coworking spaces and meeting rooms, business registration support, and even legal and tax advisory. These full-service models allow businesses to maintain a legitimate and professional presence in key economic zones like Ho Chi Minh City and Hanoi—without the high costs and commitments associated with leasing physical office space.

According to global research, the virtual office market was valued at USD 54.99 billion in 2023 and is projected to surge to USD 160.37 billion by 2030, achieving a CAGR of 16.52%. The Asia-Pacific region, in particular, is expected to dominate this expansion. Within this high-growth regional context, Vietnam has positioned itself as a leading frontier, thanks to its investment-friendly policies, high-speed digital infrastructure, and burgeoning foreign direct investment (FDI) ecosystem. In Ho Chi Minh City alone, 82% of office leasing demand in Q1 2025 came from FDI enterprises, signaling strong international confidence in Vietnam’s business environment.

Amid this market momentum, the competitive landscape of virtual office providers in Vietnam has diversified, ranging from globally established players like Regus, The Executive Centre, and WeWork, to agile, highly customized local firms such as WorkEasy, CirCO, Saigon Office, Dreamplex, and EMERHUB. Each of these providers offers a unique blend of pricing, service packages, and location advantages, tailored to specific business needs—be it affordability for early-stage startups, scalability for growing SMEs, or full-suite incorporation and compliance services for foreign businesses entering the Vietnamese market.

The rising demand for virtual offices in Vietnam is also driven by the increasing adoption of hybrid work models, with over 60% of companies in the country experimenting with blended remote setups as of 2025. This shift is reinforced by improved digital connectivity—including 65% nationwide 5G coverage, and expanded access to cloud-based collaboration tools. As businesses become more decentralized, the need for flexible, location-independent operational infrastructure becomes critical. Virtual office providers that offer a hybrid mix of physical and digital services are particularly well-positioned to thrive in this evolving environment.

Furthermore, pricing across providers is wide-ranging, starting from as low as VND 250,000/month (approx. USD 10) for basic mail-handling packages to over VND 5,000,000/month (USD 200+) for premium, full-service plans. While affordability remains a key criterion, decision-makers must also factor in value-added services, location prestige, reliability, customer support quality, and bundled coworking or meeting room access. With many providers offering tiered service plans, long-term contract discounts, and integrated business services, businesses can now choose a virtual office solution that aligns precisely with their current needs and future growth plans.

In this data-driven and carefully curated guide, we profile the Top 10 Virtual Office Providers in Vietnam for 2025, offering deep insights into their service offerings, pricing models, strengths, and strategic value. Whether you’re a local entrepreneur seeking a premium business address in District 1, a digital nomad looking for hybrid coworking options, or a foreign investor requiring incorporation and legal support, this comprehensive analysis will help you navigate Vietnam’s virtual office market with clarity and confidence.

Key Takeaways Covered in This Blog:

- Latest market size and forecast for virtual offices in Vietnam and globally

- Strategic drivers: FDI inflows, remote work culture, economic growth

- Comparative pricing and service matrix of leading providers

- Regional insights from Ho Chi Minh City and Hanoi office markets

- Best-value options for startups, SMEs, and multinational corporations

- Provider profiles with integrated services like tax, legal, and licensing

- Expert recommendations on how to choose the right virtual office provider in Vietnam

As Vietnam continues its rapid transformation into a Southeast Asian business hub, virtual offices will play a foundational role in supporting the agile, borderless businesses of tomorrow. Dive into our 2025 rankings to discover which providers are leading this transformation—and how your business can gain a competitive edge by choosing the right virtual workspace solution.

Top 10 Virtual Office Providers in Vietnam (2025)

- Regus

- The Executive Centre (TEC)

- WeWork

- Davinci Virtual

- Cekindo Vietnam

- EMERHUB

- Dreamplex

- Saigon Office

- WorkEasy coworking & café

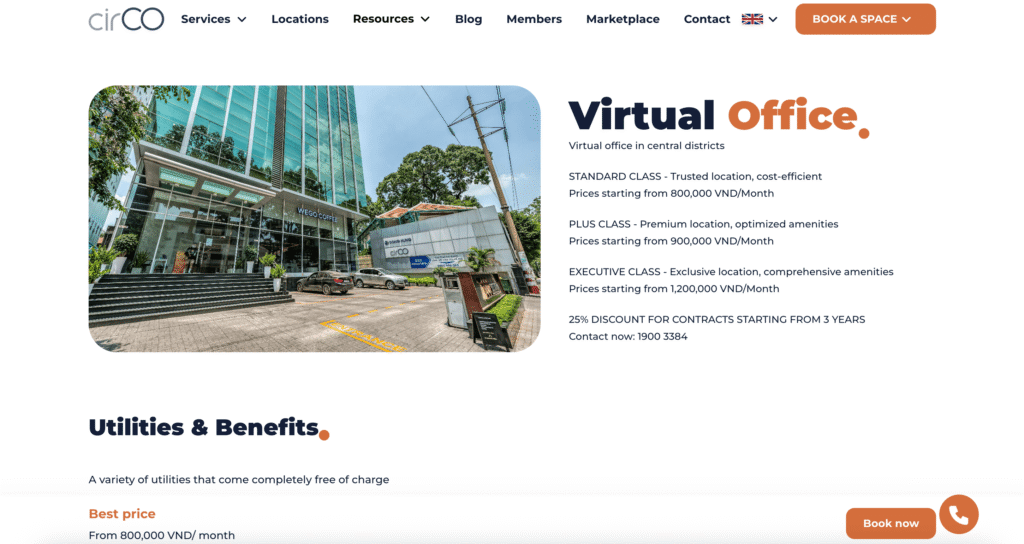

- CirCo

1. Regus

Regus, a subsidiary of IWG plc, has solidified its reputation as a global powerhouse in the realm of flexible workspaces. Its expansive global presence, premium service portfolio, and enterprise-grade infrastructure make it an ideal solution for companies with cross-border operations and global aspirations.

- Global Leadership in Flexible Workspaces

- Operates in over 4,000+ locations across 120+ countries, including a robust footprint in Vietnam.

- Offers unmatched cross-border consistency, enabling businesses to scale without geographical constraints.

- Ideal for multinational corporations (MNCs), foreign direct investment (FDI) enterprises, and regional headquarters seeking global integration.

- Strategic Fit for Vietnam’s FDI-Driven Economy

- With FDI enterprises occupying 82% of leased office space in Ho Chi Minh City, Regus’s global-standard services directly align with investor expectations.

- Foreign businesses entering Vietnam gain instant access to professional infrastructure, reducing setup lead times.

- Vietnamese enterprises expanding globally can use Regus’s network to create seamless international business continuity.

- Premium Pricing Justified by High-Value Deliverables

- Although not the lowest-cost provider, Regus’s extensive offerings and consistency across borders justify its premium pricing tier.

- Regus appeals to firms valuing operational simplicity, consistent service levels, and legally compliant office solutions.

National Presence and Office Network in Vietnam

| City | Notable Regus Locations | Coverage Highlights |

|---|---|---|

| Ho Chi Minh City | Zeta Building, L’Mak | High-end business districts |

| Hanoi | 9 strategic locations (including Press Club) | Proximity to government and enterprise hubs |

| Da Nang | Indochina Riverside Tower, The An Nam Khanh | Central Vietnam commercial access |

- Locations are selected for prestige, accessibility, and connectivity, ensuring visibility and ease for client interactions.

Virtual Office Plans & Tiered Pricing Matrix (2025)

| Package | Description | HCMC (VND) | Hanoi (VND) | Da Nang (VND) |

|---|---|---|---|---|

| Business Address | Prestigious business address suitable for licensing, legal documentation, and mail reception. | 950,000 – 1,890,000 | From 1,150,000 | From 1,050,000 |

| Virtual Office | Business address + mail handling, call answering, receptionist services, and access to Regus global network. | 2,190,000 – 3,290,000 | From 2,390,000 | From 2,150,000 |

| Virtual Office Plus | Full-featured plan with added access to meeting rooms and 5 office days/month at any global Regus location. | 4,190,000 – 5,750,000 | From 3,850,000 | From 3,550,000 |

- Flexible billing cycles and customizable service add-ons available based on business needs.

- Packages support legal company registration, making them fully compliant for foreign-owned entities operating in Vietnam.

Included Amenities Across All Plans

- Mail Handling Services

- Reception, scanning, forwarding, and secure storage.

- Live Call Answering(Available with VO and VO Plus)

- Branded receptionist services for a polished business image.

- Global Lounge Access

- Entry to Regus’s business lounges worldwide—ideal for traveling executives.

- Meeting Room Credits(VO Plus only)

- Monthly access to professional meeting spaces across the Regus network.

- Day Office Access(VO Plus)

- 5 days per month of hot-desking or private office use globally.

- Legally Registerable Business Address

- Compliant with Vietnamese business licensing regulations.

- Month-to-Month Contracts

- Ideal for startups and scaling businesses seeking agility.

Client Experience and Service Reputation

- Example Feedback: Regus – Press Club, Hanoi

- Average Rating: 4.92 / 5

- Key Highlights from Reviews:

- Prime downtown location close to government and banking institutions.

- Friendly, professional staff skilled in handling client needs.

- Well-equipped meeting rooms with modern facilities.

- Regus Vietnam maintains a high client retention rate, especially among international consulting firms, tech startups, and representative offices.

Comparative Advantage Matrix: Regus vs Other Virtual Office Providers in Vietnam (2025)

| Criteria | Regus | Local Providers |

|---|---|---|

| Global Office Access | ✔ 4,000+ locations | ✘ Typically local only |

| FDI Readiness | ✔ High compliance standards | ✘ Varies widely |

| Prestige of Business Address | ✔ Premium-grade locations | ✘ Often shared co-working spaces |

| Legal Registerability | ✔ 100% compliant | ✔ / ✘ Case-dependent |

| Pricing | ✘ Premium pricing | ✔ Budget-friendly |

| Flexibility & Scalability | ✔ Month-to-month, scalable | ✔ / ✘ Limited flexibility |

| Multilingual Support | ✔ English, Vietnamese, more | ✘ Vietnamese only often |

Final Word: Why Regus Is a Standout Virtual Office Provider in Vietnam

Regus is not just another virtual office provider—it is a strategic infrastructure partner for companies looking to operate within Vietnam’s complex, fast-evolving economic landscape. With international-standard compliance, a future-proof office network, and proven client satisfaction, Regus delivers business-ready environments that empower growth, agility, and credibility.

Its inclusion among the Top 10 Virtual Office Providers in Vietnam (2025) is both a reflection of its unmatched global synergy and a recognition of its ability to meet the nuanced demands of Vietnam’s FDI-heavy, business-centric environment. For businesses seeking to operate seamlessly, expand confidently, and compete globally, Regus remains a preferred choice.

2. The Executive Centre (TEC)

The Executive Centre (TEC) has carved out a distinct position within Vietnam’s virtual office ecosystem by offering a hybridized service model that integrates digital convenience with high-end physical office access. Focused on serving high-growth, investor-attractive cities such as Ho Chi Minh City, TEC’s service architecture is purpose-built for modern businesses—especially startups, SMEs, and international firms looking for prestige, flexibility, and community.

- Positioned Within Grade A Buildings Only

- All TEC virtual offices in Vietnam are located within premium commercial buildings in District 1, Ho Chi Minh City—offering unparalleled business credibility.

- Addresses include Friendship Tower, Saigon Centre Tower 1, and The Nexus, all within the city’s commercial and financial core.

- Member-Centric Philosophy

- TEC’s “Members-First” model influences not only service quality but also workplace aesthetics, creating a professional and inspiring environment tailored for modern enterprises.

- This philosophy extends into its flexible service delivery and curated community-building events.

- Bridging the Virtual-Physical Divide

- By including coworking hours in every plan (8 hours in entry-level, 20 hours in premium), TEC addresses the needs of today’s semi-remote teams.

- This unique hybrid structure gives startups and mobile teams periodic physical presence—ideal for client meetings, focused work, or collaborations—without committing to full-time leases.

TEC Vietnam: Location and Network Snapshot

| City | Grade A Buildings | Strategic Advantages |

|---|---|---|

| Ho Chi Minh City | – Friendship Tower – Saigon Centre Tower 1 – The Nexus | – Central District 1 – Proximity to key banks, consulates, and FDI firms |

- Exclusively located in HCMC’s central business district, ensuring visibility and legitimacy for international and domestic clients alike.

- Locations cater specifically to companies requiring prestigious addresses for legal registration, licensing, and professional perception.

Service Packages & Pricing Matrix (Monthly, VND)

| Plan | Key Features | Monthly Price (VND) |

|---|---|---|

| Business Address | – Prestigious address for registration and mail – 8 hours/month coworking access – Real-time mail alerts | From 1,100,000 |

| Call Handling | – Dedicated phone number – Bilingual receptionist call answering – 24/7 voicemail with email sound files | From 1,500,000 |

| Premium Package | – Full-featured solution: address + call handling – 20 hours/month coworking – Mail and call management | From 2,500,000 |

- Flexible monthly pricing with volume discounts for longer commitments (e.g., 10% discount for annual plans).

- All packages are designed to be legally compliant for Vietnamese company registration.

Key Amenities and Differentiators

- Multilingual Front Desk Support

- Bilingual (Vietnamese-English) receptionists offer seamless communication for international clientele.

- Virtual Mail & Call Management

- Digital access to mail delivery status and voicemail audio files sent via email.

- Meeting Room & Lounge Access

- On-demand access to executive-grade meeting and conference rooms at preferential member rates.

- Integrated Coworking Hours

- Adds operational agility for businesses needing temporary workspaces for teams or visiting staff.

- TEC Community™ Network

- Access to networking events, curated forums, and workshops to build partnerships and client pipelines.

- Flexible Contracts

- Month-to-month options support startups and short-term market entrants while annual contracts offer cost savings.

Comparative Analysis: TEC vs Other Virtual Office Providers (2025)

| Evaluation Metric | The Executive Centre (TEC) | Other Premium Providers |

|---|---|---|

| Office Location Quality | ✔ Only Grade A Buildings in CBD | ✔ / ✘ Mixed-tier buildings |

| Coworking Hours Included | ✔ 8–20 hours monthly in all plans | ✘ Typically not included |

| Call Handling with Bilingual Staff | ✔ Included in dedicated plans | ✔ / ✘ English-only or external vendor |

| Legal Business Registration | ✔ Fully compliant address usage | ✔ / ✘ Case-dependent |

| Community Building Events | ✔ TEC Community™ curated programs | ✘ Limited or non-existent |

| Long-Term Discounts | ✔ 10% for 12-month commitment | ✔ Available in select cases |

| Target Audience Fit | ✔ Ideal for SMEs, Startups, Foreign Investors | ✔ Generalized offerings |

Client Profile & Use Cases

TEC’s hybridized virtual office model is tailored for:

- Startups & SMEs

- Seeking cost-effective operations while projecting a high-end brand image.

- Need occasional access to coworking or meeting rooms.

- Foreign Representative Offices

- Require prestigious, legally recognized addresses in FDI zones.

- Benefit from bilingual staff and proximity to consulates, banks, and regulators.

- Professional Services Firms

- Consultants, legal firms, and asset managers leveraging TEC’s Grade A presence and reception services to impress clients and partners.

Why The Executive Centre is Among Vietnam’s Top Virtual Office Providers (2025)

The Executive Centre exemplifies the modern evolution of virtual work environments in Vietnam. It delivers not just an address, but a multi-dimensional platform that supports legal compliance, operational agility, and professional credibility. Its premium infrastructure, bilingual support, and embedded coworking flexibility provide a robust alternative to traditional office leases—particularly relevant in Vietnam’s startup-centric, FDI-attractive, and digitally transforming business landscape.

For enterprises seeking to balance cost-efficiency with reputation and functionality, TEC emerges as a top-tier choice in 2025, earning its place as one of Vietnam’s leading virtual office providers.

3. WeWork

WeWork, a globally renowned brand synonymous with modern workspace innovation, continues to redefine the boundaries of flexible office solutions in Vietnam. While traditionally focused on physical coworking and private office spaces, WeWork has strategically expanded into virtual office services to meet the growing demand for hybrid work models.

Its offerings are especially attractive to startups, scale-ups, and multinational firms seeking an address that conveys both prestige and flexibility, while still enjoying access to world-class office amenities and a vibrant professional community.

- Blended Physical-Virtual Workspace Strategy

- WeWork provides a virtual business address solution that allows companies to legally register in Vietnam and manage business mail, all without a permanent physical office lease.

- Unlike conventional address-only providers, WeWork integrates virtual elements into its coworking memberships, offering physical workspace credits and access to collaborative areas as part of its ecosystem.

- Ideal for Hybrid Work Models

- Businesses can easily scale between virtual presence and on-site use, ideal for modern firms practicing flexible or remote-first operations.

- WeWork’s flexible terms allow businesses to book on demand, supporting everything from occasional meetings to long-term hybrid setups.

- Brand Strength and Community-Centric Design

- With an international reputation for elevated workplace design, wellness-driven interiors, and curated professional events, WeWork appeals to businesses that view office space as an extension of their brand and culture.

Locations in Vietnam: Strategic Urban Integration

| City | WeWork Locations | Building Grade | Business District Focus |

|---|---|---|---|

| Ho Chi Minh City | – E. Town Central – Lim Tower 3 | Grade A | CBD and tech-business clusters |

- All WeWork spaces in Vietnam are Grade A commercial buildings, situated in prime urban zones, making them ideal for legal registration and maintaining a reputable corporate image.

- Facilities are tailored to international standards, catering to both foreign-invested enterprises (FIEs) and high-growth Vietnamese companies.

Service Offerings & Indicative Pricing (Monthly, VND)

| Plan / Product | Key Inclusions | Starting Price (VND) | Availability |

|---|---|---|---|

| Coworking Membership | – Desk access – Mail/package handling – Meeting room credits – Networking events | 2,500,000 | E. Town Central (HCMC) |

| 4,800,000 | Lim Tower 3 (HCMC) | ||

| Virtual Business Address | – Legally register business – Receive mail and packages – Optional mail forwarding | Upon Inquiry | Available via all Vietnam sites |

| WeWork On Demand | – Pay-per-use for office/day pass or meeting rooms | Varies by location/time | HCMC, global availability |

Note: WeWork’s Virtual Business Address plan is not listed publicly as a standalone product but is available upon request, tailored to business needs.

Included Amenities and Value-Added Services

| Category | Details |

|---|---|

| Connectivity | High-speed Wi-Fi, video conferencing tools, secure enterprise-grade network |

| Workspace Access | Meeting rooms, event spaces, hot desks, lounges |

| Reception Services | Onsite staff for guest check-ins and concierge-level support |

| Business Equipment | Printing stations, private phone booths, AV-equipped conference rooms |

| Cleaning & Maintenance | Professional daily cleaning and sanitization routines |

| Community Perks | Access to social events, wellness programs, professional workshops |

- WeWork’s multi-functional shared zones encourage cross-industry networking, making them ideal incubators for innovation, especially for startups and freelancers.

- The ambiance and amenities rival traditional offices while offering significantly greater flexibility and scalability.

Comparative Matrix: WeWork vs Competitors in Vietnam’s Virtual Office Landscape (2025)

| Criteria | WeWork | Local Providers | Premium Operators (e.g., TEC) |

|---|---|---|---|

| Global Brand Recognition | ✔ High | ✘ Limited | ✔ Moderate |

| Legal Business Address | ✔ Available upon inquiry | ✔ Widely available | ✔ Widely available |

| Mail & Package Handling | ✔ Included | ✔ Included in upper-tier plans | ✔ Included |

| Coworking Access | ✔ Coworking + credits included | ✘ Often not included | ✔ Limited hours |

| On-Demand Booking Flexibility | ✔ Pay-as-you-go options | ✘ Rare | ✔ Limited |

| Community & Networking Events | ✔ Strong emphasis | ✘ Minimal | ✔ Moderate |

| Price for Entry-Level Packages | ✘ Higher-end starting price | ✔ Budget-friendly | ✔ Mid-range |

| Office Design & Environment | ✔ Innovative, productivity-focused | ✘ Standard | ✔ Elegant, corporate-focused |

Ideal Client Profiles

- Tech Startups & App Developers

- Require collaborative and stimulating spaces for agile teams.

- Prefer community integration and creative ambiance.

- Remote-First International Firms

- Need legal registration and occasional in-country workspace.

- Benefit from WeWork’s global access and brand recognition.

- Creative Agencies & Freelancers

- Value on-demand access and community events for networking and growth.

- FDI Enterprises

- Seek prestigious office addresses in Grade A buildings to enhance brand trust.

- Require support services in English and Vietnamese for cross-border operations.

Why WeWork Deserves a Spot Among Vietnam’s Top 10 Virtual Office Providers in 2025

WeWork’s distinctive approach to virtual offices in Vietnam stands out not through conventional address-only packages, but through its holistic integration of physical and virtual infrastructure. By offering mail-handling, legal registration addresses, coworking benefits, and global scalability, WeWork serves as a strategic workspace partner rather than just a provider.

Its premium-grade environment, high-caliber community engagement, and ability to facilitate hybrid workforce models place it firmly among the most relevant and future-forward providers in the Vietnamese market for 2025. For companies navigating the blurred lines between digital presence and physical workspace, WeWork delivers a comprehensive, scalable, and innovation-friendly solution tailored for modern success.

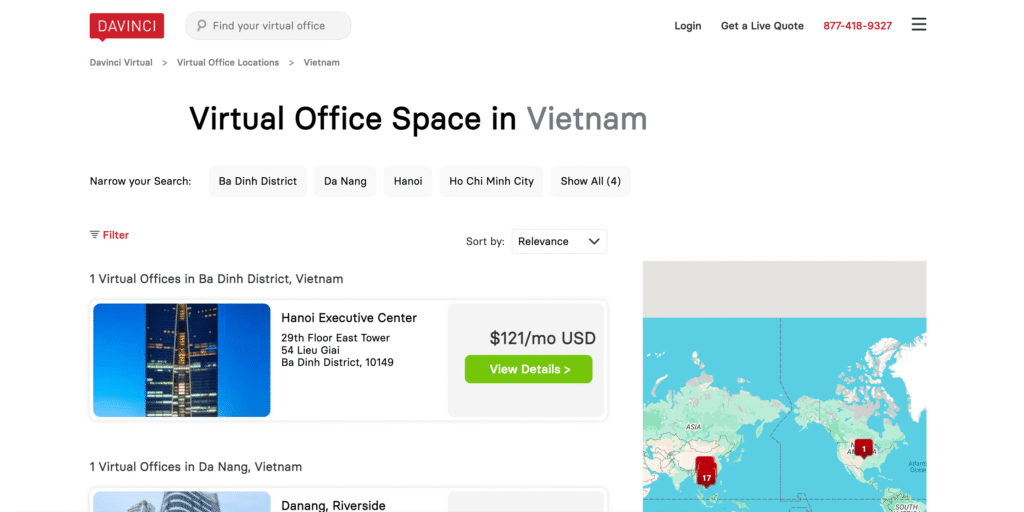

4. Davinci Virtual

Davinci Virtual, a long-established global provider of virtual office solutions, has steadily expanded its presence into key Asian markets, including Vietnam. Its core proposition is centered on affordable access to premium business addresses, complemented by an extensive array of virtual services catering to both local startups and international businesses entering the Vietnamese market.

- Global Reach with Local Anchoring

- Operates thousands of virtual office locations globally, offering immediate access to Vietnam-based addresses in Hanoi and Ho Chi Minh City, aligned with international compliance standards.

- This global presence makes Davinci an ideal option for foreign firms seeking initial market entry with low overhead while maintaining a professional image.

- Affordability and Scalability

- Davinci Virtual offers some of the most competitively priced virtual office packages in Vietnam, with entry points as low as $39/month USD.

- Their pricing model is particularly attractive for startups, freelancers, and SMEs with constrained budgets yet requiring formal business registration and professional presence.

- Comprehensive Service Portfolio

- Services extend beyond basic address rental, offering call handling, virtual receptionist, mail forwarding, and on-demand workspace access, ensuring operational flexibility.

- Critical Trade-Offs

- Despite its cost advantages, persistent client feedback on delayed mail handling and subpar customer service experiences have emerged as risk factors.

- For businesses handling time-sensitive legal, financial, or regulatory correspondence, this could result in compliance lapses or reputational harm.

Location Overview: Nationwide Virtual Office Network

| City | Virtual Office Sites | Highlights |

|---|---|---|

| Hanoi | – Daeha – Spaces Belvedere – Hanoi Tower – Sagawa Lieu Giai – Ly Thai To – The Sun Building – HQ Millennium – Sagawa D’Capitale – Sagawa VinSmart City – Sagawa TSQ Euroland | – 10+ premium address options – Located in central business and diplomatic districts |

| Ho Chi Minh City | – Multiple Grade B & A building locations (specifics on request) | – Availability across key business zones |

- Locations in both cities offer legal registrability, making them viable for foreign-owned enterprise (FOE) and domestic company setups.

Service Plans and Pricing Structure

| Plan Type | Included Services | Pricing (Monthly USD) |

|---|---|---|

| Virtual Office Address | – Prestigious business address – Mail/package receipt – Optional forwarding | From $39 in Hanoi From $56 in HCMC |

| Virtual Receptionist | – Local phone number – Professional call answering – Message forwarding | Add-on pricing applies |

| Mail Forwarding Service | – Forwarding of postal mail to preferred address (domestic/international) | Extra charges based on frequency |

| On-Demand Office Access | – Day office, meeting rooms, coworking (hourly) | From $3/hour (coworking) |

| Web Chat & Business Support | – Web chat agents, admin support, appointment setting | Premium add-ons per location |

Setup Fee: Standard $199 one-time, with discounts (e.g., $150) occasionally available per site.

Hourly Pricing Breakdown: Physical Office Usage

| Facility Type | Hanoi Rate (USD/hour) | HCMC Rate (USD/hour) |

|---|---|---|

| Coworking Space | $3 – $23 | $3 – $23 |

| Day Office | $7 – $45 | $7 – $45 |

| Meeting Rooms | $12 – $58 | $12 – $58 |

- These rates allow businesses to activate in-person operations as needed, supporting hybrid and client-facing engagements without long-term leases.

Key Amenities and Support Services

- Live Virtual Receptionists

- Available in English and Vietnamese (varies by center), delivering a professional image through consistent call handling.

- Meeting & Conference Facilities

- Bookable on demand; ideal for client interactions, workshops, or internal meetings.

- Business Mail Handling

- Incoming mail and packages received and stored; optional forwarding and scanning services offered.

- Administrative Support

- Access to Davinci’s Business Support Center, offering scheduling, document prep, and virtual assistance packages.

- Flexible Terms

- Month-to-month contracts with options to expand services as business scales.

Comparative Analysis: Davinci Virtual vs Market Competitors in Vietnam (2025)

| Service Criteria | Davinci Virtual | Local Providers | Premium Operators (e.g., Regus, TEC) |

|---|---|---|---|

| Entry-Level Pricing | ✔ Very Affordable ($39/month) | ✔ Budget-friendly | ✘ Higher pricing |

| Legal Business Address | ✔ Yes, with registration use | ✔ Available | ✔ Available |

| Mail Forwarding | ✔ Available (additional cost) | ✔ / ✘ Varies | ✔ Included in upper-tier plans |

| Call Handling / Reception | ✔ Add-on packages | ✘ Rarely included | ✔ Standard in higher plans |

| On-Demand Workspace Access | ✔ Hourly basis | ✘ Limited availability | ✔ Available, often monthly credits |

| Customer Service Quality | ✘ Mixed to poor reviews | ✔ Responsive (smaller scale) | ✔ Strong reputation |

| Suitable for Time-Sensitive Ops | ✘ Potential risk due to mail delays | ✔ / ✘ Case-dependent | ✔ High reliability |

Target Audience and Ideal Use Cases

- Entrepreneurs and Micro-Businesses

- Require low-cost virtual presence in Vietnam with minimal operational needs.

- Value price and legal address over in-person interactions.

- Freelancers and Independent Consultants

- Need a professional image and contact infrastructure to enhance client trust.

- Foreign Startups Testing Vietnam Entry

- Want fast registration and address compliance without long-term leases or capital outlay.

- Budget-Conscious SMEs

- Benefit from the ability to layer services as needed—scaling only when demand increases.

Considerations Before Choosing Davinci Virtual

While Davinci Virtual clearly meets core criteria such as affordability, location variety, and scalability, prospective clients must carefully evaluate operational risks—particularly if mail delivery speed or critical document processing is essential to business operations.

Businesses dealing with legal contracts, investor relations, government filings, or time-bound correspondence should ensure they understand the SLA (Service-Level Agreement) on mail processing or opt for add-on priority services if available.

Final Assessment: Why Davinci Virtual Earns a Spot Among Vietnam’s Top Virtual Office Providers (2025)

Davinci Virtual stands out in Vietnam’s 2025 virtual office landscape for its aggressive pricing, broad location portfolio, and flexible service model, making it one of the most accessible platforms for entrepreneurs and international market entrants. Its ability to deliver legally compliant, low-barrier office infrastructure is a strategic asset in a country where business formalization remains critical to market participation.

Despite reliability concerns around customer service and mail handling, its customizability, cost-efficiency, and broad geographic coverage ensure it remains a strong contender in Vietnam’s competitive virtual office sector, particularly for businesses prioritizing cost control and legal address setup over high-touch support.

5. Cekindo Vietnam

Cekindo Vietnam has established a niche as a market-entry specialist for foreign companies, uniquely positioning its virtual office offerings within a comprehensive suite of legal, corporate, and administrative support services. Unlike typical virtual office providers that focus solely on addresses or mail handling, Cekindo leverages its deep knowledge of Vietnam’s legal and regulatory landscape to offer a turnkey solution for companies looking to establish a compliant and efficient operational base.

- Integrated Market Entry Support

- Cekindo’s virtual office is not a standalone product but rather an extension of its business setup framework.

- This is particularly valuable for foreign direct investment (FDI) companies, which accounted for 82% of leased commercial space in Ho Chi Minh City as of 2025—underscoring the demand for tailored legal infrastructure and localized expertise.

- Foreign-Focused, Compliance-Driven Model

- Ideal for foreign investors, joint ventures, and branch offices, the virtual office service ensures all documentation meets regulatory standards for incorporation, license registration, and visa support.

- Cekindo reduces entry friction by providing a single point of coordination for everything from legal address setup to tax reporting.

- High Perceived Value Through Administrative Simplification

- Offers clear operational benefits for companies unfamiliar with Vietnam’s bureaucratic processes.

- Serves as a one-stop solution to minimise risks and delays associated with DIY or fragmented service setups.

Geographic Coverage: Cekindo Virtual Office Locations in Vietnam

| City | District | Office Locations | Strategic Benefits |

|---|---|---|---|

| Ho Chi Minh City | District 3 | Nguyen Van Mai Street | Central location, near major commercial and legal zones |

| Binh Thanh District | Vinhomes Central Park | Premium mixed-use area with residential-business blend | |

| Thu Duc City | Hiep Binh Residential Area | Emerging tech and education-focused business zone |

- All locations are legally recognized for business registration, offering credibility for licensing and investor documentation.

- The distributed placement supports a variety of industry needs, from legal firms and tech startups to foreign trade offices.

Service Packages and Pricing (2025)

| Service Type | Details | Price |

|---|---|---|

| Virtual Office – Standard | – Legal business address – Mail & parcel handling – Optional meeting room use | VND 550,000 / month |

| Virtual Office – Foreign Firms | – Tailored for foreign investors – Includes business address, mail service, and documentation support | VND 880,000 / month |

| Hourly Business Advisory Services | – Corporate secretarial, market research, setup assistance | USD $25 – $49 / hour |

Packages are priced to ensure accessibility for startups and SMEs, while still offering the depth and reliability required by multinational investors.

Additional Services Bundled with Virtual Office Plans

- Business Establishment & Incorporation

- Full registration support for local entities, branches, and rep offices.

- Licensing, shareholder documents, and capital contribution processes managed end-to-end.

- Professional Secretarial Services

- Provision of a dedicated receptionist to manage calls and provide client-facing professionalism.

- Document drafting, minutes preparation, and compliance reminders.

- Work Permit & Visa Assistance

- End-to-end advisory for foreign staff permits, investor visas, and residence cards.

- Meeting Rooms & Workspaces On-Demand

- Shared or private spaces available upon request, useful for compliance inspections or client meetings.

- Payroll & Tax Administration

- Optional add-on services to support company operations post-registration.

- Local payroll compliance, PIT filing, and corporate tax preparation.

Key Differentiators: Cekindo vs Other Virtual Office Providers

| Evaluation Criteria | Cekindo Vietnam | Traditional Providers | Premium Global Brands (e.g. Regus) |

|---|---|---|---|

| Foreign Market Entry Expertise | ✔ Deep regulatory and compliance support | ✘ Minimal | ✔ Moderate |

| Legal Address for Registration | ✔ 100% compliant | ✔ Available | ✔ Available |

| Bundled Business Advisory Services | ✔ End-to-end market entry support | ✘ Not available | ✘ Limited |

| Price Point for Entry Plans | ✔ Highly competitive (VND 550K–880K) | ✔ Variable | ✘ Higher |

| Visa, Tax, Payroll Support | ✔ Integrated | ✘ Not included | ✘ Add-on (if available) |

| Ideal for Foreign-Owned Enterprises | ✔ Strong alignment with FDI needs | ✘ Limited local knowledge | ✔ Corporate-ready |

| Service Customizability | ✔ High | ✘ Low | ✔ Medium |

Target Client Profiles

- Foreign Entrepreneurs & SMEs

- Entering Vietnam for the first time, seeking a cost-effective yet legally compliant setup with support in English.

- Multinational Expansion Teams

- Need local regulatory navigation, legal documentation, and operational execution without internal HR investment.

- Startups & Rep Offices

- Require an entry-level legal address bundled with optional meeting space and call handling, all managed through a single local partner.

- Business Process Outsourcing Clients

- Delegating non-core functions like payroll, visa, and tax reporting to reduce risk and focus on market penetration.

Verified Client Feedback: A Snapshot of Service Quality

| Criteria | Client Rating (Out of 5) | Client Commentary |

|---|---|---|

| Overall | 5.0 | “Very thorough, detailed service where they were able to simplify our business setup.” |

| Service Quality | 5.0 | High satisfaction with responsiveness, clarity, and advisory support |

| Timeliness | 5.0 | Known for adhering to timelines and registration deadlines |

- The single available review reinforces the highly specialized, client-focused delivery model that defines Cekindo’s business philosophy.

- While the review pool is limited, the qualitative feedback suggests a high degree of professionalism and operational reliability.

Conclusion: Why Cekindo Vietnam is a Top Virtual Office Provider in 2025

Cekindo Vietnam earns its place among Vietnam’s top virtual office providers in 2025 by offering far more than just a mailing address. It presents a comprehensive infrastructure for foreign market entry, allowing companies to establish a legitimate, compliant, and scalable presence in Vietnam with minimal operational friction.

By bundling legal setup, mail services, virtual reception, advisory expertise, and workspace access into a single relationship, Cekindo provides what few others in the virtual office market do: end-to-end enterprise enablement. This is particularly relevant in a Vietnamese business environment increasingly shaped by regulatory complexity and global investor interest.

For international firms, high-growth startups, and enterprises requiring localized compliance assurance, Cekindo is not just a service provider—it is a strategic partner for long-term success in Vietnam.

6. EMERHUB

EMERHUB has carved out a distinctive position within Vietnam’s virtual office market by offering a highly integrated service ecosystem tailored specifically for foreign companies entering emerging markets. Its virtual office solution is not a stand-alone feature, but rather a core component of a larger, strategically designed corporate service offering that encompasses everything from company incorporation to long-term compliance.

- Purpose-Built for Foreign Market Entrants

- EMERHUB caters specifically to international investors and businesses seeking streamlined market access in Vietnam.

- Its services mitigate local bureaucratic hurdles, ensuring compliance from day one, which is essential for avoiding delays or rejections during company setup.

- Annual Pricing Model for Long-Term Stability

- Unlike most virtual office providers that operate on a monthly billing cycle, EMERHUB adopts a flat annual rate of USD 1,200, offering predictability and administrative simplicity.

- This is highly advantageous for companies focused on cost control, operational stability, and strategic market entry planning.

- Reduces transaction friction and offers a clear yearly budgeting structure, ideal for CFOs and legal teams managing regional expansion.

- Integrated Service Delivery

- Virtual office packages are fully embedded in EMERHUB’s wider service offerings, which include company registration, HR outsourcing, legal compliance, and import-export facilitation.

- This makes EMERHUB a single-source solution for all business setup and back-office needs in Vietnam.

Location Focus: Centralised in Vietnam’s Economic Heart

| City | District | Strategic Rationale |

|---|---|---|

| Ho Chi Minh City | District 1 | – Located in Vietnam’s financial hub – Ideal for legal registration, credibility, and accessibility to authorities and partners |

- EMERHUB’s presence in District 1, Ho Chi Minh City, provides businesses with immediate visibility and credibility in Vietnam’s most commercially dynamic zone.

- District 1 is home to major law firms, government offices, and financial institutions, ensuring fast turnaround for official processes.

Service Offerings and Pricing Structure

| Service Category | Inclusions | Pricing |

|---|---|---|

| Virtual Office Plan | – Registered legal business address – Mail handling & forwarding – Meeting room access | USD 1,200/year (≈ USD 100/month) |

| Dedicated Work Desk (Add-on) | – Desk space at EMERHUB office for stationed employees | USD 250/month per desk |

| Company Registration | – Full business incorporation support | From USD 3,500 |

| Other Advisory Services | – Payroll, tax reporting, FDA/trademark registration, visa/work permit, importer of record | USD 25 – USD 49/hour |

- The flat annual pricing model makes EMERHUB particularly competitive for businesses that value simplicity, reduced administrative tasks, and long-term commitment.

- Additional service layers can be modularly added, allowing clients to build a customised compliance and operations suite.

Extended Corporate Services Aligned with Virtual Office Packages

- Business Establishment

- End-to-end company setup including licensing, documentation, capital registration, and shareholder agreements.

- Legal & Regulatory Compliance

- Support with FDA registrations, trademark filings, and corporate law adherence for foreign-invested enterprises (FIEs).

- Visa and Work Permit Support

- Full processing of investor visas, work permits, and dependent visas with ongoing renewal management.

- Payroll & Tax Outsourcing

- Monthly payroll management, statutory filings, and local compliance advisory.

- Importer of Record Services

- A unique differentiator allowing foreign companies to legally import goods without a local legal entity.

- Workforce Hosting Solutions

- Employees can be legally hosted under EMERHUB’s entity in the interim period before formal company establishment.

Competitive Comparison Matrix: EMERHUB vs. Key Competitors in Vietnam

| Evaluation Criteria | EMERHUB | Conventional VO Providers | Premium Global Firms (e.g. Regus) |

|---|---|---|---|

| Foreign Market Specialization | ✔ High | ✘ Low | ✔ Moderate |

| Annual Flat Pricing | ✔ Yes (USD 1,200/year) | ✘ Monthly only | ✘ Monthly only |

| Regulatory Setup Support | ✔ Comprehensive | ✘ Not included | ✔ Limited to referrals |

| Importer of Record Services | ✔ Unique value-added feature | ✘ Not offered | ✘ Not offered |

| Employee Hosting Capability | ✔ Yes | ✘ No | ✘ No |

| Customisation & Scalability | ✔ High | ✔ Medium | ✔ Medium |

| Cost-Efficiency (Long-Term) | ✔ Predictable & efficient | ✔ Lower entry cost, but less value | ✘ Higher entry and long-term cost |

Ideal Client Profiles for EMERHUB’s Virtual Office Solutions

- International SMEs & Enterprises Entering Vietnam

- Require both legal presence and corporate advisory support to navigate Vietnam’s evolving regulatory framework.

- Exporters & Manufacturers

- Benefit from importer of record services and regulatory compliance tools, particularly in sectors such as food, cosmetics, electronics, and pharmaceuticals.

- Remote/Hybrid Teams with Local Presence Needs

- Use EMERHUB’s desk rental add-on to station local staff during transitional periods or temporary projects.

- Investment Holding Companies & Reps Offices

- Establish a registered address and compliance base while retaining the flexibility of outsourced legal and HR infrastructure.

Client Feedback and Market Recognition

| Metric | Feedback |

|---|---|

| Service Coverage | 100% focus on Business Services and Virtual Office support |

| Customer Satisfaction | High trust among international clients |

| Client Perception | Recognised for depth of knowledge, responsiveness, and ability to simplify complex processes |

- EMERHUB’s targeted service model and focus on emerging markets like Vietnam have made it a go-to partner for international companies seeking certainty, clarity, and compliance.

Conclusion: Why EMERHUB Is a Top Virtual Office Provider in Vietnam (2025)

In the increasingly sophisticated and compliance-driven Vietnamese business environment, EMERHUB distinguishes itself as a strategic partner for foreign companies, offering far more than a business address. Its virtual office product is part of a fully integrated market entry architecture, enabling investors and global businesses to operate legally, efficiently, and flexibly from day one.

The provider’s annual flat-fee model, depth in legal and corporate services, and value-added options like importer of record and employee hosting make it uniquely valuable for businesses that prioritize long-term planning, regulatory assurance, and operational agility.

For companies entering Vietnam in 2025, EMERHUB offers not just a virtual office—but a ready-made launchpad into one of Southeast Asia’s fastest-growing economies.

7. Dreamplex

Dreamplex is redefining the virtual office paradigm in Vietnam by integrating workplace culture, wellness, and engagement into its core offering. Rather than limiting its services to conventional mail handling or address registration, Dreamplex has evolved its model into what can best be described as “Workspace-as-a-Service.” This transformation reflects a deep understanding of the modern business environment, particularly in Vietnam’s urban centres, where hybrid teams, talent retention, and employee well-being are becoming increasingly central to organisational success.

- Beyond Address: Experience-Driven Virtual Office Model

- Dreamplex positions its virtual office as a gateway to a vibrant business ecosystem, combining the functionality of a professional address with the intangible benefits of community, creativity, and corporate wellness.

- Its branding emphasises “happier team members,” community integration, and employee-centric design—indicating a strategic focus on companies that value people-first policies even in remote-first or hybrid setups.

- Ideal for Employer Branding in Vietnam’s Competitive Talent Market

- The service is tailored for companies seeking to differentiate themselves through culture and employee experience, offering training programs, creative workshops, wellness events, and social engagement as part of the package.

- This is especially relevant in Ho Chi Minh City and Hanoi, where top-tier talent is increasingly drawn to companies with flexible, human-centric cultures.

Location Footprint: Strategically Positioned Across Key Urban Centres

| City | District/Street | Purpose & Appeal |

|---|---|---|

| Ho Chi Minh City | Tran Quoc Toan | Central location ideal for access to government and commercial hubs |

| Le Hien Mai | Popular with startups and digital-first enterprises | |

| Nguyen Trung Ngan | In proximity to downtown business clusters | |

| Tran Quang Khai | Attractive for SMEs requiring accessible workspace | |

| Ngo Quang Huy | Suitable for creative firms and agencies | |

| Hanoi | Thai Ha | Prominent location with excellent access to urban amenities and residential areas |

- All locations are legally recognised for business registration and offer on-demand access to physical workspaces, enhancing operational flexibility while maintaining a consistent brand presence.

Virtual Office Service Inclusions

| Component | Details |

|---|---|

| Business Address | Prestigious, legal address usable on company registration documents and public materials |

| Workspace Access | One complimentary monthly day of access to any Dreamplex location for work or client meetings |

| Reception Services | Professional reception and mail handling to reinforce a real-office impression |

| Community Access | Full member benefits including access to events, wellness programs, and professional development sessions |

| Employee Perks & Programs | Training workshops, networking meetups, team-building activities, and curated well-being initiatives |

| Flexible Workspace Design | Access to aesthetically designed and productivity-focused work environments |

- Dreamplex’s virtual office solution provides a full-spectrum experience that bridges the gap between digital operations and tangible work environments, designed to support employee satisfaction and brand credibility simultaneously.

Pricing & Terms

| Service Component | Pricing Information |

|---|---|

| Virtual Office Package | Pricing not publicly listed; available via quote or consultation |

| Minimum Contract Term | 12 months (required) |

| Additional Business Services | USD $25 – $49 per hour (for services such as consulting, events) |

Businesses are encouraged to contact Dreamplex directly to customise their virtual office experience based on location, headcount, and service integration needs. This tailored model reflects Dreamplex’s emphasis on custom-fit experiences over rigid, one-size-fits-all plans.

Competitive Differentiators: Why Dreamplex Stands Out

| Evaluation Criteria | Dreamplex | Traditional VO Providers | Global VO Chains (e.g. Regus, WeWork) |

|---|---|---|---|

| Community & Wellness Integration | ✔ Included in membership | ✘ Typically not included | ✔ Limited, varies by location |

| Focus on Team Experience | ✔ Central to brand identity | ✘ Often transactional | ✔ Some locations offer cultural events |

| Flexible Workspace Perks | ✔ Monthly workspace day included | ✘ Often extra or restricted | ✔ Meeting room access in higher-tier packages |

| Employer Branding Value | ✔ High, through experience and events | ✘ Low | ✔ Medium |

| Soft-Skill Development Support | ✔ Workshops, trainings, and well-being programs | ✘ Not offered | ✘ Limited |

| Customisability & Local Presence | ✔ Strong in HCMC and Hanoi | ✔ Varies | ✔ Good but more standardised globally |

Ideal Client Profiles

- Hybrid & Remote-First Companies

- Seeking to offer physical workspace access and cultural benefits to remote employees or local freelancers.

- Startups & SMEs Focused on Talent Attraction

- Want a professional registered office with the added draw of social events and growth-oriented programs.

- Creative Agencies & Tech Firms

- Appreciate flexible office options and vibrant environments that nurture creativity and innovation.

- HR & Culture-Driven Organisations

- Use Dreamplex’s soft offerings to reinforce internal culture, engagement, and retention even without a full-time office.

Client Feedback & Market Positioning

| Key Value Area | Client Perception |

|---|---|

| Brand Identity | Strong alignment with modern, experience-first companies |

| Reputation in Vietnam | Consistently recognised for workspace innovation and talent-focused service design |

| Client Testimonials (Informal) | Highlight positive energy, collaborative spaces, and meaningful community interactions |

- While specific review scores are not publicly detailed, Dreamplex is widely acknowledged as a premium workspace provider that prioritises the people aspect of business.

Conclusion: Why Dreamplex is a Top Virtual Office Provider in Vietnam (2025)

Dreamplex has successfully reimagined what a virtual office can be in the context of Vietnam’s rapidly evolving work culture. It moves far beyond the minimalistic services of address rental and mail handling, offering a human-centric model that blends the flexibility of virtual operations with the richness of real-world collaboration.

With locations across major business hubs, a well-curated suite of cultural and wellness programs, and a commitment to enhancing team productivity and satisfaction, Dreamplex is the go-to choice for companies that see their office not as a cost centre—but as a strategic tool for growth, engagement, and employer branding.

In 2025, as Vietnam continues to lead Southeast Asia’s shift toward hybrid and remote models, Dreamplex stands at the intersection of space, culture, and technology—making it one of the most innovative and strategically relevant virtual office providers in the country.

8. Saigon Office

Established in 2012, Saigon Office has emerged as a pioneer in Vietnam’s office leasing sector, uniquely positioned as one of the first U.S.-invested enterprises in the local real estate and workspace market. With a clear focus on affordability, legal compliance, and service scalability, Saigon Office’s virtual office offerings are especially attractive to startups, SMEs, and foreign-invested enterprises aiming to maintain a professional presence in Vietnam without incurring the high costs of physical office leasing.

- Low-Cost Entry with High Value

- Offers one of the lowest entry-level prices in the Vietnamese market at just VND 250,000/month.

- Highly suited to cost-conscious businesses that need a registered presence in Ho Chi Minh City.

- Tiered service model enables clients to scale their virtual office support as business demands evolve.

- Strategic Discounts Encourage Long-Term Commitments

- Discounts of up to three months free incentivise extended use of services, providing cost savings for businesses planning sustained operations in Vietnam.

- This pricing architecture aligns with the needs of growth-stage companies seeking predictable long-term cost structures.

- Integrated Legal Support

- Includes consultancy on investment and immigration law, positioning Saigon Office as more than just a workspace provider—it acts as a business partner for market entry and legal navigation.

Office Location: Strategic Focus on Ho Chi Minh City

| City | District/Coverage | Strategic Advantage |

|---|---|---|

| Ho Chi Minh City | Central Business District | Located in Vietnam’s economic core, offering credibility for business registration and visibility |

- A physical presence in Ho Chi Minh City continues to be crucial for foreign-invested and domestic companies, especially as 82% of leased office space in the city is occupied by FDI firms (source: CBRE/VIR).

- The Saigon Office address serves as a professional front for official communication, licensing, and investor relations.

Tiered Virtual Office Packages & Pricing

| Package Tier | Key Features | Monthly Rate (VND) |

|---|---|---|

| Basic | – Legal company address for transaction use only | 250,000 |

| Standard | – Business registration address – Company name displayed in a glass frame at ground floor | 1,000,000 |

| Advance | – All Standard features – Company name displayed outside building facade – Company profile on official website | 1,300,000 |

- Add-on Visibility & Branding Benefits

- The Advance package boosts brand visibility by showcasing company details on Saigon Office’s website, including a dedicated company introduction page.

- Physical signage options reinforce the impression of a real, established office—essential for client perception, regulatory checks, and investor relations.

Discount Matrix for Prepaid Contracts

| Contract Term | Discount Benefit | Effective Value |

|---|---|---|

| 12 months (1-year) | 1 month free | Equivalent to ~8.3% discount |

| 24 months (2 years) | 2 months free | Equivalent to ~8.3% discount |

| 36 months (3 years) | 3 months free | Equivalent to ~8.3% discount |

- This uniform discounting scheme reinforces Saigon Office’s commitment to long-term client relationships, offering clear incentives for businesses with multi-year strategies in Vietnam.

Key Differentiators: What Sets Saigon Office Apart

| Service Criteria | Saigon Office | Typical Local Providers | International Chains (e.g., Regus) |

|---|---|---|---|

| Entry-Level Pricing | ✔ Extremely affordable (VND 250,000) | ✔ Competitive | ✘ Often significantly higher |

| Long-Term Discounts | ✔ Up to 3 months free | ✘ Rarely offered | ✔ Available but at higher base rates |

| Legal Consultancy Integration | ✔ Yes, investment & immigration support | ✘ Generally not included | ✘ Mostly limited or referred externally |

| Branding Opportunities | ✔ Signage & website listing | ✘ Minimal or no promotional benefits | ✔ Available in high-end packages |

| Focus on Ho Chi Minh Market | ✔ Strong | ✔ Localized | ✔ National/global presence, less localised |

| Flexibility & Customisation | ✔ Tiered packages for all business sizes | ✔ Moderate | ✘ Less customisation, rigid service tiers |

Ideal Client Profiles

- Vietnamese Startups & Entrepreneurs

- Looking to establish legitimacy quickly without upfront capital burdens.

- Foreign SMEs Entering Vietnam

- Seeking business registration and legal consultation bundled in one provider.

- Budget-Conscious Growth Companies

- Require a scalable virtual office model with optional upgrades and branding opportunities.

- Consulting or Service-Based Firms

- Needing a credible registered address but operating mostly off-site or digitally.

Market Feedback & Recognition

| Aspect | Client Perception & Market View |

|---|---|

| Affordability | Frequently cited as one of the most cost-effective virtual office providers in Vietnam |

| Scalability | Tiered structure enables growth from basic presence to premium visibility |

| Reliability | Long-standing operation since 2012 reinforces trust and market familiarity |

| Advisory Services | Legal and investment support further streamlines company setup and compliance |

Conclusion: Why Saigon Office is a Leading Virtual Office Provider in Vietnam (2025)

Saigon Office has successfully positioned itself at the intersection of affordability, legal reliability, and operational scalability. Its low-cost virtual office options are bolstered by optional brand-building features and strategic long-term discounts, making it particularly suited for entrepreneurs, SMEs, and foreign investors entering the Vietnamese market.

By combining flexible tiered pricing, integration with investment law consulting, and a strong presence in Ho Chi Minh City’s economic core, Saigon Office delivers a virtual office solution that goes beyond basic functionality—it becomes a launchpad for long-term growth and local credibility.

In 2025, as businesses navigate a hybrid and cost-sensitive environment, Saigon Office remains one of the most strategically sound and financially accessible virtual office providers in Vietnam.

9. WorkEasy coworking & café

WorkEasy Coworking & Café has strategically positioned itself as a high-value, budget-friendly virtual office solution in Ho Chi Minh City, catering primarily to startups, freelancers, SMEs, and foreign businesses entering Vietnam’s competitive market. What sets WorkEasy apart is its exceptionally low monthly pricing (VND 380,000) combined with an unusually generous suite of included services, many of which are typically charged as add-ons by competitors.

- Accessible Yet Premium-Looking Office Presence

- Provides businesses with a prestigious registered address in the Saigon Paragon building—an area surrounded by multinational corporations such as Vinamilk, Unilever, Grab, and KPMG.

- Designed to offer the functional benefits of a virtual office while fostering brand credibility through high-quality facilities and multilingual staff.

- Comprehensive Business Support at No Extra Cost

- Complimentary services including tax, accounting, and business registration consultation help new businesses navigate Vietnam’s regulatory landscape without additional setup costs.

- This level of support often commands significant consulting fees elsewhere, making WorkEasy’s model an ideal entry point for first-time market entrants.

- Strong Appeal for Lean and Agile Companies

- With included coworking access, reception services, drinks, and advisory support, WorkEasy blurs the lines between virtual office and startup incubator—delivering more than just an address.

Location Advantage: Premium Address in Ho Chi Minh City’s Corporate Corridor

| City | District | Property | Strategic Benefit |

|---|---|---|---|

| Ho Chi Minh City | District 7 | Saigon Paragon, Floor 2 | Surrounded by international corporations; enhances professional image and client trust |

- District 7 has emerged as Vietnam’s southern business district, offering close proximity to international schools, commercial hubs, and a rapidly growing expat population—ideal for foreign-invested companies and global startups.

Virtual Office Service Components

| Service Features | Details |

|---|---|

| Business Address | Legal address for registration and transactions at Saigon Paragon |

| Reception & Mail Handling | Multilingual front-desk team handles client calls, mail, and walk-ins professionally |

| Logo & Name Display | Company branding showcased at main entrance (digital/physical signage options available) |

| Coworking Access | Up to 15 free coworking days per month—ideal for intermittent physical work sessions |

| We Coffee Bar Perks | Up to 15 complimentary drinks monthly, enhancing hospitality for visiting clients |

| Free Business Consultation | Expert advisory in tax, accounting, registration, and licensing at no additional charge |

| Modern Amenities | Access to shared amenities including meeting areas, printing, high-speed internet, and pantry |

- This multi-layered service stack combines essential business infrastructure with comfort, hospitality, and expert compliance support, maximising value from a modest investment.

Pricing & Value Proposition

| Plan | Monthly Fee (VND) | Included Features |

|---|---|---|

| Standard Virtual Office | 380,000 | Address + Reception + Logo Display + Consultations + Coworking + Coffee + Compliance Support |

Comparative Market Positioning

| Provider | Starting Price (VND/month) | Free Coworking Access | Free Business Consulting | Multilingual Support | Coffee/Drink Perks |

|---|---|---|---|---|---|

| WorkEasy | 380,000 | ✔ (15 days) | ✔ Included | ✔ Yes | ✔ 15 drinks |

| Regus | 950,000+ | ✘ | ✘ | ✔ | ✘ |

| The Executive Centre | 1,100,000+ | ✔ (8–20 hours) | ✘ | ✔ | ✘ |

| Dreamplex | Quote-based | ✔ (1 day/month) | ✔ Events | ✔ | ✘ |

| Saigon Office | 250,000+ | ✘ | ✔ Legal consulting | ✘ | ✘ |

- WorkEasy leads on cost-effectiveness and all-included value, targeting businesses looking for maximum functionality on a lean budget.

Target Audience Profiles

- Early-Stage Startups

- Seeking affordability and flexible services without compromising on professional presentation.

- Freelancers & Solopreneurs

- Need access to occasional workspace, mailing services, and business consultancy to appear established and compliant.

- Foreign SMEs Expanding into Vietnam

- Require a registered address, local presence, and advisory guidance without leasing expensive office space.

- Digital Nomads & Remote Teams

- Looking to establish legal business presence while accessing occasional in-person workspaces.

Differentiation Matrix

| Feature Category | WorkEasy | Typical Market Average |

|---|---|---|

| Business Address | ✔ Included | ✔ Included |

| Free Coworking Access | ✔ 15 days/month | ✘ Not included or minimal (1-2 days) |

| Tax/Accounting Consultation | ✔ Included | ✘ Usually paid or outsourced |

| Signage & Logo Display | ✔ Digital/Physical | ✘ Often not offered or paid add-on |

| Coffee Bar Perks | ✔ 15 drinks | ✘ Rarely included |

| Reception in Multiple Languages | ✔ Yes | ✔ Limited to English/Vietnamese |

Client Perception & Market Standing

| Reputation Area | Performance |

|---|---|

| Affordability | One of the most competitively priced providers in Vietnam’s virtual office market |

| Service Depth | Offers services often reserved for premium plans elsewhere at entry-level pricing |

| Client Support | Strong focus on responsive service and proactive business support |

| Branding Support | Company visibility enhanced through signage and premium-grade reception services |

| Community Perception | Growing popularity among young entrepreneurs, digital professionals, and inbound foreign firms |

Conclusion: Why WorkEasy Is One of Vietnam’s Best Virtual Office Providers (2025)

WorkEasy Coworking & Café delivers exceptional value through an all-in-one virtual office solution, combining a prestigious business address with coworking access, hospitality, multilingual reception, and professional advisory support—all at a highly accessible price point.

Its presence in Ho Chi Minh City’s prestigious District 7, surrounded by multinational corporations, enhances client trust and public image. The inclusion of 15 coworking days and expert tax/legal consultations removes common barriers to entry for small businesses, making it a top-tier choice for companies that are resource-conscious but ambition-driven.

In 2025, as Vietnam’s business landscape becomes more competitive and hybrid-friendly, WorkEasy stands out as a new-generation provider that enables accessibility, flexibility, and credibility in one comprehensive virtual office model.

10. CirCo

CirCo has carved out a distinctive position in Vietnam’s 2025 virtual office market by offering granular, modular virtual office packages tailored to the flexible and evolving needs of small and medium-sized enterprises (SMEs), startups, and digital entrepreneurs. Unlike many competitors with a one-size-fits-all model, CirCo’s approach is scalable, benefit-rich, and cost-optimised, enabling clients to only pay for what they truly use.

- Custom-Fit Packages

- Businesses can select from Standard, Plus, and Executive tiers—each incrementally offering more physical access, printing, and meeting room time.

- This flexible tiering model prevents overpayment and empowers clients to adjust services as their operations scale.

- Supportive of Hybrid & Growth-Oriented Work Models

- Ideal for companies operating on a remote-first or hybrid model, which occasionally require in-person infrastructure without long-term real estate commitments.

- Additional services such as tax declaration and business establishment support offer meaningful value for market entrants.

Premium Central Locations in Ho Chi Minh City

| Branch Type | Districts Covered | Strategic Advantage |

|---|---|---|

| All Virtual Office Types | Central Ho Chi Minh City Districts | Proximity to financial institutions, law firms, and startup accelerators |

| Executive Package Access | All CirCo Locations | Offers broader mobility across business hubs in the city |

- CirCo’s centralised footprint ensures easy accessibility for client meetings, business operations, and formal address registration, enhancing both convenience and prestige.

Comparative Breakdown of Virtual Office Packages

| Package Tier | Monthly Price (VND) | Free Coworking Days (Annually) | Meeting Room Hours (Annual) | Free Printing | Event Space Discount | Branch Access |

|---|---|---|---|---|---|---|

| Standard | From 800,000 | ✘ | ✘ | ✘ | 10% | Registered Branch Only |

| Plus | From 900,000 | 15 Days | 30 Hours | 100 A4 B/W Prints | 15% | Registered Branch Only |

| Executive | From 1,200,000 | 25 Days | 40 Hours | 200 A4 B/W + 20 A4 Color | 20% | All CirCo Locations |

- VAT is not included in listed prices.

- Pricing scales over longer commitments: the longer the contract, the more cost-effective the monthly rate becomes.

Long-Term Pricing Discounts

| Contract Duration | Monthly Discounted Price (Standard Tier Example) |

|---|---|

| 1 Year | VND 800,000 |

| 2 Years | VND 1,300,000 |

| 3 Years | VND 1,800,000 – 25% Discount Applied |

- These discounts not only improve cash flow predictability but incentivize long-term planning, particularly attractive for businesses with stable Vietnam operations.

Core Amenities Across All Tiers

| Included Services | Description |

|---|---|

| Front Desk Services | Parcel and mail handling, visitor reception |

| Reception Area Access | Professionally designed spaces to host clients or informal meetings |

| Complimentary Beverages | Unlimited tea and coffee for members |

| Networking Events & Workshops | Access to curated events promoting community building and business development |

| Business Establishment Support | Optional services for new market entrants, including tax declarations |

- These baseline features ensure even entry-level clients receive a premium office experience, with the option to expand into more robust features as needed.

Target Audience Alignment

| User Segment | Why CirCo Appeals |

|---|---|

| Startups & Microbusinesses | Affordability combined with scalable physical access and networking opportunities |

| SMEs | Precision-based service models help control operational expenses during scale-ups |

| Foreign-Invested Companies | Business address in central HCMC + optional support services for incorporation |

| Remote Teams & Consultants | Executive package offers meeting access without permanent real estate commitments |

- CirCo’s adaptability ensures it fits both bootstrap entrepreneurs and scaling businesses, while maintaining brand credibility.

SEO-Optimised Feature Summary Matrix

| Feature Keyword | CirCo Virtual Office Availability |

|---|---|

| Ho Chi Minh City business address | ✔ Available in central locations |

| Free coworking access | ✔ Up to 25 days/year |

| Free meeting room hours | ✔ Up to 40 hours/year |

| Print and scan services | ✔ Up to 200 B/W and 20 color prints |

| Business support services | ✔ Tax filing, company setup |

| Discounts for long-term contracts | ✔ Up to 25% off |

| Networking events and training | ✔ Regular programming included |

| Executive mobility across branches | ✔ Included in Executive tier |

Competitive Benchmark: CirCo vs. Other Providers

| Provider | Lowest Monthly Price (VND) | Meeting Room Access | Free Coworking Days | Print Credits | Customisable Tiers | Long-Term Discounts |

|---|---|---|---|---|---|---|

| CirCo | 800,000 | ✔ Up to 40 hrs/year | ✔ Up to 25 days/year | ✔ Up to 200 pages | ✔ 3-tier model | ✔ Up to 25% |

| Regus | 950,000+ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Dreamplex | Quote-based | ✔ (1 day/month) | ✔ | ✘ | ✘ | ✘ |

| WorkEasy | 380,000 | ✘ | ✔ 15 days | ✘ | ✘ | ✘ |

| Saigon Office | 250,000 | ✘ | ✘ | ✘ | ✔ (3-tier) | ✔ |

Final Assessment: Why CirCo Earns Its Spot Among Vietnam’s Top Virtual Office Providers (2025)

CirCo exemplifies a next-generation virtual office provider that understands the nuanced needs of the modern business landscape. Its tiered service architecture, emphasis on value-added benefits, and strategically central location footprint give clients unparalleled control over their workspace strategy.

Rather than offering a static “virtual address” solution, CirCo delivers a flexible, growth-friendly environment that supports the full lifecycle of a business—from registration to expansion. Its ability to combine cost control, physical resource access, and business development infrastructure makes it an essential option for SMEs and entrepreneurs navigating Vietnam’s dynamic economy in 2025.

Market Overview: Virtual Offices as a Strategic Enabler of Vietnam’s Economic Expansion

Vietnam’s virtual office industry in 2025 is entering a transformative phase, shaped by the convergence of digitalisation, rising foreign direct investment (FDI), and the sustained proliferation of hybrid work environments. As Vietnam continues to emerge as a preferred destination for multinational corporations (MNCs), startups, and SMEs alike, virtual office solutions have become a core component of strategic market entry and operations.

- Economic Catalysts:

- Strong GDP growth projections and regional trade agreements (e.g., CPTPP, EVFTA) continue to drive foreign interest.

- The Vietnamese government’s pro-business reforms and tax incentives enhance the country’s appeal for foreign-invested enterprises (FIEs).

- Workplace Transformation:

- A definitive shift toward hybrid and remote-first operations has created demand for cost-efficient, professional-grade office infrastructure without long-term real estate commitments.

- Virtual offices serve as an agile foundation for businesses to scale and adapt, offering registered business addresses, digital communication infrastructure, and physical access as needed.

Global Market Context: How Vietnam Aligns with Regional and Worldwide Trends

Despite discrepancies in global virtual office valuations, all major datasets point to sustained growth across Asia-Pacific, reinforcing Vietnam’s strategic positioning in the region.

| Metric | Global Market (Low Estimate) | Global Market (High Estimate) | Asia-Pacific Shared Office Market |

|---|---|---|---|

| 2023 Valuation (USD) | $22.78 Billion | $54.99 Billion | – |

| 2025 Asia-Pacific Forecast | – | – | $62.63 Billion |

| 2030 Global Forecast (USD) | $48.48 Billion | $160.37 Billion | $96.19 Billion |

| CAGR (2024–2030) | 7.84% | 16.52% | 8.96% |

- Interpretation:

- Disparities in valuation arise from methodological differences—some include coworking and hybrid models, while others isolate virtual-only solutions.

- Vietnam benefits from both trends, as providers commonly bundle virtual office offerings with coworking and event space access, enhancing competitiveness.

Key Growth Drivers in Vietnam’s Virtual Office Sector

| Growth Driver | Impact on Market |

|---|---|

| Rising FDI Inflows | 82% of commercial office leases in HCMC are held by foreign-invested enterprises |

| Cost-Efficiency for SMEs | Virtual offices allow registration at prestigious addresses for as low as VND 250,000 |

| Hybrid Work Normalisation | Enterprises increasingly require partial physical infrastructure and on-demand access |

| Urban Congestion and High Rentals | Virtual offices mitigate the need for costly downtown leases |

| Legal and Administrative Streamlining | Providers now offer integrated setup, compliance, and secretarial services |

Competitive Landscape: Global Giants vs. Local Innovators

Vietnam’s 2025 virtual office market features a dynamic ecosystem of global operators and domestic service providers, each targeting a unique market segment through differentiated service models.

| Provider | Origin | Strengths | Target Clients |

|---|---|---|---|

| Regus | International | Global network, MNC-oriented, premium pricing | Multinational Corporations, Corporates |

| The Executive Centre (TEC) | International | Grade-A buildings, premium coworking hours, bilingual services | High-growth firms, professional service firms |

| WeWork | International | Hybrid access, design-led community model | Startups, tech firms, innovation teams |

| Cekindo | Local-Global | Virtual office bundled with FDI setup services | Foreign investors, market entrants |

| EMERHUB | Local-Global | Flat annual pricing, full-stack market entry solutions | Long-term international investors |

| Dreamplex | Local | Focus on employee experience, team culture, and training programs | Employer branding-focused businesses |

| CirCo | Local | Tiered pricing, cost-efficient, amenity-driven | SMEs, freelancers, growth-stage startups |

| WorkEasy | Local | Ultra-low pricing with business consultation inclusions | Budget-conscious entrepreneurs |

| Saigon Office | Local | Aggressive long-term discounts, simple branding exposure | Local SMEs, bootstrapped firms |

| Davinci Virtual | International | Broad geographic reach, pay-as-you-go add-ons | Freelancers, legal entities, remote consultants |

Value Proposition Matrix: Evaluating What Matters Most

| Evaluation Criteria | Address Registration | Mail Handling | Meeting Rooms | Coworking Access | Business Setup Support | Pricing (VND/month) |

|---|---|---|---|---|---|---|

| Regus | ✔ | ✔ | ✔ | Optional | ✘ | From 950,000 |

| TEC | ✔ | ✔ | ✔ | 8–20 hrs included | ✘ | From 1,100,000 |

| WeWork | ✔ | ✔ | ✔ (credit-based) | Unlimited with pass | ✘ | From 2,500,000 |

| CirCo | ✔ | ✔ | ✔ | 15–25 days included | ✔ | From 800,000 |

| WorkEasy | ✔ | ✔ | ✘ | 15 days included | ✔ (Tax, Accounting) | 380,000 |

| Saigon Office | ✔ | ✘ | ✘ | ✘ | ✘ | 250,000 |

| Cekindo | ✔ | ✔ | ✔ | Optional | ✔ (Full Suite) | From 550,000 |

| EMERHUB | ✔ | ✔ | ✔ | Optional | ✔ (Full Suite) | ~2,400,000 annually |

| Dreamplex | ✔ | ✔ | 1 day/month | Full community access | ✔ (Workshops & HR) | Quote-based |

| Davinci Virtual | ✔ | Mixed reviews | ✔ (Hourly) | ✘ | ✔ (Optional Add-ons) | From 950,000 |

Strategic Implications for Investors and Businesses in 2025

- Foreign Market Entrants: