Key Takeaways

- Vietnam’s top pharmaceutical companies in 2025 are driving growth through innovation, EU-GMP-certified manufacturing, and strong R&D pipelines.

- Strategic collaborations with global partners and digital transformation are reshaping Vietnam’s pharma industry landscape.

- Leading brands are expanding market share across OTC, ETC, and export segments, capitalising on rising healthcare demand and government support.

Vietnam’s pharmaceutical industry has emerged as one of the fastest-growing healthcare sectors in Southeast Asia, driven by robust economic growth, demographic shifts, supportive government policies, and increasing demand for high-quality medical treatments. As the country moves toward universal healthcare coverage and self-sufficiency in pharmaceutical manufacturing, the role of leading pharmaceutical companies—both domestic giants and foreign-invested firms—has never been more critical. The landscape in 2025 reflects a unique blend of traditional Vietnamese medicine, advanced biotechnology, and global best practices, all working together to meet the country’s diverse healthcare needs.

This comprehensive blog explores the Top 10 Leading Pharmaceutical Companies and Brands in Vietnam in 2025, offering an in-depth look at the key players shaping the future of Vietnam’s healthcare system. These companies have been selected based on their revenue performance, R&D investment, product innovation, manufacturing capabilities, distribution networks, and strategic contributions to national healthcare objectives. In doing so, this guide serves as an essential resource for investors, healthcare professionals, policy analysts, and consumers seeking to understand Vietnam’s dynamic and evolving pharmaceutical ecosystem.

Why Vietnam’s Pharmaceutical Market Matters in 2025

- Market Size and Growth:

Vietnam’s pharmaceutical market is projected to exceed $10 billion by 2026, with retail pharmacy sales alone expected to reach $16.8 billion by 2033. This reflects a CAGR of over 6.7%, fueled by increasing life expectancy, higher disposable income, and rising health awareness.

(Source: TechSci Research, IMARC Group, Fitch Solutions) - Population Dynamics:

With a population surpassing 98 million, including a rapidly aging demographic and an expanding middle class, the country presents a strong and growing demand for chronic disease medications, preventive healthcare, and advanced therapies. - Government Policy and Local Manufacturing:

The Vietnamese government continues to push for increased local production of drugs through favorable policies, tax incentives, and investments in R&D and infrastructure. The revised Law on Pharmacy (effective July 2025) is streamlining regulations and encouraging e-pharmacy, digital health adoption, and international technology transfer. - Global Integration and Investment:

Vietnam has positioned itself as a strategic pharmaceutical hub in Asia-Pacific. Global corporations like Sanofi, STADA, and Bayer have established strong footprints here, while Vietnamese pharmaceutical firms such as DHG Pharma, Traphaco, and Imexpharm are gaining recognition for their innovation, EU-GMP certifications, and export readiness.

What This Blog Covers

This blog highlights the top 10 pharmaceutical companies operating in Vietnam, showcasing how each organization contributes uniquely to national health priorities, market growth, and patient outcomes. Through detailed company profiles, financial performance reviews, and strategic outlooks, we provide:

- A third-party analytical perspective on the most influential pharmaceutical brands

- Insights into their product lines, target therapeutic areas, and technological strengths

- Revenue figures, R&D focus, and international partnerships

- Domestic vs. foreign brand dynamics in Vietnam’s regulatory landscape

- A look at how companies are leveraging AI, herbal medicine, and biotech to lead the market

Featured Companies

The top-ranking pharmaceutical firms featured in this article represent a balance of state-owned enterprises, joint-stock companies, and foreign-invested firms, including:

- DHG Pharmaceutical Joint Stock Company (DHG Pharma)

- Traphaco Joint Stock Company

- Imexpharm Corporation

- Domesco Medical Import Export JSC

- OPC Pharmaceutical Joint Stock Company

- Mekophar Chemical Pharmaceutical JSC

- Pymepharco Joint Stock Company (STADA Vietnam)

- Sanofi Vietnam

- Bayer Vietnam Ltd.

- Stellapharm J.V. Co., Ltd.

Each company has been critically evaluated for its role in enhancing drug availability, affordability, and innovation—contributing to Vietnam’s national healthcare objectives and export growth strategy.

Importance for Stakeholders

- For Investors: Understand which pharmaceutical companies offer the most strategic growth opportunities in Vietnam’s high-potential, regulated market.

- For Policymakers: Identify models of success in aligning public health goals with corporate strategy.

- For Healthcare Professionals and Pharmacies: Discover the most trusted brands with cutting-edge therapies and reliable distribution.

- For Consumers: Learn more about the companies behind the medicines they trust, from generics to advanced specialty drugs.

Looking Ahead

As Vietnam intensifies efforts to become a regional pharmaceutical powerhouse, the top companies featured in this blog are not just market leaders—they are key enablers of national health transformation. Their continued success in 2025 and beyond will depend on their ability to innovate, localize production, comply with evolving regulations, and address unmet healthcare needs.

Read on for a deep dive into the Top 10 Leading Pharmaceutical Companies and Brands in Vietnam (2025)—companies that are shaping the future of Vietnamese healthcare with every capsule, tablet, and solution they produce.

Top 10 Leading Pharmaceutical Companies and Brands in Vietnam (2025)

- Long Châu Pharmacy (FPT Retail)

- DHG Pharmaceutical Joint Stock Company

- Traphaco Joint Stock Company

- Imexpharm Pharmaceutical Joint Stock Company

- Domesco Medical Import Export Joint Stock Corporation (DOMESCO)

- OPC Pharmaceutical Joint Stock Company

- Mekophar Chemical and Pharmaceutical JSC

- Pymepharco Joint Stock Company

- Sanofi Vietnam

- Bayer Vietnam Ltd.

1. Long Châu Pharmacy (FPT Retail)

Long Châu Pharmacy, a key subsidiary of FPT Retail, has emerged as one of the Top 10 Leading Pharmaceutical Brands in Vietnam (2025). Through strategic expansion, innovation-driven digital transformation, and diversified healthcare services, Long Châu has redefined the pharmaceutical retail experience for millions of Vietnamese consumers. Its multi-pronged approach positions it as not only a medication provider but also a critical node in Vietnam’s evolving healthcare ecosystem.

National Retail Footprint and Market Reach

- Extensive Physical Coverage

- As of Q1 2025, Long Châu operates 2,022 pharmacies, spanning all 63 provinces and cities in Vietnam.

- The chain has become one of the most accessible and recognisable pharmaceutical brands nationwide.

- Integrated Healthcare Services

- Operates over 100 active vaccination centers, further embedding itself into Vietnam’s preventative healthcare network.

- Provides both pharmaceutical and basic healthcare services in-store, enhancing public access to essential medical interventions.

- Planned Expansion

- Aims to launch 500 new outlets by the end of 2025.

- Focused on underserved and tier-2/3 urban areas to ensure broader access to medicine and healthcare.

Financial Performance and Economic Impact

| Metric | Q1 2025 Value | YoY Growth |

|---|---|---|

| Total Revenue | 11,670 billion VND | +29% YoY |

| Share of FPT Retail’s Revenue | 69% | — |

| Monthly Revenue Per Pharmacy | 1.2 billion VND (avg.) | — |

- High Revenue Contribution

- Long Châu contributes nearly 70% of FPT Retail’s total earnings, underscoring its pivotal role in the group’s portfolio.

- Strong Pharmacy-Level Performance

- Each store generates an average of 1.2 billion VND in monthly revenue, indicating high footfall and effective product-mix strategies.

Strategic Positioning Through Digital Transformation

- Smart Healthcare Ecosystem

- Long Châu is at the forefront of healthcare digitalisation in Vietnam.

- Its proprietary mobile app integrates:

- AI-powered medication reminders

- Electronic vaccination record management

- Seamless home delivery tracking

- Customer-Centric Innovation

- The platform supports telemedicine features and remote prescriptions—bridging gaps in rural and remote access to care.

- Tech-Driven Operational Optimisation

- Data analytics and AI are utilised for inventory forecasting, personalised marketing, and prescription fulfilment.

Strategic Alliances and Trust-Building

- Exclusive Product Partnerships

- Official distributor of global health brands such as Blackmores, enhancing both credibility and product diversity.

- Trust-Based Brand Equity

- A transparent sourcing model and certified product quality have contributed to growing consumer confidence and brand loyalty.

Omnichannel Strength and Competitive Edge

| Channel | Key Features |

|---|---|

| Physical Stores | Immediate access to products, pharmacist consultations, vaccination services |

| E-Commerce Platform | 24/7 ordering, health content hub, AI-based recommendations |

| Mobile App | Pill reminders, digital health records, loyalty points |

| Delivery Network | Nationwide fulfillment capabilities with fast-track options |

- Omnichannel Synergy

- Long Châu’s integrated strategy offers consistent user experience across digital and physical touchpoints.

- Enhances customer retention while scaling efficiently in a fragmented retail landscape.

Why Long Châu Ranks Among Vietnam’s Top 10 Pharma Brands (2025)

- Unparalleled Geographic Coverage: A pharmacy chain present in every province, ensuring rural and urban inclusivity.

- Strong Financial Backbone: High revenue per store and significant contribution to parent group performance.

- Digital Healthcare Leadership: AI-powered app and end-to-end digital services make it a healthcare technology pioneer.

- Product Diversity and Global Alignment: Strategic partnerships with global brands enrich its offering.

- Scalability and Vision: With 500 new outlets planned and a focus on healthcare ecosystems, Long Châu is shaping the future of retail pharma in Vietnam.

Competitive Matrix: Long Châu vs. Leading Competitors (2025)

| Criteria | Long Châu Pharmacy | Pharmacity | An Khang Pharmacy |

|---|---|---|---|

| Total Stores (Q1 2025) | 2,022 | ~1,300 | ~800 |

| Revenue Growth (YoY) | +29% | +18% | +15% |

| AI Integration | Full stack (App, CRM) | Limited | Moderate |

| Vaccination Centers | 100+ | Few | None |

| Expansion Target (2025) | +500 stores | +300 stores | +200 stores |

Conclusion:

Long Châu Pharmacy, under the leadership of FPT Retail, stands out as a transformative leader in Vietnam’s 2025 pharmaceutical market. Through deep physical penetration, advanced technological deployment, and a commitment to healthcare accessibility, it continues to redefine the pharmaceutical consumer experience. Its well-rounded business model not only ensures sustained growth but also aligns with Vietnam’s broader healthcare development goals.

2. DHG Pharmaceutical Joint Stock Company

DHG Pharmaceutical Joint Stock Company, widely referred to as DHG Pharma, commands a position of undisputed leadership within Vietnam’s pharmaceutical industry. As the largest publicly-listed pharmaceutical enterprise in the nation by sales volume, output, and market capitalisation, DHG Pharma continues to define industry benchmarks through technological innovation, strategic international partnerships, and consistent financial performance. The company’s focus on sustainable growth, manufacturing excellence, and product diversification ensures its ranking among the top 10 pharmaceutical brands in Vietnam in 2025.

Dominant Market Position and Financial Strength

| Key Financial Metrics | 2024 Actuals | 2025 Target |

|---|---|---|

| Total Revenue | 5,200 billion VND | 5,210 billion VND |

| Profit Before Tax | 1,080 billion VND | 940 billion VND |

| Net Income (Latest Quarter) | 229.29 billion VND | — |

| Market Capitalisation (Aug 2025) | 13.30 trillion VND | — |

- Largest Market Capitalisation

- As of August 2025, DHG’s valuation exceeds 13.30 trillion VND, reinforcing investor confidence and long-term stability.

- Sustained Profitability

- Despite aggressive investments, the company consistently delivers robust profit margins and surpasses industry averages.

- Optimised Revenue Mix

- Balanced contributions from OTC (over-the-counter) and ETC (ethical drugs/hospital channel) bolster resilience against market fluctuations.

Comprehensive Product Portfolio and Therapeutic Leadership

- Diversified Product Lines

- DHG Pharma’s offerings span:

- Prescription medicines

- OTC drugs

- Cosmetics

- Nutraceuticals and dietary supplements

- DHG Pharma’s offerings span:

- Key Therapeutic Segments

- Specialisation in gastrointestinal and hepatobiliary care, with flagship drugs like Pantogas gaining strong brand recognition.

- Channel Penetration

- Well-established dominance in both retail pharmacies (OTC) and hospital tender markets (ETC), with tailored marketing and bidding strategies for each.

Strategic Manufacturing Upgrades and Technological Edge

| Facility/Investment | Standard | Completion | Impact |

|---|---|---|---|

| Japan-GMP Factory | Japan-GMP Certified | Q2 2024 | Increased capacity by 25% |

| EU/Japan-GMP Factory | Dual EU/Japan-GMP | Ongoing | Total investment: $30.4 million |

| Automation & Smart Lines | AI-driven lines | Scaling in 2025 | Enhances quality, efficiency, and compliance |

- Capacity Expansion

- Advanced GMP facilities increase both production scalability and regulatory compliance, opening doors to EU and Japan markets.

- Technology Transfer

- Active collaboration with Taisho Group (Japan) has accelerated the onboarding of new formulations and process innovation.

- Smart Manufacturing

- Emphasis on automation and AI-driven systems to reduce human error, shorten lead times, and maintain global standards.

Strategic Alliances and Global Orientation

- Partnership with Taisho Group (Japan)

- Long-term strategic collaboration supports:

- R&D enhancements

- Market expansion initiatives

- Knowledge transfer in drug formulation and regulation

- Long-term strategic collaboration supports:

- Global Compliance and Export Readiness

- With dual certification from EU and Japan GMP authorities, DHG is well-positioned for:

- Participation in high-value hospital tenders

- Export to developed markets, particularly across ASEAN and Europe

- With dual certification from EU and Japan GMP authorities, DHG is well-positioned for:

- Hospital Channel Competitiveness

- Enhanced GMP standards elevate the company’s profile in competitive drug bidding within Vietnam’s public healthcare system.

Distribution Strength and Market Penetration

| Distribution Asset | Details |

|---|---|

| Nationwide Logistics Network | Covers all 63 provinces with cold chain capabilities |

| Retail Pharmacy Penetration | Broad OTC availability across leading pharmacy chains |

| Institutional Partnerships | Supplies to major hospitals, clinics, and government tenders |

- Nationwide Reach

- Strong logistics capabilities and deep regional penetration ensure last-mile delivery of essential medicines.

- Integrated Supply Chain

- Seamless integration from production to delivery helps maintain inventory reliability, reduce waste, and ensure compliance.

Why DHG Pharma Ranks Among Vietnam’s Top 10 Pharmaceutical Leaders (2025)

- Largest Market Capitalisation: Most valuable listed pharmaceutical entity in Vietnam.

- GMP-Certified Manufacturing Infrastructure: Operational excellence through advanced Japan/EU-standard factories.

- Powerful International Collaboration: Strategic integration with Taisho Group offers a significant competitive advantage.

- Balanced Product and Channel Strategy: Strong in both OTC retail and ETC hospital bidding, reducing market dependency.

- Forward-Looking Investments: Committed capital in automation, GMP standards, and digital compliance for future resilience.

Competitive Comparison Matrix: DHG Pharma vs. Peer Leaders (2025)

| Criteria | DHG Pharma | Imexpharm | Traphaco |

|---|---|---|---|

| Market Cap (Aug 2025) | 13.30 trillion VND | ~6.1 trillion VND | ~3.8 trillion VND |

| Japan/EU GMP Compliance | Yes | Japan-GMP only | EU-GMP underway |

| 2024 Profit Before Tax | 1,080 billion VND | ~650 billion VND | ~400 billion VND |

| Taisho Partnership | Yes (strategic) | No | No |

| Product Export Orientation | EU & ASEAN focus | ASEAN focus | Limited |

Conclusion

DHG Pharmaceutical Joint Stock Company exemplifies a rare combination of financial strength, manufacturing sophistication, and international collaboration in Vietnam’s rapidly evolving healthcare landscape. Its large-scale production infrastructure, investment in global quality standards, and dual-market strategy (retail + hospital) ensure it remains a dominant force in 2025. With its strategic foresight and proven execution, DHG Pharma is poised to shape the next phase of pharmaceutical development both domestically and abroad.

3. Traphaco Joint Stock Company

Traphaco Joint Stock Company stands as one of Vietnam’s most trusted and time-honored pharmaceutical brands. With a legacy of over 50 years, Traphaco has successfully merged the wisdom of traditional Eastern medicine with cutting-edge Western pharmaceutical technology. Its ability to evolve with market demands while remaining deeply rooted in Vietnam’s cultural heritage has made it a beacon of sustainable innovation in the Vietnamese healthcare landscape. In 2025, Traphaco remains firmly positioned among Vietnam’s Top 10 Leading Pharmaceutical Companies, recognised for its strong financial discipline, product innovation, and sustainability-led operations.

Financial Resilience and Market Capitalisation

| Key Financial Indicators | 2024 Actual | 2025 Target |

|---|---|---|

| Consolidated Revenue | 2,370 billion VND | 2,559 billion VND (+8%) |

| Profit After Tax | 257.3 billion VND | 268 billion VND (+4.2%) |

| Market Capitalisation (Aug 2025) | 2,785.48 billion VND | — |

| EPS | 5,512 VND/share | — |

| P/E Ratio | 12.34x | — |

| P/B Ratio | 1.80x | — |

- Robust Market Position

- Traphaco maintains strong equity returns with sustainable profit margins, indicating high investor trust and brand stability.

- Capital Efficiency

- With an efficient P/E and P/B ratio, the company remains an attractive option for long-term investors seeking value in Vietnam’s healthcare sector.

Product Portfolio and Therapeutic Expertise

- Diverse Healthcare Offerings

- Traphaco’s multi-dimensional portfolio includes:

- Traditional and modern pharmaceuticals

- Functional foods and nutraceuticals

- Medical devices and cosmetics

- Industrial chemicals for healthcare use

- Traphaco’s multi-dimensional portfolio includes:

- Premium Traditional Medicine Segment

- This category, rooted in GACP-WHO certified herbal ingredients, grew by 49% in 2024.

- Boganic Premium, the flagship liver tonic, recorded 36% growth, driven by increasing consumer preference for safe, plant-based remedies.

- High-Quality Western Medicine

- Growth of 33% in 2024, largely due to:

- Bioequivalent medicines

- Technology-transferred drugs from global partners

- These products are manufactured under stringent quality standards and meet international compliance for hospital bidding.

- Growth of 33% in 2024, largely due to:

- ETC Channel Expansion

- Products transferred from Daewoong Pharmaceutical (South Korea) facilitated 10.7% revenue growth in the ethical drug (ETC) segment, enabling greater participation in provincial and central hospital tenders.

Strategic Technological and R&D Investments

| Project | Details |

|---|---|

| EU-GMP Factory | Under development with 300+ million tablets/year capacity |

| Disease Focus | Cardiovascular, diabetes, hypertension—aligned with Vietnam’s top NCDs |

| Export Strategy | Designed for regional exports and domestic hospital bidding |

- Modern Manufacturing Expansion

- The upcoming EU-GMP facility is a cornerstone for Traphaco’s future export roadmap and enhances its competitiveness in regulated markets.

- R&D-Driven Formulation Innovation

- Focused on developing next-generation therapies that address Vietnam’s growing burden of non-communicable diseases (NCDs).

- Digitally-Enabled Pharma

- Investing in digital transformation across operations, distribution, and customer engagement to modernise its B2B and B2C reach.

Sustainability-First Operations and Green Value Chain

| Sustainability Dimension | Initiative |

|---|---|

| Raw Material Sourcing | GACP-WHO certified medicinal herb zones |

| Green Manufacturing | Low-emission, resource-efficient production standards |

| Supply Chain Ethics | Traceable, eco-responsible procurement and distribution practices |

- Certified Cultivation Practices

- Traphaco’s commitment to the Green Value Chain ensures that all traditional medicines originate from traceable, sustainable sources.

- Eco-Driven Differentiation

- This approach not only meets environmental regulations but appeals to the growing eco-conscious health consumer in Vietnam and abroad.

Distribution Channels and Strategic Partnerships

| Channel/Partnership | Focus Area |

|---|---|

| Long Châu, Pharmacity, An Khang | National B2B pharmacy retail partnerships |

| Hospital & Institutional Sales | Government and private hospital tenders (ETC) |

| Digital & Modern Trade | Online B2B/B2C models and digital sales enablement |

- Strengthened B2B Collaborations

- Working with top pharmacy chains allows Traphaco to ensure professional retail execution, nationwide access, and real-time demand feedback.

- Hospital Bid Readiness

- Product compliance and EU-GMP capacity allow increased participation in competitive tenders, especially for NCD therapeutics.

Why Traphaco is One of Vietnam’s Top 10 Pharmaceutical Companies in 2025

- Over 50 Years of Brand Heritage: Deeply trusted by generations of Vietnamese consumers.

- Financial Sustainability: Strong EPS and stable revenue growth, paired with consistent market capitalisation.

- Therapeutic Versatility: Leadership in both herbal-based traditional remedies and modern bioequivalent drugs.

- Export Readiness: Advanced manufacturing capacity aligned with EU-GMP, supporting international market access.

- Sustainability Leadership: Integrates green, ethical practices across cultivation, production, and distribution.

Peer Comparison Matrix (2025)

| Criteria | Traphaco | DHG Pharma | Domesco |

|---|---|---|---|

| Market Capitalisation (Aug 2025) | 2,785.48 billion VND | 13.30 trillion VND | ~2.1 trillion VND |

| Traditional Medicine Portfolio | Yes (GACP-WHO certified) | No | Limited |

| EU-GMP Factory | Under construction | Operational (Japan-GMP) | No |

| Daewoong Tech Transfer | Yes | No | No |

| Profit After Tax (2024) | 257.3 billion VND | 1,080 billion VND | ~200 billion VND |

Conclusion

Traphaco Joint Stock Company continues to set itself apart in 2025 as a pioneer of sustainable pharmaceutical innovation in Vietnam. With its rare balance of traditional knowledge, advanced technology, and eco-conscious practices, the company is not only achieving financial success but also contributing to the transformation of Vietnam’s healthcare ecosystem. Through strategic partnerships, future-ready infrastructure, and unwavering consumer trust, Traphaco is poised for continued growth and cross-border expansion in the years ahead.

4. Imexpharm Pharmaceutical Joint Stock Company

Imexpharm Pharmaceutical Joint Stock Company, commonly referred to as Imexpharm, stands as one of Vietnam’s most technologically advanced and strategically forward-thinking pharmaceutical enterprises. With a legacy of nearly five decades and a relentless commitment to high standards of manufacturing and sustainability, the company continues to elevate Vietnam’s pharmaceutical profile on both regional and global stages. In 2025, Imexpharm remains firmly positioned among the Top 10 Leading Pharmaceutical Companies in Vietnam, thanks to its leadership in EU-GMP manufacturing, its dominant share in the antibiotics segment, and its strong trajectory in research-driven growth.

Financial Performance and Capital Market Position

| Financial Indicator (1H 2025) | Value | YoY Growth (%) | Notes |

|---|---|---|---|

| Gross Revenue | 1,442 billion VND | +28% | 46% of full-year target already achieved |

| Net Revenue | 1,227 billion VND | +22% | |

| Gross Profit | 488 billion VND | +28% | Reflects improved cost efficiency |

| Profit Before Tax (PBT) | — | +31% | 43% of year-end goal already attained |

| EBITDA Margin | 22% | +21% | Reflects high operational profitability |

| Share Price Growth (YTD as of Jun) | +10% | — | Indicates investor confidence |

- Solid Financial Discipline

- Achieving nearly half of its annual target within the first half of 2025 demonstrates strategic execution and operational agility.

- Balanced Revenue Contribution

- Both the OTC and ETC channels are robust, with ETC accounting for 53% of gross revenue—a clear sign of strong hospital presence.

- Cost-Efficient Scaling

- Profitability is supported by tight cost control, contributing to sustainable EBITDA margins and market confidence.

Therapeutic Portfolio Performance and Market Focus

| Top Therapeutic Segments (1H2025) | YoY Growth (%) | Market Focus |

|---|---|---|

| Antibiotics | +25% | Flagship therapeutic category |

| Cough & Respiratory Treatments | +73% | Seasonal and pandemic-responsive demand |

| Digestive Health | +19% | Consistent growth in urban demographics |

- Antibiotic Market Leadership

- Imexpharm remains Vietnam’s market leader in high-quality antibiotics, reflecting its long-standing scientific expertise and production superiority.

- Broad-Spectrum Formulations

- Extensive product range across acute, chronic, and preventative categories supports growth across both retail (OTC) and hospital (ETC) markets.

EU-GMP Manufacturing Capabilities and Export-Readiness

| Production Infrastructure | Details |

|---|---|

| Total Production Clusters | 4 |

| EU-GMP Certified Clusters | 3 |

| EU-GMP Production Lines | 11 |

| European Marketing Authorizations | 12 approvals for 7 products |

- Among Vietnam’s Largest EU-GMP Pharma Manufacturers

- Imexpharm operates one of the country’s most sophisticated EU-GMP production systems, ensuring compliance with international quality standards.

- Global Expansion-Ready

- With 12 marketing authorizations in Europe, the company is strategically positioned for cross-border export and international tenders.

- Integrated Supply Chain Efficiency

- EU-GMP status allows for lower batch rejection rates, improved drug quality, and access to premium-priced markets.

Research and Development as a Growth Engine

| R&D Metrics (2023–2025) | Value |

|---|---|

| R&D Investment (2023) | 5% of annual revenue |

| Total R&D Projects | 93 initiatives |

| New Product Launches | 15 product rollouts |

| Tech Transfer Partnerships | Genuone Sciences (Korea) |

| Therapeutic Focus Areas | Diabetes, Cardiovascular, Infectious |

- Innovation-Driven Development

- By consistently allocating 5% of revenue to R&D, Imexpharm has laid a sustainable pipeline for future drug innovation.

- Technology Transfer Success

- Partnership with Genuone Sciences (South Korea) strengthens its ETC portfolio with globally recognised formulations.

- Chronic Disease Focus

- Strategic emphasis on non-communicable diseases (NCDs)—diabetes and cardiovascular conditions—mirrors national health priorities.

Sales Channel Dynamics and Market Penetration

| Sales Channel | YoY Growth (1H2025) | Contribution to Revenue |

|---|---|---|

| OTC Channel | +32% | High margin, retail-driven |

| OTC Growth in Northern Vietnam | +70% | Major contributor to overall performance |

| ETC Channel | +24% | 53% of total revenue |

- Rapid OTC Expansion

- A 70% surge in Northern Vietnam’s OTC channel underlines successful regional marketing and distribution strategy.

- ETC Stability

- The hospital channel (ETC) remains the backbone, especially for antibiotics and technology-transferred therapies.

- B2B Strengthening

- Enhanced cooperation with pharmacies, hospitals, and government institutions ensures broader healthcare ecosystem integration.

Why Imexpharm is Among Vietnam’s Top 10 Pharmaceutical Companies (2025)

- Antibiotic Manufacturing Dominance: Market leader with one of the most comprehensive EU-GMP infrastructures.

- Sustainable Financial Momentum: Strong H1 2025 results with double-digit growth across revenue and profit lines.

- Globally Aligned Manufacturing: 11 EU-GMP production lines and 12 product registrations in Europe.

- Innovation-Led Strategy: Over 90 R&D projects with high-impact product launches and international tech partnerships.

- Future-Ready Vision: 2030 roadmap aims to triple revenue and strengthen regional and global market positioning.

Peer Comparison Matrix: Imexpharm vs. Industry Peers (2025)

| Key Metrics | Imexpharm | DHG Pharma | Traphaco |

|---|---|---|---|

| EU-GMP Certified Factories | 3 clusters, 11 lines | 1 (Japan-GMP) | EU-GMP factory under construction |

| Market Capitalisation (est. 2025) | ~6.1 trillion VND | 13.30 trillion VND | ~2.78 trillion VND |

| H1 2025 Revenue Growth | +28% (gross) | +8% (target for full year) | +8% (target for full year) |

| R&D as % of Revenue | 5% | ~2–3% | N/A |

| OTC Growth (Northern Region) | +70% | Moderate | Moderate |

Conclusion

Imexpharm Pharmaceutical Joint Stock Company represents the pinnacle of Vietnamese pharmaceutical manufacturing excellence in 2025. With a strategic focus on high-value antibiotics, international certification standards, and deep-rooted research innovation, it has secured a dominant position in both domestic and export markets. As the demand for GMP-compliant drugs rises in Southeast Asia and beyond, Imexpharm is ideally positioned to scale as a regional pharmaceutical leader, solidifying its legacy as a transformative force in Vietnam’s healthcare future.

5. Domesco Medical Import Export Joint Stock Corporation (DOMESCO)

Established in 1989, DOMESCO has grown into one of the most reputable and diversified pharmaceutical enterprises in Vietnam. As a vertically integrated company engaged in the production, trade, import, and export of pharmaceuticals, medical devices, and raw materials, DOMESCO exemplifies resilience, quality, and global competitiveness. In 2025, the company continues to be ranked among the Top 10 Leading Pharmaceutical Companies in Vietnam, with a well-earned reputation for maintaining financial health, expanding internationally, and delivering high-impact therapeutics across multiple therapeutic categories.

Financial Strength and Capital Market Confidence

| Key Financial Metrics | FY 2024 | Trailing 12 Months (Mar 2025) |

|---|---|---|

| Revenue | $72.83 million USD | $77.12 million USD |

| EBITDA | $9.38 million USD | $9.95 million USD |

| Net Income | $7.73 million USD | $8.26 million USD |

| Total Debt | $0 | $0 |

| Market Capitalisation (Jul 2025) | $85.2 million USD | — |

| Shares Outstanding | 34.7 million shares | — |

- Zero-Debt Structure

- DOMESCO operates with zero financial debt, a rare strength in the capital-intensive pharmaceutical sector—reflecting strong internal financing and prudent fiscal management.

- Consistent Profitability

- The company’s net income grew steadily between FY 2024 and early 2025, supported by strong EBITDA margins and disciplined cost controls.

- Investor Confidence

- With a market capitalisation of $85.2 million USD, DOMESCO maintains a solid valuation, signaling sustained trust from shareholders and institutions alike.

Diversified Product Portfolio and Therapeutic Breadth

| Therapeutic Segment | Flagship Products | Function |

|---|---|---|

| Cardiovascular Medicine | AMPLODIPIN 5mg | Blood pressure and heart health management |

| Antibiotic Treatments | ZINMAX | Broad-spectrum infection control |

| Pain Management | ALPHACHYMOTRYPSIN DOREN | Anti-inflammatory and enzymatic pain relief |

| Herbal Medicines | DOMESCO Herbal Line | GACP-WHO-certified traditional herbal remedies |

| Functional Foods | Vitamin/Mineral Supplements | Preventive health and wellness |

| Medical Equipment | Diagnostic and minor surgical tools | B2B healthcare equipment supply |

- Integrated Product Pipeline

- The company’s product mix spans chemical pharmaceuticals, herbal-based remedies, and medical devices, allowing it to address both acute and chronic care markets.

- WHO-GMP Certified Facilities

- All products are manufactured under WHO-GMP standards, ensuring global compliance and therapeutic consistency across categories.

- Herbal and Supplement Innovation

- Through dedicated herbal medicine and food supplement factories, DOMESCO taps into the growing demand for plant-based and preventive health solutions.

Manufacturing Infrastructure and Regulatory Standards

| Facility Type | GMP Certification | Function |

|---|---|---|

| Pharmaceutical Factories (3 units) | WHO-GMP | Chemical drug manufacturing |

| Herbal Medicine Factory | WHO-GACP & WHO-GMP | Natural medicine production |

| Food Supplement Factory | Functional GMP | Nutraceuticals and health supplements |

- Regulatory Excellence

- DOMESCO’s adherence to WHO-GMP and GACP-WHO guidelines positions it as a globally compliant manufacturer, capable of entering highly regulated markets.

- Scalable Production

- Factory systems are optimised for high-volume, export-grade manufacturing, supporting regional and global distribution goals.

Global Export Orientation and International Presence

| Export Destinations | Region | Market Characteristics |

|---|---|---|

| France, USA, Canada | North America & EU | High regulatory compliance and advanced markets |

| Singapore | ASEAN | Premium regional healthcare market |

| Cambodia | CLMV Region | High-volume, cost-sensitive therapeutic market |

- Trusted International Supplier

- DOMESCO’s products are used by millions of patients worldwide, reflecting long-standing export credibility and compliance with international pharmaceutical standards.

- Regulatory Readiness for Advanced Markets

- Its presence in Europe and North America underscores the company’s ability to meet complex drug registration and safety standards.

Strategic Priorities and Long-Term Vision

- Product Quality and Innovation

- Ongoing commitment to enhancing clinical efficacy, patient safety, and formulation innovation across core segments.

- Distribution Channel Expansion

- Strengthening nationwide B2B and B2C distribution systems, with greater presence in retail pharmacy chains and institutional procurement networks.

- Domestic and International Collaborations

- Active engagement with both Vietnamese health authorities and foreign partners to expand licensing, co-development, and market access.

- Sustainability Integration

- Emphasis on eco-friendly production processes, especially in the herbal and nutraceutical lines, aligning with the global shift toward green pharmaceuticals.

Why DOMESCO is One of Vietnam’s Top 10 Leading Pharmaceutical Brands (2025)

- Debt-Free Financial Model: Operates entirely without debt, ensuring financial independence and stability.

- WHO-GMP Certified Manufacturing System: Compliance with international quality standards across chemical, herbal, and supplement factories.

- Broad Product Range: Delivers critical medications in cardiology, infection control, pain relief, and wellness.

- Export Credibility: Proven presence in major pharmaceutical markets including North America, Europe, and ASEAN.

- Sustainable Growth Vision: Forward-looking strategies prioritising innovation, collaboration, and market diversification.

Peer Benchmarking Matrix (2025)

| Metric | DOMESCO | Imexpharm | DHG Pharma |

|---|---|---|---|

| Market Cap (Jul 2025) | $85.2 million USD | 13.30 trillion VND (~$525M) | |

| WHO/EU-GMP Certified Factories | 3 WHO-GMP | 3 EU-GMP | 1 Japan-GMP |

| Debt Position | 0 (debt-free) | Moderate | Moderate |

| Export Markets | USA, France, ASEAN | ASEAN, EU | Domestic with Japan focus |

| Herbal Medicine Capacity | Dedicated factory | Limited | GACP-certified sourcing |

Conclusion

DOMESCO Medical Import Export JSC exemplifies the fusion of financial prudence, high-quality production, and global expansion readiness within Vietnam’s rapidly evolving pharmaceutical sector. As a company with no debt, strong exports, and GMP-certified facilities across multiple therapeutic domains, DOMESCO is well-positioned to remain a top-tier pharmaceutical player both domestically and abroad in 2025 and beyond.

6. OPC Pharmaceutical Joint Stock Company

OPC Pharmaceutical Joint Stock Company has carved out a distinguished position in Vietnam’s pharmaceutical landscape by focusing on traditional and herbal medicine innovation, rooted in both scientific rigor and centuries-old healing knowledge. As of 2025, OPC is recognised among the Top 10 Leading Pharmaceutical Companies in Vietnam, owing to its advanced extraction technologies, GACP-WHO-compliant raw material sources, and growing international partnerships. It continues to be a key driver in Vietnam’s movement toward sustainable, plant-based therapeutics, with an increasing footprint in both domestic and export markets.

Financial Overview and Operational Capacity

| Key Financial Indicator | Value / Note (2025) |

|---|---|

| Jitta Score (Performance Metric) | 3.70 |

| YoY Earnings Change (Latest Quarter) | -24.81% |

| Workforce Size (as of June 2025) | 727 employees |

| Market Capitalisation | Not disclosed |

| Financial Transparency | Partial, with stock tracked on public metrics |

- Moderate Market Visibility

- Despite limited published profit data, OPC’s public stock tracking tools like Jitta provide insight into investment performance and operational sentiment.

- Operational Workforce

- With 727 employees, the company maintains lean but highly specialised operations, focusing on value-added herbal drug development rather than mass generics.

Product Portfolio and Therapeutic Expertise

| Therapeutic Segment | Product Focus |

|---|---|

| Cardiovascular Health | Herbal vasodilators and blood pressure stabilisers |

| Nervous System Support | Neuroprotective botanicals |

| Vitamins & Minerals | Herbal-enriched supplements |

| Respiratory System | Cough syrups, expectorants from natural origins |

| Musculoskeletal and Pain Relief | Anti-inflammatory plant-based formulations |

| Digestive & Hepatobiliary System | Liver detox tonics and digestion aids |

| Endocrine System | Herbal therapies for blood sugar control |

| Urological Support | Natural diuretics and infection prevention |

- Comprehensive Herbal Therapeutics

- OPC’s products address over 10 major therapeutic categories, reflecting an ambitious clinical development pipeline aligned with Vietnam’s most pressing chronic and lifestyle-related conditions.

- Plant-Based Specialisation

- The company stands out for its expertise in botanical drug extraction and standardisation, with strong capabilities in active ingredient quantification—a key requirement for international registration and GMP compliance.

Manufacturing Standards and Infrastructure

| Asset Type | Details |

|---|---|

| Herbal Medicine Production Factory | Equipped with EU-standard technology, compliant with modern pharma protocols |

| Medicinal Herb Cultivation Zones | GACP-WHO certified farms across multiple provinces in Vietnam |

| Technology Integration | Exploring AI-powered drug R&D platforms |

- GACP-WHO Certified Raw Materials

- OPC’s cultivation areas ensure clean, traceable, and bioactive herbal ingredients, essential for premium product positioning.

- Production Modernisation

- Advanced production lines adhering to EU-GMP principles improve quality consistency, batch traceability, and international export readiness.

- Emerging Technologies in R&D

- The company is actively investigating AI integration in research to optimise plant-based compound identification, predictive efficacy modeling, and clinical data management.

Strategic Partnerships and Market Expansion

| Partner | Type | Focus |

|---|---|---|

| Aribio (South Korea) | Biopharmaceutical partner | Joint R&D in plant-based drug innovation |

| Samjin (South Korea) | Herbal medicine collaborator | Co-development of health supplements |

| Vietnamese Hospitals & Pharmacies | Domestic channel partners | Distribution of prescription and OTC products |

| Supermarket Chains & E-commerce | Retail expansion | B2C health and wellness product availability |

- Domestic Ecosystem Engagement

- OPC maintains multi-tiered partnerships with Vietnam’s top hospitals, retail chains, and independent pharmacies, enabling national-level therapeutic reach.

- International Collaboration

- By partnering with innovative South Korean biopharma firms, OPC is enhancing its product pipeline for export and technology transfer.

- E-Commerce and Retail Penetration

- Expansion into online health platforms and supermarkets helps the company capture the fast-growing consumer self-care segment.

Export Market Reach and Global Integration Strategy

| Export Destination | Market Region | Market Type |

|---|---|---|

| Nigeria, Laos, Cambodia | Traditional markets | Long-standing buyers of Vietnamese herbals |

| Canada, South Korea, Thailand | Emerging partners | Strategic growth regions |

| Myanmar | Frontier market | Underdeveloped but high-potential |

- Diversified Export Network

- OPC’s expansion into both traditional and new international markets enhances brand visibility and revenue diversification.

- Market Entry Preparation

- The company’s investment in international-standard manufacturing and clean input sourcing is designed to meet registration criteria in regulated economies like Canada and South Korea.

Why OPC is One of Vietnam’s Top 10 Pharmaceutical Companies in 2025

- Pioneer in Herbal Pharmaceutical Innovation: Longstanding leadership in botanical drug development with a therapeutic focus on prevalent diseases in Vietnam and Southeast Asia.

- Certified Cultivation and Extraction Excellence: Fully GACP-WHO aligned herbal farms and proprietary extraction technology.

- Global R&D and Tech Partnerships: Co-development projects with Korean biotech firms and initiatives in AI-driven pharmaceutical innovation.

- Modern Production Capabilities: EU-standard herbal manufacturing infrastructure with the potential for regulated market exports.

- Expanding Multichannel Reach: Strong domestic coverage combined with growing international presence and e-commerce adoption.

Comparative Matrix: OPC vs. Leading Herbal and Botanical Pharma Players in Vietnam (2025)

| Key Attribute | OPC | Traphaco | Nam Dược (Private) |

|---|---|---|---|

| Focus Area | Herbal & traditional | Hybrid (herbal + modern) | Herbal medicines |

| GACP-WHO Certified Raw Material Sources | Yes | Yes | Partial |

| Factory Compliance Level | EU-standard | EU-GMP (under development) | Unknown |

| R&D Tech Partnerships | South Korean firms | Korean tech transfer | Limited |

| AI Integration in R&D | In exploratory phase | Not reported | Not applicable |

| Export Markets | 8+ countries | 4–5 countries | Primarily domestic |

Conclusion

OPC Pharmaceutical JSC represents a strategically positioned, innovation-driven herbal pharmaceutical leader in Vietnam. Through a combination of scientific herbal medicine, clean and certified sourcing, and AI-assisted research ambitions, the company is well-aligned with both domestic healthcare needs and global phytopharma trends. Its commitment to sustainability, therapeutic diversity, and international collaboration underscores its status as a transformative force in Vietnam’s evolving pharmaceutical ecosystem in 2025 and beyond.

7. Mekophar Chemical and Pharmaceutical JSC

Founded in 1977, Mekophar Chemical Pharmaceutical Joint Stock Company (Mekophar) has evolved into one of Vietnam’s most experienced pharmaceutical manufacturers. With nearly five decades of industry presence, Mekophar stands out for its specialization in generic medicines, active pharmaceutical ingredients (APIs), and a highly diversified therapeutic product portfolio. As of 2025, Mekophar continues to play a pivotal role in Vietnam’s public health ecosystem, supporting both domestic healthcare delivery and regional pharmaceutical supply chains.

Corporate Structure and Financial Position

| Metric | Value (as of Dec 2024) |

|---|---|

| Charter Capital | VND 255.46 billion |

| Shares Outstanding | 25,545,867 shares |

| Market Capitalisation | Not publicly disclosed |

| Financial Statements Audited On | March 24, 2025 |

| Years in Operation | 48 years |

- Robust Capital Base

- With a charter capital exceeding VND 255 billion, Mekophar is well-capitalized to sustain expansion, regulatory compliance, and R&D investments.

- Audited Transparency

- The company maintains audited financial records, reflecting a commitment to governance, regulatory adherence, and investor confidence.

Extensive Therapeutic Portfolio

| Therapeutic Class | Product Categories |

|---|---|

| Respiratory Support | Cough suppressants, expectorants, mucolytics |

| Anti-infectives | Antibiotics, antimalarials, antiprotozoals, antituberculosis agents |

| Pain & Inflammation | Analgesics, antipyretics, anti-inflammatory agents |

| Gastrointestinal Treatments | Anthelmintics, GI tonics, digestive aids |

| Cardiovascular System | Antihypertensives, anti-anginals, vasodilators |

| Metabolism & Endocrine Disorders | Metabolic drugs, diabetes management |

| Women’s Health | Vaginal preparations |

| Vitamins & Nutraceuticals | Tonics, multivitamin complexes |

| Infusion & Irrigation | IV fluids, sterile irrigation solutions |

| Dermatology & Cosmetics | Skincare and cosmetic solutions |

- Therapeutic Breadth

- Mekophar’s vast catalog ensures access to affordable treatments across acute and chronic disease segments—crucial for Vietnam’s public and private healthcare sectors.

- Pharmaceutical + Herbal Dual Focus

- Alongside allopathic (synthetic) drugs, the company produces herbal and nature-based medications, offering integrated care solutions aligned with regional consumer preferences.

Manufacturing and Distribution Infrastructure

| Location | Function |

|---|---|

| Ho Chi Minh City (HQ) | R&D, corporate operations, and distribution |

| Hanoi, Da Nang, Can Tho, Nghe An | Regional logistics and sales branches |

| Nationwide Distribution Network | Over 15 years of coverage through national wholesalers, hospitals, and pharmacies |

- Multi-Channel Distribution

- Mekophar has established one of Vietnam’s most comprehensive supply chains, spanning hospital tenders, private pharmacies, regional drugstores, and direct-to-retailer channels.

- Medical Sales Force

- A professional team of medical representatives and pharmaceutical marketers facilitates outreach and education across both urban and rural health markets.

Export Capabilities and Global Footprint

| Region | Countries | Market Nature |

|---|---|---|

| Southeast Asia | Laos, Myanmar, Cambodia | Regional partners for generics and herbal medicine |

| Sub-Saharan Africa | Nigeria, Democratic Republic of Congo | High-demand, volume-driven markets |

| Eastern Europe | Moldova, Ukraine, Russia | Price-sensitive but quality-focused markets |

- Regional Exporter of Vietnamese Pharmaceuticals

- Mekophar has cultivated long-term trading relationships in emerging and frontier markets, supplying essential medications where affordability and therapeutic reliability are paramount.

- Compliance-Ready Supply Chain

- With GMP-compliant operations and documentation support, Mekophar’s exports meet basic international registration requirements for entry into low- and middle-income countries.

Strategic Mission and Innovation Outlook

- Mission-Focused Development

- Mekophar’s core mission is to search, develop, and deliver safer, more effective, and affordable therapeutic solutions, responding to public health challenges at scale.

- Commitment to Pharmaceutical Science

- The company continues to invest in active pharmaceutical ingredient production, a sector critical to Vietnam’s pharmaceutical self-reliance and cost control.

- Future Innovation Pathways

- Though primarily focused on generics, Mekophar is exploring value-added formulations, fixed-dose combinations, and incremental innovation to enhance treatment outcomes.

Why Mekophar Is Among Vietnam’s Top 10 Leading Pharmaceutical Companies in 2025

- Legacy Expertise: Nearly 50 years of uninterrupted operations in API and finished drug production.

- Extensive Product Diversity: One of the broadest therapeutic portfolios in the Vietnamese pharmaceutical industry.

- National Distribution Excellence: Full-spectrum reach across urban hospitals, pharmacies, and rural healthcare units.

- Export-Oriented Infrastructure: Decades-long export presence in Southeast Asia, Africa, and Eastern Europe.

- Balanced Therapeutic Focus: Equal emphasis on chemical generics and herbal medicine lines to address varying consumer and patient needs.

Competitor Benchmarking Matrix (2025)

| Metric / Attribute | Mekophar | Domesco | DHG Pharma |

|---|---|---|---|

| Year Established | 1977 | 1989 | 1974 |

| Core Focus | Generics & APIs | Chemical + Herbal | Branded Generics + ETC |

| Distribution Network | Nationwide (5+ branches) | Nationwide + Export | Nationwide + Japan-linked |

| Export Regions | Asia, Africa, Eastern Europe | Americas, ASEAN | Domestic, Japan-focused |

| Therapeutic Breadth | High (20+ segments) | Moderate | High |

| Herbal Medicine Line | Yes | Yes | Limited |

Conclusion

Mekophar Chemical Pharmaceutical JSC is one of Vietnam’s most strategically resilient, therapeutically comprehensive, and export-capable pharmaceutical manufacturers. Its long-standing dedication to API synthesis, wide-scale generics, and distribution excellence ensures it remains a critical player in both domestic healthcare supply and international therapeutic outreach. In 2025, Mekophar stands as a beacon of veteran strength, formulation diversity, and public health value in Vietnam’s pharmaceutical sector.

8. Pymepharco Joint Stock Company

As a core subsidiary of the internationally renowned STADA Group, Pymepharco Joint Stock Company has emerged as a critical strategic outpost for delivering “German-standard healthcare” across Southeast Asia. Leveraging Vietnam’s rapidly modernizing pharmaceutical landscape and STADA’s global R&D infrastructure, Pymepharco is transforming from a domestic manufacturer into a regional pharmaceutical innovation and distribution powerhouse.

Corporate Positioning and Market Reputation

| Corporate Attribute | Details (2025) |

|---|---|

| Parent Company | STADA Arzneimittel AG (Germany) |

| Jitta Score | 4.99 |

| Stock Performance Indicator | Revenue and earnings marked as “Consistent” |

| YoY Earnings Change | -1.22% |

| Listed Market | Vietnam Stock Exchange |

| Ownership Role | Key Asian manufacturing base for STADA |

- High Investment Grade Rating

- A Jitta Score of 4.99 underscores Pymepharco’s strong fundamental stability and long-term investor confidence.

- Strategic Asset for STADA

- Pymepharco is STADA’s primary production and distribution gateway into Southeast Asia, aligning with its global expansion strategy focused on EMEA and APAC markets.

- German Pharmaceutical Standards

- All manufacturing operations are aligned with EU-GMP protocols, integrating German engineering precision with Vietnam’s competitive operating advantages.

Product Portfolio and Therapeutic Coverage

| Segment | Example Products & Applications |

|---|---|

| Prescription Drugs (Rx) | Cardiovascular, metabolic disorder treatments, anti-infectives |

| Over-the-Counter (OTC) | Pain relief, respiratory care, immune boosters |

| Biopharmaceuticals | Hormonal therapies, complex injectables, specialty oncology |

| Consumer Healthcare | Wellness products and supplements under the STADA brand umbrella |

- Legacy Product Integration

- Flagship global drugs from STADA’s portfolio, such as Nizoral® (antifungal), Grippostad® (cold & flu), and Lunestil® (sleep aid), are co-marketed and locally distributed by Pymepharco.

- High-Impact Therapeutic Focus

- Core emphasis on treating cardiovascular diseases, metabolic syndromes (e.g., diabetes), musculoskeletal conditions, and oncology, mirroring Vietnam’s evolving disease burden.

Manufacturing and Infrastructure Excellence

| Attribute | Details |

|---|---|

| Manufacturing Standards | EU-GMP certified |

| R&D Focus | Formulation innovation, biopharma adaptation |

| Technological Edge | German equipment, integrated automation |

| Role in STADA Network | Primary manufacturing hub for Asia-Pacific distribution |

- Advanced Production Facilities

- Pymepharco operates state-of-the-art plants, employing automated lines, sterile manufacturing suites, and bioequivalence-tested drug development units.

- Integrated R&D Pipeline

- The company invests steadily in R&D partnerships and tech transfer, aligning its roadmap with STADA’s global drug lifecycle management strategy.

Strategic Role in Regional Expansion

| STADA Strategic Initiative | Vietnam-Specific Implementation via Pymepharco |

|---|---|

| Market Penetration in Asia-Pacific | Leverages Vietnam as a low-cost, high-efficiency base |

| Localisation of Global Brands | Produces STADA drugs tailored for Southeast Asian markets |

| Investment in R&D and Quality Systems | Builds formulation capacity for regional regulatory approval |

| Distribution and Export Network | Uses Vietnam as a launchpad to ASEAN and frontier markets |

- Favorable Operating Conditions

- Vietnam’s stable investment climate, government support for pharma localization, and skilled scientific workforce bolster Pymepharco’s cost-efficiency and innovation capacity.

- Bridge Between Europe and Asia

- Pymepharco plays a transcontinental integration role, harmonizing European pharmaceutical standards with Asian distribution dynamics.

Strategic Differentiators and Competitive Strengths

- Part of a Global Pharmaceutical Powerhouse

- Backed by STADA’s extensive product pipeline, global brand credibility, and financial capital, Pymepharco has unrivaled scalability in the Vietnamese context.

- German-Vietnamese Pharmaceutical Synergy

- Uniquely blends Vietnamese agility and affordability with German regulatory compliance and R&D prowess.

- Multi-Segment Capabilities

- Active across Rx, OTC, and biopharmaceutical verticals, ensuring resilience and adaptability to both public health and commercial market needs.

- Consistent Financial Fundamentals

- Despite minor earnings contraction, the long-term revenue performance is consistent, backed by high-value production and licensing operations.

Comparative Matrix: Pymepharco vs. Other Internationally-Backed Firms in Vietnam

| Attribute | Pymepharco (STADA) | DHG Pharma (Taisho) | Imexpharm (Genuone) |

|---|---|---|---|

| Parent Company | STADA (Germany) | Taisho (Japan) | Genuone (Korea) |

| Core Segment | Generics, Biopharma | Branded generics, ETC | Antibiotics, OTC, ETC |

| Export Role | Regional base | Selective export | Limited global reach |

| Biopharma Integration | Yes | No | Partial |

| EU-GMP Certification | Yes | Yes (recent) | Yes |

| Consumer Healthcare Focus | Strong | Moderate | Moderate |

Why Pymepharco Ranks Among Vietnam’s Top 10 Leading Pharmaceutical Companies in 2025

- International Backbone: Full backing and strategic guidance from STADA Group, one of Europe’s most prominent pharmaceutical entities.

- Advanced Production Capabilities: Operates EU-GMP certified facilities with future-ready automation and sterile injectable capacities.

- Regional Integration Leader: Serves as a central pharmaceutical hub for STADA’s Asia-Pacific supply and expansion strategy.

- Product Diversification: Offers prescription, OTC, biopharma, and consumer health solutions, covering all key therapeutic domains.

- Sustainable Growth Model: Focused on R&D investment, tech transfer, and local-global product harmonization, ensuring long-term scalability and resilience.

Conclusion

In 2025, Pymepharco JSC stands as a symbol of Vietnam’s pharmaceutical integration into the global healthcare economy. Through its German-aligned standards, STADA’s strategic direction, and robust multi-therapy portfolio, the company is positioned not only as a domestic market leader but as a key pharmaceutical export and innovation hub for Southeast Asia. Its status as a Top 10 pharmaceutical company in Vietnam reflects not only its current capabilities but also its transformative potential in reshaping regional healthcare delivery.

9. Sanofi Vietnam

With over five decades of continuous presence, Sanofi Vietnam, a subsidiary of the global healthcare giant Sanofi Group, stands as a cornerstone of the Vietnamese pharmaceutical landscape. Recognized for its diversified portfolio across prescription medicines, consumer healthcare, and vaccines, Sanofi Vietnam’s strategic investments, local manufacturing footprint, and regional export capabilities position it as one of the most influential international pharmaceutical companies operating in Vietnam today.

Corporate Overview and Strategic Market Position

| Attribute | Details (2025) |

|---|---|

| Parent Company | Sanofi Group (France) |

| Years of Operation in Vietnam | Over 50 years |

| Regional Coverage | Vietnam, Laos, Cambodia |

| Manufacturing Sites in Vietnam | 2 operational; 1 under construction |

| Local Production Contribution | 80% of Sanofi Vietnam’s product volume |

| Export Share | 20% of local output exported to other Asian countries |

- Longevity in the Market

- As one of the earliest foreign pharmaceutical investors in Vietnam, Sanofi has consistently contributed to the development of local healthcare infrastructure and manufacturing standards.

- Strategic ASEAN Hub

- Vietnam serves not only as a key consumer market but also as a strategic regional production and export base for Sanofi’s expansion across Southeast Asia.

Robust Product Portfolio and Therapeutic Leadership

| Segment | Key Product Offerings & Focus Areas |

|---|---|

| Prescription (Ethical) Medicines | Diabetes, cardiovascular, oncology, immunology |

| Consumer Healthcare (OTC) | Vitamins, allergy relief, flu care, pain management |

| Human Vaccines | Pediatric, influenza, hepatitis, and combination vaccines |

| Biopharmaceuticals | Rare diseases, enzyme replacement, and specialty biologics |

- Over 100 Pharmaceutical Products

- Sanofi Vietnam offers broad-spectrum therapeutic coverage, addressing both communicable and non-communicable diseases prevalent in Vietnam and the region.

- Leadership in Vaccine Innovation

- The company plays a pioneering role in vaccine manufacturing and immunization programs, helping bridge vaccine accessibility gaps in Vietnam and neighboring countries.

R&D Investment and Global Pipeline Contributions

| Metric (Sanofi Global) | Details |

|---|---|

| Total Clinical-Stage Projects | 82 (as of July 31, 2025) |

| Phase 3/Submissions | 30 projects |

| Focus Areas | Immunology, oncology, neurology, rare diseases |

| Global R&D Investment (2024–2030) | $20 billion (US investment alone) |

| Cost Savings for R&D Reallocation | €2 billion (2024–2025) |

- R&D-Driven Strategy

- Sanofi’s long-term vision emphasizes pipeline innovation, with particular focus on difficult-to-treat and chronic diseases, ensuring a steady flow of next-generation therapies.

- Vietnam as a Beneficiary of Global Innovation

- Through clinical trial participation, tech transfer, and access to advanced formulations, Vietnam benefits directly from Sanofi’s innovation engine.

Local Manufacturing Expansion and Technology Transfer

| Project | Key Metrics |

|---|---|

| Vaccine Technology Transfer (2025) | Partnership with VNVC |

| New Vaccine Facility | 26,000 sqm in Long An Province |

| Initial Investment | $77.2 million |

| Projected Annual Capacity | 100 million vaccine doses |

| Operational Objective | Local production of Sanofi vaccines for domestic and regional use |

- Sovereign Vaccine Production Capacity

- This state-of-the-art facility will reduce Vietnam’s reliance on imported vaccines and elevate its bio-manufacturing independence.

- Support for National Immunization Programs

- Sanofi’s investment reinforces its role in public health protection, contributing directly to Vietnam’s national vaccination coverage and pandemic preparedness.

Social Contribution and Health Education Programs

- Medical Education and Capacity Building

- Sanofi Vietnam actively engages in continuing medical education (CME) for healthcare professionals, ensuring up-to-date knowledge transfer across therapeutic areas.

- Corporate Social Responsibility (CSR)

- The company supports public health campaigns, rural outreach initiatives, and partnerships with NGOs, aligned with sustainable health development goals.

Comparative Matrix: Sanofi Vietnam vs Other Global Pharma Players in Vietnam (2025)

| Metric | Sanofi Vietnam | Pfizer Vietnam | GSK Vietnam |

|---|---|---|---|

| Years in Vietnam | 50+ | 30+ | 25+ |

| Local Manufacturing | Yes (2 plants, 1 under construction) | No | No |

| Export Contribution | 20% of local output | N/A | N/A |

| Vaccine Production | Yes (with VNVC) | No | No |

| Product Categories | Ethical, OTC, vaccines | Mainly Rx | Rx, Vaccines |

| Regional Influence | Vietnam + Indochina | Vietnam | Vietnam + Asia Pacific |

Why Sanofi Vietnam Is One of the Top 10 Pharmaceutical Companies in Vietnam in 2025

- Deep Market Integration

- With over 50 years in the country, Sanofi has localised its operations across production, R&D, and supply chain, achieving embedded influence in Vietnam’s healthcare system.

- Manufacturing Scale and Export Potential

- One of the only global pharmaceutical firms with a multi-factory presence in Vietnam, Sanofi supplies both the domestic and regional markets efficiently.

- Vaccine Sovereignty Initiatives

- Through its joint venture with VNVC, Sanofi is helping to localize vaccine production and reduce reliance on imports, supporting public health resilience.

- Scientific and Technological Alignment

- Leveraging European R&D excellence combined with Vietnamese manufacturing agility, Sanofi Vietnam is strategically positioned for long-term leadership.

- Broad Portfolio and Disease Coverage

- From chronic disease management to infectious disease prevention, Sanofi’s diversified offerings serve millions of Vietnamese patients across age groups and health conditions.

Conclusion

Sanofi Vietnam exemplifies how multinational pharmaceutical firms can become deeply embedded in a local ecosystem through a combination of long-term investment, localized production, scientific innovation, and public health collaboration. In 2025, its dual role as a healthcare provider and economic contributor ensures it maintains a leadership position in Vietnam’s rapidly evolving pharmaceutical industry.

10. Bayer Vietnam Ltd.

As a dynamic arm of the global Bayer Group, Bayer Vietnam Ltd. has evolved into a multidisciplinary force across Vietnam’s healthcare, consumer health, and agricultural sectors. Operating in the country since 1994, Bayer Vietnam has successfully localized its strategy to meet both public health needs and national development goals, making it one of the most influential and diversified pharmaceutical and life science companies in Vietnam today.

Corporate Presence and Operational Scale in Vietnam

| Attribute | Details (2025) |

|---|---|

| Year of Market Entry | 1994 |

| Local Facilities | Factory in Dong Nai, Offices in Hanoi & Ho Chi Minh City |

| Parent Company | Bayer Group (Germany) |

| Global R&D Spend (2024) | €5.86 billion |

| Global R&D Workforce | ~15,900 scientists |

- Strategic Manufacturing Base

- Bayer Vietnam’s Dong Nai production facility is outfitted with state-of-the-art manufacturing systems, supporting both domestic distribution and regional supply.

- Comprehensive Geographic Coverage

- With operations in Hanoi (North), Ho Chi Minh City (South), and Dong Nai (Manufacturing Hub), the company ensures nationwide reach and logistics efficiency.

Key Business Divisions and Market Focus

| Division | Focus Areas in Vietnam |

|---|---|

| Pharmaceuticals | Prescription drugs in cardiology, oncology, hematology, ophthalmology, and women’s health |

| Consumer Health | OTC medications for general health, immunity, pain, and digestive care |

| Crop Science | High-tech agricultural inputs: fungicides, herbicides, insecticides, and hybrid seeds |

- Pharmaceutical Innovation

- Bayer Vietnam’s Pharmaceuticals Division delivers breakthrough treatments for chronic and complex diseases, including oncology, ophthalmology, and reproductive health.

- Trusted OTC Brands

- The Consumer Health Division offers globally recognised OTC products, positioning Bayer as a household name in preventive and daily health maintenance.

- Sustainable Agri-Science

- Through its Crop Science Division, Bayer supports Vietnam’s rural economy by enhancing crop yields, protecting biodiversity, and encouraging sustainable farming practices.

Strategic Innovation, Partnerships, and Public Health Impact

| Initiative | Description & Impact |

|---|---|

| Better Life Farming (BLF) Alliance | Launched Oct 2024 to empower smallholder coffee & durian farmers via advisory and agri-tech |

| ForwardFarming for Rice (2023) | A sustainability-driven rice cultivation program using Bayer crop science innovations |

| MoU with Hung Vuong Hospital (2023) | Collaboration to advance women’s health through clinical education and professional training |

| Open Innovation Model | Combines in-house R&D with external partnerships to accelerate local access to innovation |

- Integrated Rural and Urban Healthcare Focus

- Bayer’s partnership with Hung Vuong Hospital enhances gynecological and obstetric care by introducing modern therapies and educational support to healthcare providers.

- Rural Economic Development

- Through its agricultural alliances, Bayer not only delivers productivity-enhancing inputs, but also builds long-term livelihood resilience for Vietnamese farmers.

- Open Innovation Strategy

- Bayer Vietnam implements open collaboration frameworks with local researchers, health institutions, and agritech innovators to solve Vietnam’s most pressing health and agricultural challenges.

Bayer’s Global Strength Supporting Local Growth

| Metric (Global) | Relevance to Vietnam |

|---|---|

| €5.86 billion R&D spend (2024) | Fuels local adaptation of global therapies and agri-science solutions |

| 15,900 R&D scientists worldwide | Supports robust knowledge transfer into Vietnam’s healthcare system |

| Global Leadership in Women’s Health | Local deployment of best-in-class therapies and medical education |

| Strong Sustainability Agenda | Promotes climate-smart agriculture and green chemistry practices |

- Vietnam as an Innovation Adopter

- Bayer channels its global R&D breakthroughs into Vietnam, making advanced diagnostics and therapeutics more accessible and affordable for local populations.

- Sustainability and ESG Alignment

- The company’s activities in pharmaceuticals and crop science are closely aligned with Vietnam’s green growth strategy and UN SDGs, particularly in climate and health.

Comparative Matrix: Bayer Vietnam vs Other Leading Pharma MNCs in Vietnam (2025)

| Criteria | Bayer Vietnam | Sanofi Vietnam | GSK Vietnam |

|---|---|---|---|

| Years in Vietnam | 30+ | 50+ | 25+ |

| Manufacturing Facility | Yes (Dong Nai) | Yes (2, third under construction) | No |

| Key Strength | Multi-sector integration | Vaccine localization, Rx, OTC | Rx, respiratory, dermatology |

| Agricultural Operations | Yes (Crop Science Division) | No | No |

| Public Health Partnerships | Yes (Women’s health, farming) | Yes (Vaccines, VNVC) | Yes (training & access) |

Why Bayer Vietnam Ranks Among the Top 10 Pharmaceutical Companies in Vietnam (2025)

- Multidimensional Market Leadership

- Bayer Vietnam excels across pharmaceuticals, consumer health, and agriculture, a rare multi-industry approach that few competitors match.

- Pioneering Public Health Impact

- Strategic alliances, such as the Hung Vuong Hospital collaboration, show Bayer’s commitment to enhancing women’s health outcomes through local integration.

- R&D-Led Value Creation

- Supported by billions in global R&D investments and over 15,900 scientists, Bayer Vietnam ensures rapid technology transfer and localization of cutting-edge treatments.

- Sustainability-Driven Agriculture

- Through initiatives like Better Life Farming and ForwardFarming, Bayer is helping modernize Vietnam’s agriculture with climate-resilient solutions.

- End-to-End Ecosystem Integration

- From drug discovery and distribution to crop optimization and health education, Bayer Vietnam integrates science and sustainability into every aspect of its business.

Conclusion

In 2025, Bayer Vietnam Ltd. is widely regarded not only as a pharmaceutical company but as a science-led ecosystem builder at the intersection of health, agriculture, and environmental sustainability. Its diverse verticals, global innovation pipeline, and strategic collaborations make it a formidable force shaping Vietnam’s healthcare and agri-development future, solidifying its place among the Top 10 Leading Pharmaceutical Companies in Vietnam.

Conclusion

Vietnam’s Pharmaceutical Market in 2025: Top Companies & Strategic Outlook

Vietnam’s pharmaceutical sector has entered a critical phase of transformation in 2025, driven by rapid economic growth, demographic shifts, health policy reforms, digital disruption, and increased investor interest. The market is strategically positioned as one of Southeast Asia’s most promising pharmaceutical hubs.

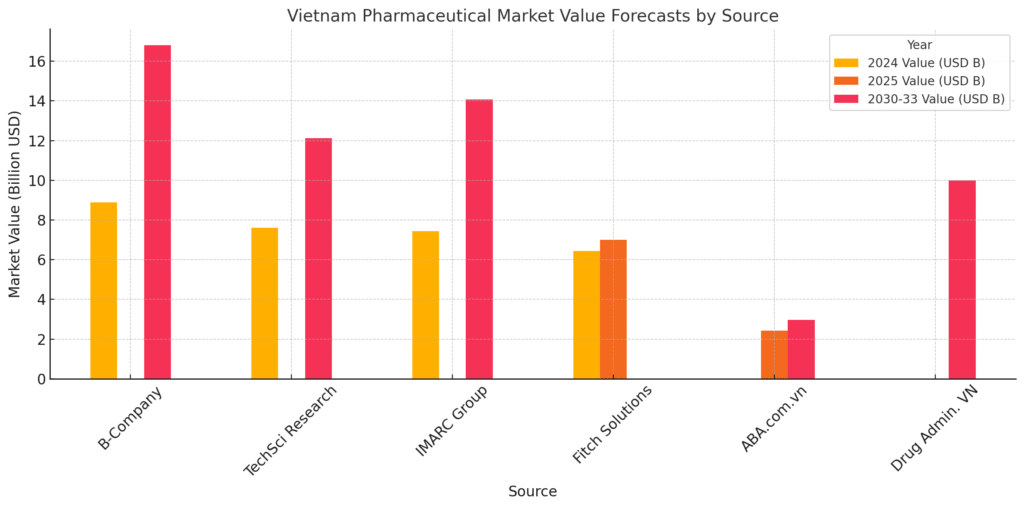

Market Growth and Size Forecasts: A Multi-Source Perspective

Despite varied figures across research bodies due to differing market definitions (retail vs. total, inclusion of medical devices, etc.), all major projections point to robust double-digit growth over the next decade.

Comparative Table: Pharmaceutical Market Value Projections for Vietnam

| Source | 2024 Value (USD) | 2025 Value (USD) | 2030-2033 Value (USD) | CAGR Estimate | Remarks |

|---|---|---|---|---|---|

| B-Company | $8.9 billion | N/A | $16.8 billion (2033) | 6.7% (2025–2033) | Focused on retail pharmacy segment |

| TechSci Research | $7.6 billion | N/A | $12.12 billion (2030) | 7.96% (2025–2030) | Includes both retail and institutional sales |

| IMARC Group | $7.4 billion | N/A | $14.1 billion (2033) | 7.34% (2025–2033) | Forecasted across therapeutic and OTC categories |

| Fitch Solutions (VND) | VND 154.1 trillion | VND 166.8 trillion | N/A | N/A | Based on government budget allocations |

| ABA.com.vn | N/A | $2.43 billion | $2.96 billion (2029) | 5.06% (2025–2029) | Narrower focus, possibly on online/e-pharmacy sales |

| Drug Administration VN | N/A | N/A | >$10 billion (2026) | N/A | Local industry projection for total market size |

Insight: The fragmented range of market forecasts underscores definitional variances but collectively affirms a strong upward growth path. Long-term projections converge around $14–17 billion by 2033, validating Vietnam as a high-opportunity pharmaceutical market.

Strategic Growth Drivers of Vietnam’s Pharmaceutical Industry

Economic Development and Rising Middle-Class Spending

- Sustained GDP growth has catalyzed improvements in income, healthcare access, and pharmaceutical consumption.

- Between 2012–2020, average monthly income doubled, significantly expanding consumer demand for OTC supplements, wellness products, and branded pharmaceuticals.

Demographics: Aging Population & Emerging Middle Class

- Over 98 million people in 2025, with a rapidly aging segment:

- 7.6 million aged 65+ in 2020, projected to exceed 18% of the population by 2049.

- A middle class of 30+ million individuals is increasingly health-conscious and willing to pay for Western-quality treatment and specialist care.

Government Policy and Universal Healthcare Expansion

- Health insurance coverage reached 90% by 2019, with a 95% target by 2025.

- Revised Pharmacy Law (effective July 1, 2025):

- Enables pharmacy chains and digital pharma models

- Strengthens IP protection and local manufacturing incentives

Public & Private Healthcare Infrastructure Development

| Target Year | Hospital Beds | Doctors | Pharmacists | Nurses (per 10,000 people) |

|---|---|---|---|---|

| 2025 | 33 | 15 | 3.4 | 25 |

| 2030 | 35 | 19 | 4 | 33 |

| 2050 | 45 | 35 | 4.5 | 90 |

- Expansion of private hospitals and clinics expected to serve 25% of patients by 2050.

- Modernization of six major hospitals to international standards underway as of 2024.

Disease Burden: Rise of Non-Communicable & Infectious Diseases

- 81% of deaths in 2019 due to NCDs (heart disease, cancer, diabetes).

- Diabetes prevalence: 6% of adult population (approx. 5 million people).

- Infectious diseases such as tuberculosis persist, sustaining demand for antibiotics and vaccines.

Digitalization & Emergence of E-Pharmacies

- Internet penetration and mobile usage have catalyzed rapid growth of e-pharmacy platforms.

- Benefits:

- Wider access in rural areas

- Transparent pricing

- Improved supply chain efficiency

Vietnam Pharmaceutical Market Segmentation Overview

| Segment | Insights |

|---|---|

| Generic vs. Branded | Strong government support for local generics, growing consumer shift toward premium brands |

| ETC vs. OTC | Balanced growth: OTC up 32% YoY, ETC up 24% YoY (Imexpharm H1 2025) |

| Key Therapeutics | Cardiovascular, Metabolic Disorders, Oncology, Musculoskeletal, Anti-infectives |

| Distribution Models | Retail Pharmacy, Hospital Pharmacy, E-Pharmacy, B2B Virtual Platforms |

Industry Challenges and Strategic Opportunities

Fragmented Retail Landscape & Consolidation Potential

| Indicator | Vietnam | United States (for comparison) |

|---|---|---|

| Independent Pharmacies | 98.5% of total | < 30% |

| Sales Reps per $10M in Revenue | 55 | 3 |

| Suppliers Needed by One Pharmacy | 5+ | 1–2 |

- Highly fragmented supply chain increases cost and reduces efficiency.

- Consolidation via large pharmacy chains and e-commerce platforms expected.

High Distribution Costs & Supply Chain Complexity

- Small order volumes, low-frequency deliveries, and a dense retail map contribute to inefficiency.

- Solution pathways:

- Digital logistics platforms

- Centralized warehousing

- Strategic regional partnerships

Reducing Import Dependency

- Vietnam currently imports 70–80% of pharmaceutical raw materials.

- Goal: Meet 20% of domestic API demand by 2030 through: