Key Takeaways

- VinFast, Pega, and Yadea lead Vietnam’s electric motorbike market with innovative models tailored for urban mobility in 2025.

- Domestic brands dominate over 70% of new E2W sales, benefiting from local insight, government incentives, and strong distribution.

- Consumer demand for affordable, high-performance electric two-wheelers is driving rapid model innovation and competitive pricing.

In 2025, Vietnam stands at the forefront of a transportation transformation, driven by the rapid electrification of its two-wheeler segment. As one of the largest motorcycle markets in the world, with over 75 million registered motorbikes, Vietnam’s urban and rural mobility has long depended on two-wheelers for daily commuting, commercial deliveries, and economic productivity. However, amid rising environmental concerns, government policy shifts, and technological innovation, a new generation of electric motorbikes (E2Ws) is reshaping the country’s mobility landscape. This blog explores the Top 10 Electric Motorbike Brands and Models in Vietnam in 2025, spotlighting the key players, best-selling models, and the consumer trends driving this electrification boom.

Electric motorbikes are no longer niche or novelty products in Vietnam. From students and office workers to logistics couriers and rural riders, a broad spectrum of users is turning to EVs as a cleaner, more efficient alternative to gasoline-powered vehicles. What once began as a budget-friendly solution for short-distance commuters has evolved into a diverse and competitive sector that includes high-performance scooters, smart-connected models, and stylish, tech-integrated bikes built for Vietnam’s fast-changing roads and consumer preferences.

The Vietnamese government has taken a proactive stance in accelerating this shift. Under Decision No. 876/QD-TTg, it aims to eliminate gasoline-powered vehicles by 2040 and achieve 100% electrification of transport by 2050. Complementing these long-term goals are immediate policy incentives—such as 0% registration fees, VAT reductions, and consumer subsidies—which have made electric motorbikes increasingly accessible. As a result, by mid-2025, electric two-wheelers already account for approximately 12–15% of total new motorbike sales, with projections estimating 2 million electric units annually by 2036.

This unprecedented growth has intensified competition among domestic and international brands, each seeking to establish dominance in various sub-segments of the market. Vietnamese manufacturers such as VinFast, Pega, and Anbico are leveraging localized supply chains and deep market insight to offer competitively priced, high-performance electric models. At the same time, global players like Yadea, NIU, and Gogoro are entering the Vietnamese market with advanced technology, smart mobility platforms, and aggressive pricing strategies. These developments have expanded the product ecosystem, ranging from budget commuter bikes under $700 to high-end models equipped with AI, IoT connectivity, and regenerative braking systems.

This blog provides a meticulously curated list of the Top 10 Electric Motorbike Brands and Models in Vietnam in 2025, ranked by a combination of factors including:

- Market share and unit sales

- Consumer popularity and pricing

- Technological innovation and performance

- Sustainability features and battery efficiency

- Design, build quality, and after-sales support

Each brand and model highlighted reflects the broader shifts occurring within the electric mobility sector in Vietnam. Whether you are an industry investor, a policymaker, a tech enthusiast, or a potential buyer, understanding the leading electric motorbike brands is essential to grasping the future of transportation in one of Southeast Asia’s most dynamic economies.

In the following sections, we will break down each brand’s positioning, key specifications, and competitive strengths, along with an analysis of why these models have earned their place in the top 10. The goal is to provide readers with a comprehensive and comparative view of the 2025 Vietnamese electric motorbike landscape—its leaders, innovators, and game-changers.

Let’s begin by exploring the major players and the standout models driving Vietnam’s two-wheeled electric revolution.

Top 10 Electric Motorbike Brands and Models in Vietnam in 2025

- VinFast

- Pega

- Yadea

- Dibao

- Anbico

- NIU

- Gogoro

- Dat Bike

- DK Bike

- Other Notable Brands: Detech, EVGO, Vmoto, Tailg

1. VinFast

1. Dominance in Market Share and Ecosystem Strategy

1.1 Market Leadership

- As of July 2025, VinFast commands over 43% of Vietnam’s electric motorbike market, establishing itself as the undisputed market leader.

- This dominance stems not only from first-mover advantage but from strategic vertical integration, sustained investment, and consumer-oriented innovation.

1.2 Manufacturing Capacity

- VinFast’s Hai Phong facility—launched in 2018—boasts an annual production capacity of 250,000 units, one of the largest in Southeast Asia for EV motorbikes.

| Metric | Value |

|---|---|

| Year Established | 2018 |

| Annual Capacity | 250,000 units |

| 2023 Q3 Sales | 28,220 units |

| Jan-May 2025 Growth | +488% YoY |

1.3 Sales and Growth Momentum

- Q3 2023: Sold 28,220 units — +177% QoQ and +113% YoY.

- Jan–May 2025: 488% growth compared to the same period in 2024.

2. Key Strategic Differentiators

2.1 Aggressive Pricing Strategy

- VinFast has implemented a 15–20% price reduction across its EV models, undercutting equivalent gasoline motorbikes.

- This approach makes e-mobility financially accessible for the mass market and directly accelerates EV adoption.

2.2 National Charging Infrastructure

- Over 150,000 charging poles installed across:

- Shopping centers

- Highway rest stops

- Apartment complexes

- Urban public zones

Impact: Significantly reduces “range anxiety” and removes a major psychological barrier for EV adoption.

2.3 Battery Leasing & Incentives

- Offers flexible battery leasing plans:

| Usage Plan | Monthly Fee | Deposit |

|---|---|---|

| < 2,000 km/month | 350,000 VND | 2,000,000 VND |

| > 2,000 km/month | 990,000 VND | 2,000,000 VND |

| Full Battery Purchase (Optional) | 10,900,000 VND | N/A |

- Free nationwide charging until May 2027 (Hanoi) as part of buyer incentives.

3. Highlighted Electric Motorbike Models (2025)

3.1 VinFast Evo200

- Segment: Mid-range

- Price: 18,000,000 VND (excluding battery)

| Specification | Value |

|---|---|

| Max Speed | 70 km/h |

| Range | 203 km |

| Motor Power | 2500W |

| Battery Capacity | 3.5 kWh LFP |

| Charging Time | 4–10 hours |

| Trunk Volume | 22 liters |

| Weight (with battery) | 97 kg |

- Popular with delivery and ride-hailing drivers, notably VinFast’s own XanhSM fleet—some reporting over 100,000 km driven without major issues.

- Ideal for urban commuting; only limitation is slightly cramped seating for taller riders.

3.2 VinFast Klara S2

- Segment: Upgraded commuter

- Target User: Urban professionals

- Price Range: Competitive mid-tier

| Specification | Value |

|---|---|

| Max Speed | 78 km/h |

| Range | 194 km |

| Motor Power | 3000W |

| Battery Capacity | 3.5 kWh LFP |

| Charging Time | ~6 hours |

| Trunk Volume | 23 liters |

| Weight (with battery) | 112 kg |

- The Klara line enjoys strong brand loyalty; initial S2 release saw 15,000–20,000 preorders.

- Suited for users seeking balance between speed, style, and sustainability.

3.3 VinFast Vento S

- Segment: Premium smart scooter

- Target User: Tech-savvy urbanites

- Price Range: Upper tier

| Specification | Value |

|---|---|

| Max Speed | 89 km/h |

| Range | 160 km |

| Motor Power | 5200W (side motor) |

| Battery Type | LFP |

| Charging Time | ~6 hours |

| Trunk Volume | 25 liters |

| Weight (with battery) | 122 kg |

| Smart Features | PAAK, Smart Lock, eSIM |

- Includes “Phone as a Key” (PAAK), OTA updates, and automatic diagnostics—positioning it as a leading smart electric scooter in Vietnam.

3.4 VinFast Feliz S

- Segment: Mid-range commuter

- Target User: Daily riders seeking performance

| Specification | Value |

|---|---|

| Max Speed | 78 km/h |

| Range | 198 km |

| Motor Power | 3000W |

| Battery Capacity | 3.5 kWh LFP |

| Charging Time | ~6 hours |

| Trunk Volume | 25 liters |

| Weight (with battery) | 110 kg |

- Offers a compelling value proposition with long range and balanced performance.

- Highly rated for daily commutes and ride-hailing services.

3.5 VinFast Evo200 Lite

- Segment: Youth & student market

- Max Speed: 49 km/h

- Range: Up to 205 km

- Price: 22,000,000 VND

| Highlights | Details |

|---|---|

| Trunk Capacity | 22 liters |

| Designed For | Students / Low-speed zones |

| Eco-Focused | Yes |

- Strategically designed to meet licensing requirements for students while still offering extended range and practicality.

3.6 VinFast Motio

- Segment: Entry-level / Budget

- Price: 12,000,000 VND

| Features | Benefit |

|---|---|

| Low Pricing | Increased accessibility |

| Practical Design | Suitable for short trips |

| Minimalist Build | Easy to maintain |

- Motio serves as an entry point for Vietnam’s lower-income segment—enabling mass-scale electrification.

4. Competitive Advantage Matrix

| Factor | VinFast’s Advantage | Impact on Market |

|---|---|---|

| Manufacturing Scale | 250,000 units/year | Market readiness, supply chain control |

| Charging Infrastructure | 150,000+ charging poles | Convenience, reduced adoption barriers |

| Battery Leasing Flexibility | Affordable monthly plans | Lower upfront costs for consumers |

| Model Variety | From student to premium models | Appeals to all income segments |

| Smart Technology Integration | PAAK, eSIM, OTA updates | First-mover edge in smart features |

| Strategic Pricing | 15–20% below ICE competitors | Accelerated conversion to EVs |

5. Conclusion: Why VinFast is a Top 10 Electric Motorbike Brand in Vietnam (2025)

- VinFast’s unparalleled ecosystem approach—combining high-volume manufacturing, nationwide charging infrastructure, affordable battery leasing, and cutting-edge smart technology—has redefined the electric motorbike market in Vietnam.

- The brand’s scalability, product diversity, and aggressive expansion strategy are unmatched by any domestic or foreign competitor operating in Vietnam today.

- As the Vietnamese government pushes toward net-zero targets, VinFast is positioned not only as a dominant player but a catalyst for the country’s sustainable mobility transformation.

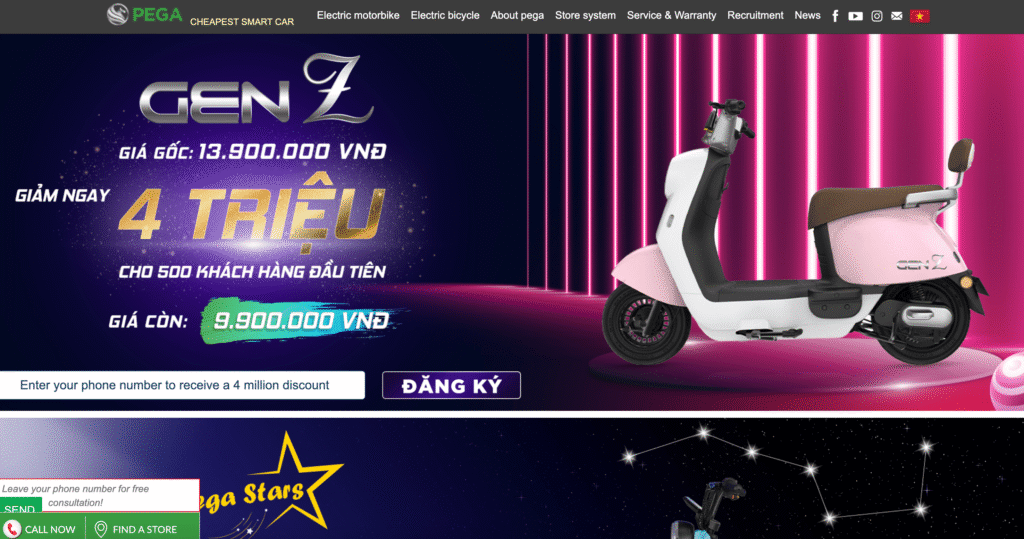

2. Pega

1. Strategic Market Position and Domestic Production Excellence

1.1 Competitive Standing in Vietnam’s EV Market

- As of mid-2025, Pega commands an estimated 16% share of Vietnam’s burgeoning electric motorbike market, firmly placing it among the top two domestic manufacturers.

- The brand’s consistent annual sales of approximately 30,000 units over the past three years underscores both its production reliability and sustained consumer demand.

| Indicator | Data |

|---|---|

| Market Share (2025) | ~16% |

| Annual Production Capacity | 60,000 units |

| Factory Location | Vietnam (since 2012) |

| Annual Sales (avg, past 3 years) | ~30,000 units |

1.2 Localized Manufacturing and Value Delivery

- Founded in 2007, Pega was among the earliest local innovators to recognize the potential of electric mobility in Vietnam.

- Through fully localized production and assembly, Pega keeps costs low without compromising quality—ensuring price-sensitive Vietnamese consumers get a high-quality product at a competitive rate.

- The brand benefits from a robust distribution network, enabling nationwide reach and after-sales support.

2. Affordability-Driven Strategy with Customer-Centric Innovation

2.1 Focus on Cost-Effective Engineering

- Pega positions itself as the preferred brand for affordability-conscious buyers, competing against both high-end local players and influxes of budget Chinese imports.

- The company’s core proposition lies in delivering practicality, decent performance, and modern aesthetics, all at accessible price points.

2.2 Consumer Assurance Initiatives

- Pega stands out by offering a 3-day return policy for its flagship NewTech model—one of the few brands in Vietnam to publicly implement this.

- This initiative not only builds brand trust and loyalty but also reinforces the manufacturer’s confidence in its product quality.

| Competitive Features | Strategic Impact |

|---|---|

| Local production & sourcing | Cost control and market responsiveness |

| 3-day return policy | Enhances consumer trust, supports brand credibility |

| Broad price range | Serves entry-level to mid-premium segments |

| After-sales support infrastructure | Ensures long-term customer satisfaction |

3. Key Electric Motorbike Models by Pega (2025)

3.1 Pega NewTech

- Segment: Urban commuter / male riders

- Launch Date: January 11

- Price:

- Promotional: 22,000,000 VND

- Standard: 25,000,000 VND

| Specification | Detail |

|---|---|

| Motor Power | 1500W |

| Top Speed | 60 km/h |

| Range per Charge | 90 km |

| Battery Utility | Phone charging capability |

| Aesthetic Focus | Masculine, robust design |

| Trunk Volume | Modest (noted in reviews) |

- Designed for daily commutes, the NewTech is especially suitable for urban male users seeking a durable, stylish, and economical vehicle.

- Unique utility includes dual-use battery functionality as a power bank for mobile devices—an added convenience for tech-oriented consumers.

3.2 Pega S

- Segment: Premium urban scooter

- Positioning: Budget alternative to Honda SH-style scooters

- Target Consumer: Status-conscious urban commuters

| Specification | Detail |

|---|---|

| Motor Power | 4000W PMSM motor |

| Top Speed | 65 km/h |

| Range per Charge | 120 km |

| Battery Type | Lithium-ion |

| Battery Lifespan | 1,000 charge cycles |

| Load Capacity | Up to 250 kg |

| IP Rating | IP67 waterproof motor |

| Seat Height | 780mm |

- Pega S offers performance and premium styling at a mid-range price point, mimicking the design of Honda SH 2020 while delivering modern electric power.

- The IP67-rated motor ensures functionality in wet and challenging conditions—appealing to riders in Vietnam’s flood-prone cities.

3.3 Pega Aura

- Segment: Stylish budget commuter

- Design Inspiration: Vespa-style European aesthetics

- Price: 14,800,000 VND

| Specification | Detail |

|---|---|

| Motor Power | 1200W–1400W |

| Top Speed | 60 km/h |

| Range per Charge | 60–100 km |

| Aesthetic Profile | Fashionable, Vespa-like curves |

| Price Advantage | One of the most affordable in class |

- Aura is ideal for riders seeking visual flair and functional range at a low entry cost.

- The combination of elegant design and moderate specs makes it particularly popular among younger, style-conscious urban riders.

4. Competitive Benchmarking Matrix (2025)

| Criteria | Pega | VinFast | Chinese Imports |

|---|---|---|---|

| Local Production | Yes | Yes | No |

| Average Price Range | 14M – 25M VND | 12M – 30M+ VND | 9M – 20M VND |

| Smart Features | Limited | Advanced (eSIM, PAAK, etc.) | Basic |

| Battery Leasing Options | No | Yes | No |

| Motor Durability | High (IP67 for Pega S) | High | Variable |

| Customer Return Policy | 3-day return (NewTech only) | None disclosed | None |

| Ideal Target Segment | Budget + Practical users | Mass market + Premium | Entry-level price seekers |

5. Conclusion: Why Pega is a Top 10 EV Motorbike Brand in Vietnam (2025)

- Pega’s focus on cost-effectiveness, local manufacturing, and consumer-first policies has carved out a resilient position in Vietnam’s EV motorbike hierarchy.

- Its product lineup offers a well-balanced mix of performance, practicality, and affordability, catering to a broad demographic from first-time users to mid-tier urban commuters.

- While Pega may not lead in technological sophistication, it excels in meeting everyday transport needs with dependable products, thus solidifying its place among Vietnam’s Top 10 Electric Motorbike Brands for 2025.

3. Yadea

1. Market Penetration and Expansion Strategy in Vietnam

1.1 Solidifying Presence in a Competitive Landscape

- As of July 2025, Yadea’s market share in Vietnam stands at approximately 8.6%, with some industry estimates placing it closer to 12–13%, reflecting its strong upward trajectory.

- The company achieved a remarkable 36.8% sales growth in the first five months of 2025, highlighting growing consumer confidence and adoption of Yadea products nationwide.

| Metric | Value |

|---|---|

| Market Share (2025) | 8.6%–13% |

| Sales Growth (Jan–May 2025) | +36.8% YoY |

| Retail Network | 700+ outlets nationwide |

| Number of Models Offered | 15 |

| Price Range | $480 – $1,000 |

1.2 Local Manufacturing and Investment Commitments

- Yadea became the first foreign-invested E2W manufacturer in Vietnam with its initial factory established in 2019.

- In a bold display of long-term strategic commitment, Yadea invested $100 million to construct its second Vietnamese factory in Bac Giang, projected to open in 2024.

- This expansion is expected to boost Yadea’s annual production capacity to 2.5 million units, positioning the brand as a volume leader not only in Vietnam but across ASEAN.

| Factory Milestone | Detail |

|---|---|

| First E2W Plant in Vietnam | Established 2019 |

| Second Factory (Bac Giang) | $100M investment, opens 2024 |

| Combined Production Capacity | 2.5 million units/year |

Strategic Impact: Lower import costs, improved logistics, greater control over supply chains, and enhanced pricing competitiveness within the Vietnamese market.

1.3 Consumer-Centric Marketing and Affordability Campaigns

- Yadea has implemented aggressive promotional campaigns, such as the widely publicized “Swap Petrol for Electric” program, offering VND 2 million (~$80) in trade-in discounts for customers switching from gasoline motorbikes.

- The brand’s wide accessibility through over 700 retail points, including Tier-2 and Tier-3 cities, allows it to tap deeply into both urban and suburban markets—especially students, gig economy workers, and value-driven consumers.

2. Strategic Positioning in the Budget and Smart-EV Segments

2.1 Diversified Product Portfolio

- Yadea’s catalogue features 15 electric motorbike models, catering to a wide demographic:

- Entry-level users seeking affordability

- Urban commuters needing efficiency

- Tech-oriented youth desiring smart features

- Mid-premium riders demanding design and durability

| Segment | Target Buyer | Models |

|---|---|---|

| Budget | Students, low-income users | Vekoo, X-Joy |

| Mid-range Utility | Urban commuters | Buye, Voltguard P |

| Premium Smart-EV | Professionals, tech users | G5 (Standard & Lite), Voltguard P |

3. Highlight Models: Specifications & Market Appeal (2025)

3.1 Yadea G5

- Segment: Premium Urban Smart-EV

- Variants:

- Lite: 21.9M VND

- Standard: 39.99M VND

- Top Model: ~40M VND

| Key Specification | Detail |

|---|---|

| Max Speed | 50 km/h |

| Range per Charge | 65 km (Eco) / 55 km (Sport) |

| Motor Power | 1200W |

| Display | 7-inch full-color LCD |

| Waterproof Rating | IPX7 (motor) / IPX6 (entire vehicle) |

| Trunk Volume | 26 liters |

| Smart Features | Touch interface, modern aesthetic |

- Highly regarded for its futuristic design, smooth ride, and intelligent dashboard, the G5 competes in the smart electric category for tech-savvy urban riders.

3.2 Yadea Buye

- Segment: Mid-range Commuter

- Price: 22,000,000 VND

| Specification | Detail |

|---|---|

| Max Speed | 50 km/h |

| Range per Charge | 90+ km |

| Motor Power | 1200W |

| Trunk Volume | 20 liters |

| Waterproof Rating | IPX6 |

| Design Aesthetic | Minimalist European style |

- Praised for its balanced performance and minimalist elegance, Buye is a strong choice for young professionals and college students seeking range without breaking the bank.

3.3 Yadea Vekoo

- Segment: Budget-friendly

- Price: 14,990,000 VND

| Specification | Detail |

|---|---|

| Max Speed | 38 km/h |

| Range per Charge | 65 km |

| Motor Power | 1000W TTFAR |

| Connectivity | “EasyGo” App Integration |

| Features | Keyless start, Bluetooth unlock |

| Waterproof Rating | IPX6 |

- Offers advanced connectivity features at an entry-level price, making it one of the most feature-packed budget EVs in Vietnam.

3.4 Yadea Voltguard P

- Segment: Smart Urban Commuter

- Price: 27,990,000 VND

| Specification | Detail |

|---|---|

| Max Speed | 50 km/h |

| Range per Charge | 100 km |

| Motor Power | 2550W (max) |

| Smart Features | Bluetooth unlock, App control |

| Charging Features | USB mobile charging port |

| Waterproof Rating | IP67 motor |

- Positioned to challenge higher-tier brands, the Voltguard P delivers both longer range and superior technology for demanding riders.

3.5 Yadea X-Joy

- Segment: Entry-level Youth

- Price: 15,500,000 VND

| Specification | Detail |

|---|---|

| Max Speed | 40 km/h |

| Range per Charge | 50 km |

| Motor Power | 600W GTR |

| Waterproof Rating | IPX7 |

- With its youth-friendly design and dependable engineering, X-Joy is a go-to choice for first-time riders or short-distance commuters in smaller cities.

4. Competitive Landscape Matrix (Vietnam, 2025)

| Key Factors | Yadea | VinFast | Pega |

|---|---|---|---|

| Manufacturing Presence in VN | 2 plants (foreign-invested) | 1 major domestic plant | Local factory since 2012 |

| Price Range | 14.9M – 40M VND | 12M – 30M+ VND | 14M – 25M VND |

| Retail Reach | 700+ stores nationwide | Integrated showrooms | Mid-sized national distribution |

| Tech/Smart Features | Strong in mid & premium segments | Very strong in premium models | Basic, limited |

| Entry-level Affordability | Yes | Yes | Yes |

| Range of Offerings | 15+ models | 6+ models | 3–4 major models |

| Customer Incentives | Petrol trade-in program | Free charging incentives | 3-day return policy (NewTech only) |

5. Conclusion: Why Yadea is a Top 10 EV Motorbike Brand in Vietnam (2025)

- Yadea’s successful blend of international scale, local production, broad accessibility, and smart product design has allowed it to quickly rise in Vietnam’s electric motorbike market.

- Its ability to serve both budget-conscious and tech-seeking consumers across a wide geographic footprint has strengthened its market relevance.

- Through strategic investments, aggressive trade-in campaigns, and a continuously expanding smart-product portfolio, Yadea is well-positioned as a serious contender for top-tier leadership in Vietnam’s EV two-wheeler industry.

4. Dibao

Dibao, a prominent Chinese-origin electric vehicle brand, has firmly entrenched itself in Vietnam’s burgeoning e-mobility sector. By July 2025, the company commands approximately 12% of Vietnam’s electric two-wheeler (E2W) market, positioning it as a top contender in the affordable and youth-targeted mobility segment.

With a distribution network that spans over 400 retail agents across the country, Dibao has achieved nationwide accessibility, allowing it to maintain high sales volumes and consistently capture the attention of first-time EV buyers and students. This reach, paired with its aggressive pricing strategy, positions Dibao as a dominant player in the budget-conscious and mass-market electric motorbike segments.

Strategic Positioning and Brand Philosophy

Market Strategy Highlights

- Affordability at Scale:

- Dibao’s pricing models are designed for Vietnam’s entry- to mid-tier markets, targeting students, working-class consumers, and urban commuters.

- Price points generally range from 18 million to 24 million VND, making Dibao one of the most accessible brands in the country.

- Youth-Oriented Appeal:

- Designs are inspired by classic European scooters like the Vespa, combining nostalgia with modern electric functionality.

- Aesthetic choices and color variations resonate strongly with Gen Z and young millennials.

- Broad Nationwide Distribution:

- Over 400 physical showrooms and agents ensure Dibao’s presence in both major cities and rural provinces.

- Enables easy access to servicing, spare parts, and after-sales support.

Key Electric Motorbike Models by Dibao (2025)

| Model | Price (VND) | Motor Power | Max Speed (km/h) | Range (km) | Charge Time (hrs) | Special Features |

|---|---|---|---|---|---|---|

| Pansy S3 | 21,990,000 | 1350W | 45–55 | 60–100 | 10–13 | Vespa-style design |

| Gogo Moon | 23,890,000 | 1500W | 45–50 | 60–80 | 10–13 | Massive 60L trunk |

| Rosa | 18,990,000 | 1400W | 40–50 | 80–100 | ~12 | IP67X waterproof motor |

Model Profiles

🔹 Dibao Pansy S3

- Target Segment: Urban commuters and young female riders seeking a stylish yet functional ride.

- Design Aesthetic:

- Heavily inspired by classic Vespa models, giving it a premium appearance.

- Compact and elegant styling well-suited for daily city travel.

- Performance Highlights:

- Equipped with a 1350W motor, capable of speeds up to 55 km/h.

- Offers an extended travel range of up to 100 km per charge in optimal conditions.

- Takes around 10 to 13 hours to fully charge.

- Usability & Weight:

- Weighs approximately 98 kg, contributing to enhanced stability during rides.

- Offers moderate storage and efficient battery performance.

🔹 Dibao Gogo Moon

- Target Segment: Riders seeking a mix of practicality, design, and storage capacity.

- Design Strength:

- Larger and more robust than the Pansy S3.

- Designed for utility, ideal for users who require extensive under-seat storage.

- Functional Advantages:

- Motor Output: 1500W, delivering consistent torque and acceleration.

- Range: 60–80 km depending on terrain and load.

- Trunk Capacity: A standout feature with nearly 60 liters of storage space, making it one of the most spacious scooters in the segment.

- Weight: Approximately 107 kg, contributing to road grip and smooth handling.

🔹 Dibao Rosa

- Target Segment: Students and eco-conscious commuters looking for a compact, waterproof e-scooter.

- Design and Engineering:

- A newer addition to the Dibao lineup, launched to meet rising demand in flood-prone urban zones.

- Compact and sleek profile tailored for city navigation.

- Performance Features:

- Powered by a 1400W motor, achieving speeds of up to 50 km/h.

- Travel range varies between 80–100 km per charge.

- Fully charges in approximately 12 hours.

- Waterproof Engineering:

- IP67X-rated motor, specifically designed to function reliably in flooded or high-moisture environments.

- Load capacity of 130 kg, suitable for most urban riders.

Dibao’s Competitive Advantages in Vietnam’s E-Mobility Landscape

| Factor | Dibao’s Strength |

|---|---|

| Price-to-Performance Ratio | Delivers extended range and moderate speed at highly affordable price points |

| Aesthetic Appeal | Retro-modern styling resonates with fashion-conscious younger demographics |

| Distribution Network | Over 400 agents provide wide accessibility across Vietnam |

| Model Diversity | Offers multiple models for varied commuting needs and environmental conditions |

| Urban Utility Focus | High trunk volumes and waterproof features designed for Vietnam’s urban ecosystem |

Conclusion: Why Dibao is One of Vietnam’s Top 10 E-Motorbike Brands in 2025

Dibao’s ascension in the Vietnamese electric motorbike sector is no coincidence—it is a direct result of the brand’s strategic positioning in price-sensitive segments, aesthetic and functional product design, and an unmatched national distribution network. Its robust sales performance, particularly among students and urban riders, proves that volume-driven success paired with affordability remains a winning formula in Vietnam’s dynamic e-mobility market.

With models like the Pansy S3, Gogo Moon, and Rosa delivering a balance of performance, design, and affordability, Dibao is set to continue leading the entry-level electric scooter category while capitalizing on emerging trends in urban sustainability.

5. Anbico

Anbico has emerged as a resilient domestic brand in Vietnam’s fast-evolving electric mobility landscape. With an estimated 8.3% share of the national electric motorbike market in 2025, the company has carved a niche by offering affordably priced electric vehicles that strike a unique balance between traditional aesthetics and contemporary technology.

Unlike competitors who often chase ultramodern minimalism or mass-market designs, Anbico’s strategy revolves around preserving cultural identity in vehicle design, making its electric motorbikes stand out in a highly competitive field. With a strong emphasis on cost efficiency, aesthetic appeal, and everyday usability, Anbico continues to resonate with price-sensitive consumers, students, and value-focused urban riders.

Strategic Positioning and Market Relevance

Key Differentiators

- Vietnamese Origin and Local Market Insight:

- As a domestic manufacturer, Anbico has a deep understanding of Vietnamese consumer needs, allowing it to tailor its models effectively to local commuting patterns and preferences.

- Affordable Mobility:

- Pricing ranges from 14 million to 20 million VND (approx. $600–$1,000), firmly situating Anbico in the budget to lower mid-range bracket.

- This pricing strategy enables access to e-mobility for a broader population base.

- Design Identity:

- Anbico uniquely integrates Vietnamese design sensibilities into its product lines—an uncommon approach in a market saturated with international styling trends.

- Models often feature rounded contours, metallic finishes, and stylized frames, which appeal to culturally-conscious buyers.

Key Electric Motorbike Models by Anbico (2025)

| Model | Price Range (VND) | Motor Power | Top Speed (km/h) | Range per Charge (km) | Vehicle Weight (kg) | Market Positioning |

|---|---|---|---|---|---|---|

| Valerio SP | 14,500,000 – 17,500,000 | 1000W | 45–50 | 80–100 | ~93 | Entry-level commuter model |

| Valerio GS New | 19,000,000 – 190,000,000* | 1600W | 45–50 | 80–100 | ~90 | Mid-range to high-spec variant |

*Note: The wide pricing range for the Valerio GS New may indicate availability in multiple configurations or potential pricing anomalies across dealers.

Model Profiles

🔹 Anbico Valerio SP

- Overview:

- Positioned as a compact and efficient daily commuter, the Valerio SP is ideal for students and low-income workers in urban and peri-urban zones.

- Performance & Specs:

- Motor Power: 1000W, enabling smooth operation in congested traffic environments.

- Top Speed: 45–50 km/h, suitable for regulated urban zones.

- Range: Up to 100 km on a single charge under optimal conditions.

- Weight: Around 93 kg, balancing stability and maneuverability.

- Design and Appeal:

- Integrates minimalist yet retro design cues, offering an alternative to conventional city e-bikes.

- Lightweight build and moderate size make it suitable for both men and women.

🔹 Anbico Valerio GS New

- Overview:

- Serves as Anbico’s flagship model, potentially available in multiple versions or trim levels.

- Performance & Specs:

- Motor Output: Enhanced 1600W motor, delivering greater torque and climb capability.

- Top Speed: Consistent 45–50 km/h cruising speed, with improved acceleration.

- Range: 80–100 km per full charge, supporting longer commutes.

- Weight: ~90 kg, indicating lightweight design despite its upgraded motor.

- Pricing Note:

- The pricing spectrum from 19 million to 190 million VND suggests diverse configurations, optional tech add-ons, or premium dealer markups.

- Consumer Segment:

- Targeted at users seeking enhanced power delivery, refined design, and extended durability.

Anbico vs Competitors: Value and Design Matrix

| Feature | Anbico | VinFast | Dibao |

|---|---|---|---|

| Market Focus | Budget to mid-range | Mid to premium | Budget, high-volume |

| Design Philosophy | Traditional + modern fusion | Sleek, modern Vietnamese | Vespa-inspired, youth-centric |

| Top Speed Range (km/h) | 45–50 | 50–70 | 40–55 |

| Typical Price Range (VND) | 14M – 20M | 20M – 50M | 18M – 24M |

| Target Demographic | Students, cultural enthusiasts | Urban professionals | Students, price-driven users |

| Motor Power Range | 1000W–1600W | 1200W–2000W | 1350W–1500W |

Why Anbico Ranks Among Vietnam’s Top 10 Electric Motorbike Brands in 2025

Strategic Market Contribution

- Despite operating below the top tier in terms of market share, Anbico plays a crucial role in the democratization of electric mobility in Vietnam.

- Its commitment to affordability and unique brand identity allows it to serve a growing market segment that values both cultural authenticity and environmental sustainability.

Model Highlights

- The Valerio SP continues to be a popular choice for everyday commuting with exceptional cost-efficiency.

- The Valerio GS New, with its elevated performance metrics, demonstrates Anbico’s ability to innovate while staying true to its design DNA.

Customer Impact

- Through its domestic roots and consumer-centric product design, Anbico has succeeded in creating models that reflect local identity, while still aligning with global trends in electrification and green transportation.

Conclusion

Anbico exemplifies how a homegrown Vietnamese electric motorbike manufacturer can thrive by addressing affordability, national identity, and functionality. Its market share may not match that of larger players, but its influence and distinctiveness make it a key pillar in the diversified e-mobility market of Vietnam in 2025. By staying committed to its niche and evolving gradually with consumer demand, Anbico remains one of the most relevant and strategically important EV brands in the country.

6. NIU

As Vietnam’s electric motorbike market continues to grow in complexity and sophistication, NIU Technologies, an internationally recognized smart EV brand, has established a firm foothold with a 6.2% national market share. NIU’s distinctive market appeal lies in its tech-forward design philosophy, premium components such as Bosch motors, and IoT-enabled features, which collectively position the brand as a top-tier choice for urban commuters seeking connectivity, performance, and innovation.

Brand Profile: NIU’s Positioning in Vietnam’s Electric Motorbike Market

1. Technological Differentiation and Market Approach

- Smart Urban Mobility Pioneer: NIU is widely credited for pushing the boundaries of e-scooter technology by integrating advanced battery systems, cloud connectivity, and mobility data services.

- Bosch Partnership: Most NIU vehicles are powered by Bosch motors, offering both performance reliability and engineering credibility in a market often dominated by lower-spec domestic alternatives.

- IoT Ecosystem Integration: Features such as app-based diagnostics, theft alerts, real-time tracking, and remote vehicle management make NIU models highly attractive to tech-savvy Vietnamese urbanites.

2. Target Demographics

- Affluent urban commuters, tech enthusiasts, and middle-class professionals represent the core user base.

- NIU appeals to buyers who value connectivity, aesthetics, and sustainability over low pricing.

3. After-Sales Experience: A Market Challenge

- While praised for innovation, customer feedback highlights weaknesses in after-sales support, particularly in the availability of spare parts and localized maintenance services.

- Service infrastructure development remains a key area for strategic investment if NIU is to grow further in Vietnam’s competitive market.

NIU Electric Motorbike Model Comparison (2025)

| Model | Motor Power | Top Speed | Range (per Charge) | Key Features | Price (VND) | Target Segment |

|---|---|---|---|---|---|---|

| NQi GTS | 3000W–3500W Bosch | 70–80 km/h | 110–160 km | CBS braking, USB port, LED dashboard, anti-theft alarm, keyless start | ~55M+ VND | High-end commuters |

| MQi GT | 6500W | Up to 100 km/h | ~100 km | 4th Gen Lithium battery, customizable LED display, Bluetooth keyless entry | ~70M+ VND | Performance-oriented riders |

| N1S | 1200W Bosch | 30–40 km/h | 90–100 km | Smooth ride, app integration, real-time location tracking | 35,000,000 VND | Mid-range urban riders |

| M1S | 800W–1200W | 50+ km/h | 90–120 km | Lightweight, elegant design, quiet operation | 48,000,000 VND | Students and entry-premium |

| NSport | 1500W Bosch | 48 km/h | Up to 130 km | FOC motor control, EBS regenerative braking, Bosch drivetrain | 58,000,000 VND (excl. VAT) | Eco-conscious tech users |

Key Advantages of NIU in Vietnam’s EV Market

- Technological Leadership:

- Proprietary battery management systems and regenerative braking.

- First-mover in connected mobility in Vietnam’s electric 2-wheeler segment.

- Design & User Experience:

- Sleek, urban-oriented design language.

- LED digital displays, minimalist aesthetics, and ergonomic structures.

- Sustainability Edge:

- Incorporates FOC (Field-Oriented Control) technology to optimize battery usage and reduce energy loss.

- EBS (Electric Brake System) that contributes to energy efficiency by recycling up to 6% of kinetic energy.

Strategic Opportunities & Market Outlook

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Advanced tech features & Bosch integration | Limited service infrastructure in Vietnam | Expand service centers & app services | Competitors offering similar features at lower prices |

| International brand recognition | Premium pricing limits accessibility | Growing demand for smart EVs in urban centers | Service dissatisfaction affecting brand trust |

| Strong global R&D backing | Low presence in non-urban regions | Partnerships with Vietnamese distributors/dealers | Domestic brands expanding smart tech rapidly |

Conclusion: Why NIU Is a Top 10 EV Motorbike Brand in Vietnam (2025)

NIU’s stronghold in Vietnam’s EV landscape is rooted in its global innovation ecosystem, sustainable engineering practices, and premium urban commuter offerings. While current limitations in after-sales support need urgent redress, the brand’s forward-thinking mobility solutions have already won favor among the digitally connected, urban middle-class Vietnamese. NIU’s focus on blending performance, style, and intelligence ensures its continued relevance and growth as one of the Top 10 Electric Motorbike Brands in Vietnam for 2025.

7. Gogoro

Gogoro, a forward-thinking Taiwanese electric mobility company established in 2011, has emerged as a disruptor in the global two-wheeler EV industry. Despite its relatively modest 3.1% market share in Vietnam as of 2025, Gogoro’s influence far outweighs its numbers—primarily due to its pioneering battery-swapping infrastructure, which has set a new standard for urban electric transportation.

Strategic Positioning in Vietnam’s EV Landscape

- Unique Value Proposition

Gogoro is not merely selling electric scooters; it is redefining energy infrastructure for two-wheel mobility:- Introduced an instant battery-swapping model to counteract traditional EV barriers such as long charging times and limited range.

- Globally operates 2,000+ GoStation® battery swap stations, enabling full “refueling” in under 6 seconds.

- The system eliminates range anxiety and offers urban commuters unmatched convenience.

- Urban Mobility Focus

The company is aligned with the needs of Vietnam’s high-density cities, where quick turnarounds and reliability are essential for both personal and commercial use. - Technological Edge

- Use of water-cooled, high-torque electric motors ensures strong performance in variable road conditions.

- Integration of smart dashboard systems, IoT connectivity, and keyless control appeal to younger, tech-savvy demographics.

Challenges to Market Expansion in Vietnam

While Gogoro’s technological prowess is well-documented, several challenges may be limiting its deeper market penetration:

| Challenge | Impact on Adoption | Mitigation Strategy |

|---|---|---|

| High Initial Purchase Costs | Limits accessibility to budget-conscious buyers | Introduce installment plans or lease models |

| Limited Swap Infrastructure Locally | Reduces utility in suburban/rural areas | Accelerate GoStation® rollout in key regions |

| After-Sales Support Concerns | Affects long-term brand loyalty | Strengthen local partnerships and service centers |

Gogoro’s Notable Models in Vietnam (2025)

Gogoro offers a diverse product portfolio tailored to a mix of performance, affordability, and convenience. Below is a detailed matrix:

| Model | Max Speed (km/h) | Range (km/charge) | Motor Power | Notable Features | Price (Approx.) |

|---|---|---|---|---|---|

| Gogoro S2 | 92 | 150 | 7.6 kW | 0–50 km/h in 3.9s, premium ride, urban power scooter | $3,500 USD |

| Gogoro Viva Mix | 90 | 150 | 6 kW (8 hp) | Carbon belt drive, water-cooled, quiet performance | $2,200 USD |

| Gogoro Smartscooter | 50 | 80–90 | 1,200W | Core battery-swapping scooter, ideal for short urban commutes | 29,500,000 VND |

| Gogoro JVC | 50 | 100 | 1,520W | Lightweight and affordable entry-level EV with smart controls | 13,690,000 VND |

Why Gogoro Ranks Among the Top 10 Electric Motorbike Brands in Vietnam (2025)

- Unmatched Innovation in Battery Technology

- Gogoro remains the only brand in Vietnam offering a fully integrated battery-swapping system at scale.

- Reduces downtime and eliminates the infrastructure dependence on home or public charging stations.

- Strong Appeal to Delivery Services and Urban Riders

- The swappable battery system is particularly valuable for high-frequency riders such as food and goods delivery services.

- High uptime leads to better productivity and lower total cost of ownership in operational fleets.

- Brand Equity from Global Recognition

- Having expanded into multiple Asian and European markets, Gogoro brings global expertise and reliability.

- Vietnamese consumers increasingly recognize Gogoro as a premium, future-forward EV brand.

- Environmental and Urban Synergy

- Gogoro’s solution contributes directly to urban emission reduction goals and supports the Vietnamese government’s push for cleaner transportation systems.

Conclusion: A Catalyst for Vietnam’s Smart Mobility Ecosystem

Although Gogoro’s market share in Vietnam is still in the single digits, its transformative infrastructure model, high-performance vehicles, and clear alignment with smart city ambitions make it a vital player in Vietnam’s electric mobility evolution. The brand’s success hinges on its ability to scale local swap station networks and create more inclusive pricing strategies, but its presence already marks a crucial step forward in redefining how Vietnamese cities move.

8. Dat Bike

Dat Bike has rapidly emerged as one of the most formidable electric motorbike brands in Vietnam. Founded in 2019 by a Vietnamese-American entrepreneur, the company has earned national recognition for its relentless focus on performance, innovation, and scalability—three pillars that have positioned it as a transformative force in the country’s e-mobility landscape. Holding an estimated 2–3% share of Vietnam’s electric motorbike market as of 2025, Dat Bike stands apart not only as a domestic champion but also as a bold disruptor of internal combustion engine (ICE) dominance.

Strategic Vision: Engineering Performance Beyond Expectations

- High-Performance Benchmarking

- Dat Bike engineers its EVs to outperform gasoline-powered motorbikes, a radical strategy that goes beyond merely replacing fossil-fuel transportation.

- The brand has broken industry expectations with its flagship Quantum S series, offering record-setting ranges of up to 285 km per charge, among the highest in the Southeast Asian market.

- Continuous Product Optimization

- Each successive model release has demonstrated measurable gains:

- Cost reduction of at least 20%

- Improvements in range, motor power, and charging speed by 30% or more

- These enhancements respond directly to key consumer concerns such as “range anxiety,” charging time, and affordability—barriers that still inhibit EV adoption in Vietnam.

- Each successive model release has demonstrated measurable gains:

- Localized Market Understanding

- As a Vietnamese-born brand, Dat Bike benefits from:

- Deep cultural insights into user behavior

- Agility in navigating local regulatory landscapes

- Optimized vehicle configurations for Vietnam’s road conditions and climate

- As a Vietnamese-born brand, Dat Bike benefits from:

Infrastructure & Production Scalability

| Metric | 2024 | 2025 (Projected) | Growth Rate |

|---|---|---|---|

| Monthly Production Capacity | 500 units/month | 1,000 units/month | +100% YoY |

| Retail Stores (National) | 5 | 20+ company-owned outlets | +300% YoY |

| Store Presence (Cities) | 3 major cities | Nationwide coverage | Full provincial rollout |

- Robust Distribution Strategy

- Unlike many EV startups, Dat Bike owns its retail network, ensuring quality control, consistent branding, and superior customer experience.

- This vertical integration model accelerates customer trust, after-sales service reliability, and brand equity.

- Regulatory Foresight

- Dat Bike is strategically positioned to benefit from upcoming petrol motorbike bans in major Vietnamese cities.

- Its product line is already compliant with emission-free transport mandates, giving it a first-mover advantage as cities transition.

Dat Bike Product Portfolio (2025): Performance-Driven Electric Motorbikes

Below is a performance and features comparison of Dat Bike’s key models available in Vietnam:

| Model | Max Speed (km/h) | Range (km) | Charging Time | Motor Power | Trunk Volume | Price (VND) | Unique Selling Points |

|---|---|---|---|---|---|---|---|

| Quantum S1 | 100 | 285 | ~2.5–5 hrs | 7,000W | 44L | Not listed | Longest-range EV, premium performance |

| Quantum S2 | 90 | 285 | ~2.5–5 hrs | 6,000W | 44L | Not listed | Balance between power and cost-efficiency |

| Quantum S3 | 90 | 200 | 2.5 hrs (1800W) | 6,000W | 44L | 34,900,000 | Strong acceleration, spacious storage |

| Weaver 200 | 90 | 130–200 (depending on speed) | 1 hr for 100km 3 hrs full | 6,000W | Moderate | 44,900,000 (refurbished) | Fast charging, urban commuting, gasoline alternative |

Model Highlights and Strategic Value

1. Quantum S Series (S1 / S2 / S3)

- Top-tier performance with ranges up to 285 km, enabling true long-distance commuting without recharge interruptions.

- Quantum S1 reaches 100 km/h, appealing to users demanding high-speed capability.

- Large 44-liter trunk space positions these scooters as viable for commercial uses (e.g., delivery, logistics).

- High-torque 6,000–7,000W motors outperform many ICE equivalents in urban acceleration.

2. Weaver 200

- Fast charging: Achieves 100 km of range with just 1 hour of charge—ideal for daily commuters.

- Equipped with a 6000W motor, matching mid-range petrol bikes in torque and top speed.

- Excellent choice for first-time EV buyers, especially in urban centers transitioning from ICE vehicles.

Why Dat Bike Earns a Top 10 Spot Among Vietnam’s Electric Motorbike Brands in 2025

- Homegrown Engineering Excellence

- Represents Vietnam’s capacity to compete globally in electric mobility, not just assemble.

- Offers a national alternative to foreign imports, aligning with government goals of EV self-sufficiency.

- Designed for the Future of Vietnamese Cities

- All models engineered to operate seamlessly within smart city infrastructure and zero-emission transportation frameworks.

- Efficient powertrain designs and fast-charging features make Dat Bike ideal for next-gen mobility needs.

- Consumer-Centric Product Development

- Adapts rapidly to consumer feedback—adding trunk space, refining torque delivery, reducing charge times.

- Builds each vehicle as an ICE replacement, not merely a green alternative.

- Scalability with Vision

- Dat Bike’s combination of product innovation, in-house distribution, and production ramp-up allows it to scale nationally faster than many competitors.

Conclusion: Dat Bike as Vietnam’s Flag-Bearer for Two-Wheel Electrification

Dat Bike has succeeded in proving that electric motorbikes can be more than just sustainable—they can be desirable, powerful, and culturally resonant. Through local innovation, aggressive performance targets, and nationwide expansion, the brand has entrenched itself as a strategic cornerstone in Vietnam’s push toward a zero-emission transport future. As regulatory bans on petrol bikes take hold, Dat Bike is uniquely positioned to lead—not follow—the next era of urban mobility in Vietnam.

9. DK Bike

Despite holding a relatively modest market share—just under 3% as of 2025—DK Bike plays an essential role in Vietnam’s electric mobility transformation. As a domestically established brand, DK Bike has positioned itself in the budget and mid-range electric motorbike segment, offering economically accessible models priced between 600 USD and 1,000 USD.

This strategic market positioning makes DK Bike one of the most important enablers of mass EV adoption, especially among students, first-time buyers, and low-to-middle income groups. Its affordability-driven approach aligns closely with Vietnam’s nationwide electrification goals and helps ensure that sustainable transportation options are not limited to higher-income consumers.

Strategic Significance in Vietnam’s EV Ecosystem

Inclusive Mobility for Mass Adoption

- Primary Focus: Entry-level to mid-tier EV motorbikes

- Target Customers:

- Students and youth seeking affordable personal transport

- Budget-conscious consumers transitioning from traditional bicycles or ICE motorbikes

- Rural and peri-urban populations looking for low-maintenance, fuel-free alternatives

Supporting National EV Goals

- By ensuring price diversity across the EV motorbike market, DK Bike:

- Reduces reliance on internal combustion engines among lower-income groups

- Accelerates Vietnam’s roadmap to low-emission mobility, especially in educational hubs and satellite towns

- Complements government efforts to decarbonize daily commutes and enhance energy efficiency

Product Portfolio Overview: Compact, Efficient, and Affordable

DK Bike offers a compact lineup of cost-effective electric two-wheelers designed for short-range urban commuting. While they may lack the advanced features of premium brands, their value proposition lies in affordability, accessibility, and basic reliability.

| Model Name | Price (VND) | Estimated Range (km) | Top Speed (km/h) | Charging Time (est.) | Target User Group | Distinctive Features |

|---|---|---|---|---|---|---|

| DK EZ 1 | 15,790,000 | ~60–80 km | ~40 km/h | ~6–8 hours | School & college students | Lightweight, easy to maneuver |

| DK Xmen One | 17,990,000 | ~70–90 km | ~45 km/h | ~6–8 hours | Entry-level urban riders | Sporty design, competitive entry price point |

Note: Technical specifications are industry estimates based on comparable class models, as the manufacturer does not disclose full specs publicly.

Why DK Bike Ranks Among Vietnam’s Top 10 EV Motorbike Brands in 2025

1. Widespread Affordability: The Gateway to Electrification

- DK Bike addresses the critical affordability gap in Vietnam’s EV market.

- Its price structure makes EVs attainable to a broader segment of the population, thereby ensuring inclusive adoption of green mobility.

2. First-Mover Brand Loyalty in the Budget Segment

- Among early brands catering specifically to price-sensitive riders, DK Bike has built a loyal user base, particularly among students and young workers.

- The brand is often a consumer’s first exposure to electric transportation, thus playing a gateway role in the wider transition.

3. Local Brand Advantage and Distribution Reach

- As a domestic manufacturer, DK Bike benefits from:

- Local assembly capabilities

- Adaptability to Vietnamese road conditions

- Strategic retail partnerships in educational districts

- Its distribution model focuses on accessibility, with outlets near schools, vocational centers, and public transit nodes.

4. Contribution to National Mobility Equity

- EV adoption must be demographically equitable to succeed.

- DK Bike ensures that the electrification movement is not confined to urban elites, making it a key pillar of Vietnam’s sustainable transport narrative.

DK Bike: Strategic Positioning in Vietnam’s EV Brand Matrix (2025)

| Brand Name | Market Segment | Average Price Range (VND) | Range Performance | Charging Speed | Innovation Level | Mass Adoption Potential |

|---|---|---|---|---|---|---|

| DK Bike | Budget / Mid-tier | 15–18 million | Low-Mid (~80 km) | Moderate | Basic | High (cost-driven) |

| VinFast | Mid to High-End | 25–80 million | High (>200 km) | Fast | High | Moderate-High |

| Dat Bike | High-Performance | 35–60 million | Very High (285 km) | Very Fast | Advanced | Moderate |

| Yadea | Entry to Mid-Range | 18–35 million | Medium (~150 km) | Moderate | Moderate | High |

Conclusion: DK Bike’s Role as the People’s Choice in Electric Two-Wheelers

DK Bike may not dominate headlines or showcase cutting-edge EV tech, but its role is no less important. As a volume-driven, affordability-first brand, it is the quiet enabler of Vietnam’s electric mobility transition. Its strategic focus on the under-served segments of the market ensures that the path to zero-emission transport is not reserved for the few—but open to the many.

In 2025, DK Bike earns its place among Vietnam’s Top 10 Electric Motorbike Brands not through flash or speed, but through reach, relevance, and real-world impact.

10. Other Notable Brands: Detech, EVGO, Vmoto, Tailg

While major players such as VinFast and Dat Bike dominate headlines, a collection of secondary but strategically significant brands—including Detech, EVGO, Vmoto, and Tailg—play a vital role in diversifying Vietnam’s electric mobility ecosystem. These companies, despite holding market shares typically under 3%, contribute by addressing underserved segments, experimenting with different pricing strategies, and introducing international competition.

Their inclusion in Vietnam’s Top 10 Electric Motorbike Brands of 2025 is justified by their:

- Contribution to price diversity and accessibility

- Expansion of technology choices for consumers

- Support for EV adoption across socio-economic tiers

1. Detech: A Budget-Focused Domestic Brand in Transition

Company Overview

- Headquarters: Vietnam

- Market Share (2025): Under 3%

- Positioning: Budget electric motorbikes priced below VND 20 million

- Target Segments: Entry-level riders, students, low-income urban and rural users

Key Models and Pricing

| Model Name | Price (VND) | Approx. USD | Target User Segment | Notable Features |

|---|---|---|---|---|

| Espero Enigma | 18,800,000 | ~$790 | Budget daily commuters | Basic styling, affordability-first design |

| Espero Diamond Plus | 18,500,000 | ~$780 | Urban school-goers | Slightly upgraded aesthetics |

| Espero T-Rex | 14,500,000 | ~$610 | Rural students, low-income | Ultra-low cost option with minimalist design |

Performance & Market Impact

- Strengths:

- Highly affordable models catering to first-time EV users

- Domestic brand familiarity boosts accessibility in tier-2 cities

- Challenges:

- Legacy quality concerns from ICE models like the “Win” may hinder EV trust

- Lack of major innovation or unique technological offerings

Strategic Value

- Detech plays a critical role in Vietnam’s rural EV penetration, particularly for regions where affordability is a non-negotiable factor. However, to maintain relevance, Detech must address historical quality concerns through consistent product reliability and stronger after-sales service.

2. EVGO (Son Ha Group): Balancing Innovation with Price Sensitivity

Company Overview

- Parent Company: Son Ha Group

- Market Focus: Mid-range to premium electric scooters

- Market Share: Estimated under 3%

- Notable Feature: Lack of battery rental option, which affects price competitiveness

Key Models and Pricing

| Model | Price (VND) (excl. battery) | Est. Full Price (incl. battery) | Key Segment | Comment |

|---|---|---|---|---|

| EVGO VS125 | 44,900,000 | ~70,000,000 | Premium urban users | Stylish but price-prohibitive |

| EVGO A | 24,900,000 | ~40,000,000+ | Mid-range buyers | Practical, but lacks aggressive USP |

| EVGO C | 19,900,000 | ~35,000,000+ | Budget commuters | Affordable but overshadowed by rivals |

| EVGO D | 20,900,000 | ~36,000,000+ | Students, workers | Functional design, moderate pricing |

Strengths and Weaknesses

| Strengths | Weaknesses |

|---|---|

| Backed by a large Vietnamese conglomerate | High total cost due to lack of battery rental |

| Diverse product line addressing multiple needs | Price point overlaps with superior competitors like VinFast |

| Design-focused offerings | Battery replacement concerns deter cost-sensitive buyers |

Strategic Value

- EVGO represents a growing domestic attempt to capture the mid-to-premium EV space, yet its pricing strategy presents a critical bottleneck to wider adoption. Without addressing battery ownership costs or introducing rental models, EVGO risks alienating its price-sensitive base.

3. Vmoto: International Presence with Niche Premium Appeal

Company Overview

- Origin: Australia (branded as Super Soco internationally)

- Vietnam Market Share: Under 3%

- Positioning: Premium electric scooters and motorbikes with European-inspired design

- Target Market: Affluent urban professionals, tech-savvy riders

Key Models and Estimated Pricing

| Model | Regional Price (RM) | Approx. VND Equivalent | Range & Performance | Buyer Profile |

|---|---|---|---|---|

| TC Max | 19,900 RM | ~42,000,000 VND | ~110 km range, 100 km/h top speed | Commuters, young professionals |

| CPX Pro | 25,900 RM | ~55,000,000 VND | ~140 km range, urban scooter | Delivery fleet, city riders |

Strategic Role

- Vmoto enhances Vietnam’s EV market diversification by introducing foreign styling, higher performance benchmarks, and global manufacturing standards. Although volume remains modest, Vmoto:

- Raises consumer expectations for safety and design

- Creates upward pressure on local brands to innovate

4. Tailg: Scaling Up with Manufacturing Muscle

Company Overview

- Origin: China

- Vietnam Investment: Manufacturing plant in Hung Yen with 350,000 units/year capacity

- 2025 Market Target: Valuation exceeding $8 billion

- Market Strategy: High-volume production + competitive pricing

Key Models and Pricing

| Model | Price (VND) | Market Tier | Feature Highlights |

|---|---|---|---|

| Tailg Y5 | 35,000,000 | Mid-range urban | Sleek design, smart dashboard options |

| Tailg Doris | 25,000,000 | Entry-level commute | Compact, easy-to-ride for city travel |

| Tailg S35 Running | 40,000,000 | Premium commuter | Extended range, modern aesthetics |

Strategic Advantages

- Local Production:

- Enhances price competitiveness via lower import taxes

- Faster distribution and after-sales service

- Aggressive Expansion Plan:

- Direct challenge to Yadea, VinFast, and even Honda

- Tailg is positioning itself as a mass-market disruptor by balancing scalability with affordability

Risks and Market Perception

- While Chinese-origin brands sometimes face trust barriers in Southeast Asia, Tailg’s localized production and scale could help counter negative perceptions through visible commitment.

Comparative Matrix: Notable Secondary EV Brands in Vietnam (2025)

| Brand | Origin | Market Share | Avg. Price Range (VND) | Key Segment | Strength | Challenge |

|---|---|---|---|---|---|---|

| Detech | Vietnam | <3% | 14M – 19M | Entry-level urban and rural | Ultra-low prices | Historical quality concerns |

| EVGO | Vietnam | <3% | 20M – 70M | Mid to high-end commuters | Wide range, strong parent co. | High cost, no battery rental |

| Vmoto | International | <3% | 42M – 55M | Niche urban premium | Stylish, global appeal | Limited local support & awareness |

| Tailg | China | <3% (est.) | 25M – 40M | Mass mid-range & entry-level | Manufacturing scale in VN | Chinese brand perception |

Conclusion: How These Brands Strengthen Vietnam’s EV Evolution

Although smaller in market size, Detech, EVGO, Vmoto, and Tailg are key enablers of Vietnam’s electric two-wheeler transformation. Each offers distinct value propositions—from low-cost accessibility (Detech) to international styling (Vmoto) and industrial scale (Tailg).

Their presence ensures:

- Wider product variety across multiple income levels

- Healthy market competition, pushing both domestic and foreign leaders to innovate

- Expanded geographic and demographic EV penetration

Together, they fortify Vietnam’s position as Southeast Asia’s most dynamic electric motorbike market in 2025.

Vietnam’s Electric Motorbike Market in 2025: A Comprehensive Analysis

1. Charging Infrastructure: Development Trajectory and Ongoing Limitations

Current Landscape of EV Charging Network

- The surge in electric motorbike adoption across Vietnam is outpacing the expansion of essential charging infrastructure.

- VinFast, the country’s dominant EV brand, has installed over 150,000 charging poles nationwide. These are located strategically in:

- Shopping malls

- Highway rest stops

- Urban residential areas

- Public parking zones in major cities

- Despite this significant investment, overall infrastructure availability remains severely limited.

| City | Charging Stations (2025) | Estimated EV Fleet | Infrastructure Coverage |

|---|---|---|---|

| Ho Chi Minh City | ~600 | 350,000–400,000 motorbikes | <10% |

| Hanoi (V-Green data) | 1,000 | 250,000+ (est.) | ~15% |

Gaps and Strategic Expansion Goals

- HCMC targets: 3,000 charging and battery-swapping stations by 2028.

- Major constraint: lack of national charging standard, creating interoperability challenges.

- This fragmented approach restricts:

- Brand-agnostic usage of charging points

- Consumer convenience and confidence

- Efficient private sector participation

Future Demand Forecast (World Bank Projections)

| Metric | By 2030 | By 2050 |

|---|---|---|

| EV Chargers Needed | 800,000 | 6,000,000 |

| Batteries Required | 2 million | 10 million |

Conclusion: Without urgent public-private coordination and investment, the EV charging ecosystem risks becoming the primary bottleneck to mass-scale adoption.

2. Battery Technology Evolution and Lifecycle Challenges

Market Transition: From Lead-Acid to Lithium-Ion

- Prior to 2023, lead-acid batteries dominated the market (70%+ share), due to:

- Low upfront cost

- Simpler local manufacturing

- However, growing consumer expectations around durability and performance have accelerated the shift.

| Battery Type | Market Share (2024) | Projected CAGR (2025–2030) | Key Benefits |

|---|---|---|---|

| Lithium-Ion | 88.52% | 7.01% | Long lifespan, higher range, lighter |

| Lithium Iron Phosphate | Fast-growing segment | N/A | Explosion-resistant, high safety |

Innovative Domestic Applications

- VinFast and Dat Bike lead in high-performance battery usage:

- Dat Bike: Claims up to 15-year battery lifespan or 150,000 km usage

- Batteries retain over 70% capacity after extended use

Persistent Challenges in Battery Lifecycle

- Battery degradation occurs within 2–3 years for many users.

- Replacement costs:

- Range between VND 5 million – 15 million ($210–$630)

- Deters middle- and lower-income consumers from long-term commitment

Market Opportunity: This issue opens avenues for businesses offering:

- Battery diagnostics and protection services

- Extended battery warranties

- Refurbishment and second-life battery markets

3. Addressing Range Anxiety and Consumer Sentiment

Psychological Barriers to Adoption

- Despite an average daily commute of 27 km, most consumers seek models offering 150–200 km range per charge.

- This trend illustrates a preference for psychological comfort and reliability over purely functional utility.

Safety Concerns and Public Incidents

- Incidents such as a residential fire in Hanoi (linked to EV charging) have triggered:

- Temporary bans on apartment-based charging

- Heightened consumer safety concerns

- Misinformation and fear hinder trust even when accidents are unrelated to EV batteries

Urban Infrastructure Limitations

- Many buildings lack:

- Ground-floor charging stations

- Safe, accessible electricity access points

- Residents in multi-storey or rented properties face unique difficulties

Strategic Recommendations:

- Expansion of battery-swapping stations to reduce charging dependency

- Manufacturer-led education campaigns on battery safety

- Integration of range assurance features and smart battery diagnostics

4. Regulatory and Market Obstacles

Economic Accessibility and Financial Incentives

- High upfront costs remain a primary deterrent, especially for low-income urban and rural consumers.

- Governmental policies (e.g. registration waivers, battery-leasing models) are in place but limited in scope.

| EV Model | Average Price (VND) | Target Audience | Battery Policy |

|---|---|---|---|

| VinFast Feliz S | ~29,000,000 | Mid-income daily commuters | Optional battery rental |

| Dat Bike Weaver++ | ~65,000,000 | Tech-savvy and eco-conscious | Battery included (long lifespan) |

| EVGO VS125 | ~70,000,000 (with batt.) | High-end commuter segment | No rental option |

Public Transport as a Structural Limitation

- Cities like Hanoi and HCMC face underdeveloped mass transit systems

- As petrol-bike bans are introduced, lack of alternatives may:

- Widen the mobility gap among low-income populations

- Generate urban congestion and logistical strain

Electric Grid Capacity Constraints

- Meeting future EV penetration targets requires:

- A 12–20% increase in national grid capacity between 2045 and 2050

- Smart grid development and energy diversification

- Current infrastructure is insufficiently equipped to handle large-scale EV deployment

Policy Insight: Holistic EV policy must integrate energy planning, transportation reform, and financial accessibility to ensure equitable transition.

Conclusion: The Road Ahead for Vietnam’s Electric Motorbike Revolution

Vietnam’s electric motorbike revolution is at a pivotal inflection point in 2025. While momentum is strong—with technological advancements, rising consumer awareness, and growing government support—critical structural, psychological, and logistical barriers remain. For the nation to transition from early adoption to mainstream saturation, a coordinated and multi-dimensional strategy is essential, one that encompasses:

- Scalable and standardized charging infrastructure

- Affordable and durable battery technologies

- Transparent communication on safety and performance

- Infrastructure expansion in both urban and rural settings

- Grid modernization and renewable energy integration

By addressing these core pillars, Vietnam can solidify its position as a leading electric mobility hub in Southeast Asia and unlock the full potential of sustainable two-wheeled transportation.

Government Support and Incentives in the Vietnamese Electric Motorbike Market (2025)

I. National Policy Landscape and Strategic Roadmaps

Policy Framework Driving Electrification

- The Government of Vietnam has taken a decisive stance in favor of electric mobility as part of its overarching climate strategy.

- Its regulatory framework aligns closely with the national net-zero emissions pledge for 2050, and explicitly targets internal combustion engine (ICE) vehicles for progressive phaseout.

- Policymakers have issued clear urban transport electrification directives to accelerate adoption across high-density city zones.

Phased Petrol Motorbike Ban: Key Timelines

| City | Regulated Zone | Ban Effective From |

|---|---|---|

| Hanoi | Ring Road 1 | July 1, 2026 |

| Ring Road 2 | January 1, 2028 | |

| Ring Road 3 | 2030 | |

| Ho Chi Minh City | Entire Inner Core | Plan to replace 400,000 ICE bikes, timeline under review |

- These bans will effectively create a non-discretionary market for electric two-wheelers (E2Ws), compelling consumers to switch to compliant vehicles.

- This represents a structural tailwind for electric motorbike brands, ensuring baseline demand growth regardless of traditional consumer sentiment.

Net-Zero Transport Goals: Long-Term Mandates

- By 2025: 100% of newly purchased urban public buses must be electric or green-energy vehicles.

- By 2030: At least 50% of vehicles in major cities must be fully electric.

These initiatives are not merely symbolic—they act as demand anchors that reshape manufacturing, investment, and infrastructure planning across Vietnam’s mobility ecosystem.

II. Financial Incentives: Tax Exemptions, Direct Subsidies, and Trade-In Schemes

National-Level Incentives

- Registration Fee Exemption:

- 0% registration fee for electric motorbikes, valid until February 2027.

- Value-Added Tax (VAT) Reduction:

- Lower 8% VAT rate applied to electric vehicles versus standard rates.

These measures effectively reduce upfront costs by several million VND, significantly narrowing the price gap between ICE and electric motorbikes.

City-Level Subsidies: Hanoi as a Leading Case

| Target Group | Proposed Subsidy Amount |

|---|---|

| General Consumers | VND 3 million (~$115) |

| Near-Poor Households | VND 4 million (~$155) |

| Poor Households | VND 5 million (~$195) |

| Residents in Regulated Zones | Full coverage of registration/licensing costs |

- These targeted grants are intended to ensure equity in access to cleaner mobility solutions, particularly for lower-income groups reliant on motorbikes for economic survival.

- Hanoi’s inclusive model could serve as a blueprint for other Vietnamese cities.

Manufacturer-Led Trade-In Programs

| Manufacturer | Campaign Name | Discounts & Incentives Offered |

|---|---|---|

| VinFast | “Swap Petrol for Electric” | – VND 1 million cash incentive – Dealer gifts – 15–20% model price discount |

| Yadea | E-Bike Trade-In Campaign | – VND 2 million (~$80) discount on new e-motorbikes |

These collaborations between public and private sectors create a multi-channel incentive ecosystem—decreasing switching barriers for end-users while driving up conversion rates.

III. Policy Impact on Market Dynamics and Adoption Trends

Electrification Adoption: Measured Impact of Regulation

| Metric | 2021 | 2022 | 2025 (Est.) |

|---|---|---|---|

| E2W Market Share (Electric) | 10% | ~12% | 18–22% |

| Urban ICE Replacement (planned units) | 150,000+ | 250,000+ | 400,000+ |

- Adoption is no longer solely driven by environmental consciousness or fuel savings.

- Regulatory pressures—such as bans and targeted subsidies—have institutionalized consumer behavior change, particularly in urban areas.

- The electric motorbike is transitioning from a green alternative to a regulated necessity.

Investment and Innovation Stimulus

- The clarity of long-term government policy has catalyzed capital influx from domestic and international manufacturers.

- Both foreign direct investment (FDI) and local startups are scaling production, supply chains, and aftersales networks.

- Policy predictability lowers investor risk, making Vietnam an attractive EV manufacturing and R&D hub in Southeast Asia.

IV. Equity and Infrastructure Considerations in Policy Execution

Socioeconomic Equity in Electrification

- Despite incentives, the upfront cost of many electric motorbikes remains prohibitively high for rural or low-income populations.

- Government programs are attempting to bridge this gap, but implementation remains uneven between provinces.

- There is a need for expanded microfinance tools or EV-leasing models to support vulnerable groups, particularly:

- Delivery drivers

- Students

- Informal workers

Infrastructure Synchronization with Policy Goals

- Successful implementation of bans and incentive programs depends heavily on charging infrastructure and battery availability.

- A misalignment between policy goals and infrastructure readiness could lead to:

- Market bottlenecks

- User dissatisfaction

- Black-market trade in ICE vehicles

Conclusion: Policy as a Market Shaper

The Vietnamese government’s robust electric mobility policy is no longer just a set of regulatory instruments—it is now the defining force behind the transformation of Vietnam’s urban transport landscape. Through a blend of hard mandates, fiscal incentives, and collaborative industry engagement, the state has cultivated a demand environment where electric motorbikes are not merely viable—they are increasingly indispensable.

Evolving Consumer Trends and Behavioral Shifts

Demographic Segmentation of EV Users

Vietnam’s electric motorbike (E2W) market in 2025 is witnessing a dynamic shift in consumer preferences, largely fueled by an intersection of environmental awareness, rising fuel costs, and the appeal of modern vehicle design.

- Key Demographics Driving Demand:

- Young Professionals: Driven by aesthetics, tech integration, and environmental values.

- University Students: Attracted by affordability, low operational costs, and compact design.

- Female Riders: Prefer lighter, quieter, and more manageable vehicles in urban traffic.

Core Drivers of Adoption

| Adoption Driver | Impact on Market Growth |

|---|---|

| Environmental Awareness | Growing concern over air pollution is shifting demand away from ICE motorbikes. |

| Fuel & Maintenance Savings | EVs cost 70–90% less to operate than petrol bikes. |

| Product Innovation | Sleek designs and integrated smart features appeal to digital-first consumers. |

| Urban Mobility Efficiency | Compact and quiet designs are well-suited for Vietnam’s congested cities. |

- Operational Cost Comparison (per 60 km ride):

| Mode | Electric Motorbike | Gasoline Motorbike |

|---|---|---|

| Energy/Fuel Cost | ~VND 3,200 (USD 0.13) | VND 30,000–50,000 (USD 1.25–2.10) |

| Maintenance Frequency | Minimal | High (oil changes, mechanical wear) |

| Noise & Emissions | Silent, zero-emission | Loud, high CO₂ and NOx emissions |

Conclusion: Daily commuters now view E2Ws not just as a trend, but as a rational, cost-saving alternative to petrol-powered vehicles.

2. Commercial Sector: A High-Growth Catalyst

Emergence of Fleet Electrification

While consumer demand forms the foundation of Vietnam’s E2W market, fleet and logistics electrification is rapidly becoming its most potent accelerator.

- Growth in Fleet Demand:

- Delivery & logistics fleets are projected to grow at a CAGR of 32.21% through 2030.

- This is primarily driven by:

- Government pressure to phase out petrol-based ride-hailing bikes.

- Lower operating costs for businesses with high daily mileage.

- Example – Cost Advantage for Couriers:

- EV couriers save between VND 40,000–60,000/day on fuel.

- Over a month, this equals ~ VND 1.2–1.8 million ($47–$70) in savings per vehicle.