Key Takeaways

- Understand Vietnam’s Startup Ecosystem: Vietnam’s growing economy and government support make it a prime location for startups, offering incentives, funding resources, and a young, tech-savvy workforce.

- Navigate Legal and Tax Requirements: Properly registering your business, choosing the right structure, and staying compliant with Vietnam’s tax laws are essential steps for a smooth startup launch.

- Leverage Local Networks and Government Resources: Building a local network and tapping into government programs, incubators, and grants can accelerate growth and provide valuable support for long-term success in Vietnam.

Vietnam has rapidly become one of Southeast Asia’s most attractive destinations for startups, offering a unique mix of economic growth, a youthful population, and a government eager to foster innovation. As the country’s digital economy continues to flourish, more entrepreneurs and investors are recognizing Vietnam’s potential as a thriving hub for new ventures.

With a growing middle class, high internet penetration rates, and a strong emphasis on technology-driven solutions, Vietnam provides a fertile ground for startups across various sectors—including technology, fintech, e-commerce, education, and logistics. The combination of a fast-growing economy and a high demand for innovative solutions makes Vietnam an exciting frontier for entrepreneurs looking to establish a startup in a dynamic and emerging market.

Starting a business in Vietnam, however, requires a solid understanding of the local landscape. From navigating regulatory frameworks and cultural nuances to identifying suitable funding sources, aspiring entrepreneurs must be prepared for a unique journey. While Vietnam’s business environment is welcoming, it has its own complexities, such as language barriers, regulatory intricacies, and the need for localized strategies to attract and retain Vietnamese consumers. Understanding these aspects is crucial for laying a strong foundation for your startup and gaining an edge in a competitive landscape.

In this comprehensive guide, we will walk you through each step of launching a startup in Vietnam, providing essential insights and practical tips to help you navigate the process with confidence. Whether you’re a foreign entrepreneur interested in tapping into Vietnam’s market potential or a local looking to leverage the country’s supportive startup ecosystem, this guide covers everything from initial market research to legal compliance, networking, and securing funding. We will also explore how to take advantage of government incentives and local resources that can significantly benefit your venture.

Embarking on a startup journey in Vietnam is more than just establishing a business—it’s an opportunity to make a meaningful impact in one of Asia’s most promising markets. With the right preparation and an understanding of the Vietnamese entrepreneurial ecosystem, you can set up a thriving startup that contributes to Vietnam’s continued growth and innovation. Read on to discover the step-by-step roadmap to starting a successful business in Vietnam and learn how to turn your entrepreneurial vision into reality in this vibrant, opportunity-rich country.

How to Start a Startup in Vietnam: A Step-by-Step Guide

- Understanding Vietnam’s Startup Landscape

- Researching the Market and Identifying Opportunities

- Choosing a Business Structure

- Registering Your Business in Vietnam

- Securing Funding and Financial Resources

- Complying with Tax and Legal Requirements

- Building a Local Network and Finding Talent

- Marketing and Launching Your Startup

- Leveraging Government Support and Resources

1. Understanding Vietnam’s Startup Landscape

Vietnam’s startup ecosystem has undergone a remarkable transformation in recent years, positioning the country as one of the most promising destinations for entrepreneurship in Southeast Asia. With a dynamic mix of young, tech-savvy talent, a fast-growing middle class, and increasing government support, Vietnam is emerging as a key player in the region’s startup scene. However, like any growing market, understanding the local landscape is essential for success. This section delves into the factors that define Vietnam’s startup environment, providing you with crucial insights into market trends, industries with high potential, key challenges, and opportunities for foreign entrepreneurs.

Key Drivers of Vietnam’s Startup Ecosystem

- Economic Growth and Market Size

- Vietnam has one of the fastest-growing economies in Southeast Asia, with a GDP growth rate consistently above average over the past decade.

- The country’s young population (with a median age of around 30 years) and rapidly expanding middle class offer an enormous consumer base for startups.

- The government’s commitment to digital transformation and economic reform has created a favorable environment for business innovation.

- Supportive Government Policies

- The Vietnamese government has implemented various policies to stimulate entrepreneurship, including tax incentives, investment in infrastructure, and regulations that encourage foreign investment.

- Specific initiatives like the Vietnam Startup Support Program and the Vietnam Silicon Valley project provide startups with access to funding, mentorship, and networking opportunities.

- For example, in 2020, Vietnam introduced a new law to streamline the registration of startups, significantly reducing bureaucratic delays.

- Digital Transformation and Tech Savviness

- Vietnam’s adoption of digital technology is accelerating, with internet penetration rates exceeding 70%, contributing to the rapid growth of e-commerce, fintech, and tech-related industries.

- A young and tech-savvy population is driving innovation in the digital space, from mobile apps to e-payment solutions and artificial intelligence.

- Vietnam is now a regional leader in tech hubs, with Ho Chi Minh City and Hanoi serving as major centers for startups and tech companies.

High-Potential Industries for Startups in Vietnam

- E-Commerce

- Vietnam’s e-commerce market is one of the fastest-growing in Southeast Asia, expected to reach $15 billion by 2025. With a strong mobile internet user base, Vietnam is ripe for digital retail innovations.

- Popular platforms such as Tiki and Lazada Vietnam have transformed online shopping habits, creating opportunities for new e-commerce businesses targeting specific niches.

- Example: Shopee Vietnam, a subsidiary of Singapore-based Sea Group, has become one of the most popular e-commerce platforms in the country, offering a successful model for new entrants.

- Fintech

- The fintech sector in Vietnam has witnessed explosive growth, driven by the country’s large unbanked population and a growing demand for digital payment solutions.

- Fintech startups, ranging from e-wallets to lending platforms, are benefiting from favorable regulations and increased mobile penetration.

- Example: MoMo, a Vietnamese e-wallet app, has become one of the most widely used fintech solutions in the country, enabling users to make payments, transfer money, and access financial services from their smartphones.

- Healthtech

- The healthtech sector is emerging as a major area for innovation, particularly in telemedicine, digital health records, and online pharmacies.

- With the ongoing global health crisis, Vietnam’s digital healthcare solutions are gaining traction as the demand for remote consultations and health monitoring services continues to rise.

- Example: Doctor Anywhere, a telemedicine platform operating in Vietnam, allows users to consult doctors remotely, making healthcare more accessible to underserved areas.

- Agritech

- Agritech is an area where startups are helping improve productivity and sustainability in the agricultural sector by leveraging technology for smart farming solutions, logistics, and supply chain management.

- Vietnam’s status as one of the largest agricultural producers in Southeast Asia makes it an ideal market for agritech startups looking to optimize farming practices.

- Example: TaniHub, a Vietnamese agritech startup, connects farmers with buyers through its online platform, improving market access and logistics efficiency.

- Edtech

- Education technology (edtech) is a rapidly growing sector in Vietnam, driven by the country’s young population and the increasing demand for quality education and professional training.

- The rise of online learning platforms, digital courses, and personalized learning tools are transforming the education landscape in both rural and urban areas.

- Example: Topica, an edtech platform offering online university programs and professional certifications, has expanded significantly in Vietnam, addressing the growing need for affordable and accessible education.

Key Challenges for Startups in Vietnam

- Regulatory Complexities

- Despite government efforts to streamline business processes, the regulatory environment can be complex and difficult for new entrepreneurs to navigate, particularly for foreign investors.

- Businesses must be aware of local labor laws, tax obligations, and import-export regulations that could impact their operations.

- Example: Foreign entrepreneurs often face restrictions on ownership, as certain sectors (e.g., telecommunications and media) require Vietnamese majority ownership.

- Cultural and Language Barriers

- While Vietnam is increasingly globalized, local culture and language can present challenges for foreign entrepreneurs looking to connect with consumers and local partners.

- Building trust and understanding local customs are essential for success in this market.

- Example: Many foreign startups in Vietnam have hired local teams or partnered with Vietnamese co-founders to overcome language and cultural barriers.

- Competition in Key Sectors

- While the startup ecosystem is thriving, many sectors, such as e-commerce and fintech, are highly competitive, with both local and international players vying for market share.

- Startups need to find a unique value proposition and innovative business models to stand out.

- Example: In the e-commerce space, companies like Lazada and Shopee dominate, making it challenging for new entrants to establish themselves without offering unique services or niche products.

Opportunities for Foreign Entrepreneurs

- Foreign Investment and Partnership Opportunities

- Vietnam is increasingly open to foreign investment, with the government offering incentives such as tax exemptions for startups, especially in high-tech and innovative industries.

- Strategic partnerships with local companies can help foreign entrepreneurs better understand the market and navigate cultural differences.

- Example: Global companies like Amazon and Alibaba have successfully entered the Vietnamese market through joint ventures, which allows them to leverage local expertise while tapping into the growing consumer market.

- Access to a Skilled and Affordable Workforce

- Vietnam boasts a young, educated, and increasingly skilled workforce, making it an ideal location for startups looking to hire talent at competitive wages.

- The tech and IT sectors, in particular, have seen a surge in demand for skilled professionals, with many young graduates fluent in both Vietnamese and English.

- Example: Major tech companies like FPT Software and VNG Corporation have attracted top talent, highlighting the availability of skilled labor in the country.

- Government Support and Funding Initiatives

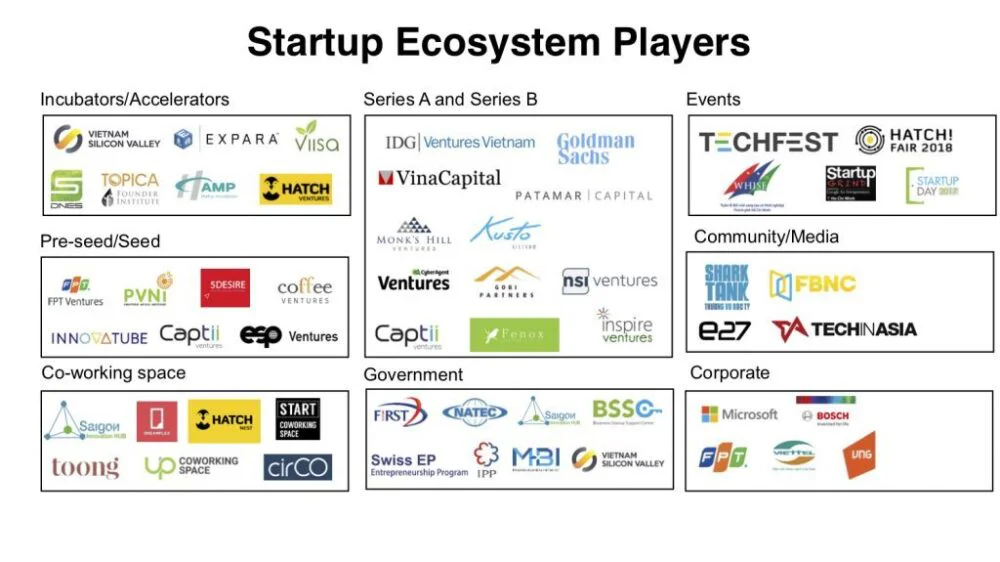

- Vietnam has a range of programs designed to support startups, including government-backed incubators, accelerators, and venture capital firms that specialize in early-stage investments.

- International investors, such as Sequoia Capital and Accel, have also shown increased interest in funding Vietnamese startups due to the country’s high growth potential.

- Example: VinaCapital, a leading Vietnamese venture capital firm, has been actively investing in local tech startups, further fueling the growth of the startup ecosystem.

In conclusion, Vietnam offers a thriving and dynamic environment for startups, driven by rapid economic growth, digital transformation, and a supportive regulatory framework. By understanding the local market, tapping into high-potential industries, and navigating the challenges unique to the country, entrepreneurs can unlock significant opportunities in one of Southeast Asia’s most promising startup ecosystems.

2. Researching the Market and Identifying Opportunities

Before launching a startup in Vietnam, conducting thorough market research is crucial to understanding the landscape, identifying consumer needs, and uncovering opportunities. As with any business venture, the more information you gather, the better equipped you’ll be to navigate the challenges and maximize your chances for success. Researching the market not only helps you refine your business concept but also enables you to understand competitive dynamics, customer behavior, and industry trends. This section explores how to effectively research the market in Vietnam and identify key opportunities that align with the country’s unique business environment.

Understanding Consumer Behavior and Preferences

- Demographic Insights

- Vietnam’s population of over 98 million people is young and increasingly urbanized, with over 40% of the population under the age of 25.

- This presents opportunities in industries such as fashion, technology, entertainment, and digital services, which appeal to the younger, tech-savvy consumer base.

- The increasing urbanization of cities like Ho Chi Minh City and Hanoi creates a growing demand for products and services tailored to urban living, including smart home technologies, modern retail solutions, and urban mobility services.

- Consumer Spending Patterns

- Vietnam’s rising middle class, estimated to comprise 33% of the population by 2025, is shifting spending habits toward higher-quality goods and services, including international brands and premium offerings.

- Local consumers have become more open to online shopping and digital payment solutions, making e-commerce and fintech sectors particularly attractive.

- Example: Tiki, one of Vietnam’s leading e-commerce platforms, has seen significant growth due to rising online shopping trends fueled by the middle class’s increasing disposable income.

- Cultural Sensitivities and Preferences

- Understanding local cultural preferences and values is critical for tailoring your products or services to meet Vietnamese expectations. For example, Vietnamese consumers may prioritize affordability and practicality, especially in rural areas, while those in urban centers are often more open to premium or international products.

- Example: In the food and beverage sector, local brands often emphasize traditional ingredients and flavors in their offerings, while multinational brands like McDonald’s have customized their menus to include more local dishes to appeal to local tastes.

- Technology Adoption and Digital Literacy

- Vietnam has a rapidly expanding digital ecosystem, with mobile-first internet usage being the norm. Over 70% of the population is online, and mobile phones are the primary means of internet access for many consumers.

- With the increasing penetration of smartphones and internet connectivity, mobile apps, e-commerce, and online services are booming. Vietnamese consumers are increasingly relying on digital solutions for convenience, from food delivery to online banking.

- Example: The MoMo e-wallet is widely used for online payments, reflecting the country’s strong shift towards cashless transactions.

Analyzing Industry Trends and Key Sectors for Growth

- Tech and Digital Innovation

- Vietnam’s tech industry is booming, and startups focused on software development, e-commerce, AI, and data analytics are gaining significant traction.

- The country is witnessing a surge in demand for digital solutions, driven by both local consumer needs and the government’s push toward digitalization in various sectors such as banking, education, and healthcare.

- Example: VNG Corporation, one of Vietnam’s leading tech companies, has expanded from being a gaming company to a major player in the social media, e-commerce, and fintech sectors, demonstrating the increasing diversity and opportunity within Vietnam’s tech space.

- Fintech and Digital Payments

- The fintech market in Vietnam is one of the fastest-growing in Southeast Asia, fueled by the country’s large unbanked population and the growing adoption of digital wallets, lending platforms, and mobile banking services.

- Local regulations are evolving to support fintech development, with initiatives such as the “National Payment Network” to streamline digital payments and increase financial inclusion.

- Example: MoMo, a popular Vietnamese mobile wallet, has over 20 million users and continues to expand, positioning itself as a leader in Vietnam’s rapidly growing fintech ecosystem.

- E-Commerce and Online Retail

- Vietnam’s e-commerce market is expected to reach $15 billion by 2025, driven by the growing number of online shoppers, the adoption of digital payment systems, and an expanding logistics infrastructure.

- E-commerce is not just limited to big players like Lazada and Shopee but extends to niche segments such as second-hand goods, fashion, and personalized products.

- Example: Tiki and Sendo, both Vietnamese platforms, are capitalizing on the rise of online shopping and local e-commerce preferences, with Tiki positioning itself as a premium platform.

- Health and Wellness

- The health and wellness industry in Vietnam is growing rapidly, with a focus on fitness, organic products, mental health, and nutrition.

- Growing awareness about healthy living is prompting Vietnamese consumers to spend more on organic food, fitness memberships, and wellness products.

- Example: TheCoffeeHouse, a local coffee shop chain, is expanding its menu to include healthier options, tapping into the growing demand for healthier food and beverage alternatives.

- Sustainable and Eco-Friendly Solutions

- Sustainability is becoming a key concern for Vietnamese consumers, with increasing interest in eco-friendly products, renewable energy, and sustainable business practices.

- As Vietnam grapples with pollution and environmental issues, there is a significant opportunity for startups offering green solutions, including waste management, renewable energy, and eco-friendly consumer goods.

- Example: Cotecland, a sustainable construction and real estate development firm, has been leading the charge in eco-friendly housing, demonstrating the increasing demand for sustainability in the country.

Identifying Competitive Gaps and Market Niches

- Market Research and Competitive Analysis

- In a rapidly growing economy like Vietnam’s, competition is fierce across many sectors. Analyzing your competitors—both local and international—helps you identify gaps in the market and areas for innovation.

- Focus on customer pain points and challenges that are not being fully addressed by current market leaders. This could include gaps in service quality, convenience, pricing, or product availability.

- Example: Despite the success of large e-commerce platforms like Lazada and Shopee, smaller players focusing on niche markets, such as local artisan goods or hyper-local delivery services, have found a lucrative customer base by addressing specific needs.

- Addressing Unmet Needs

- Vietnam’s market is still developing in several sectors, with significant room for innovative products and services to address unmet needs. Look for problems in local industries that are underserved by current offerings.

- Example: Gojek, an Indonesian ride-hailing service, successfully entered the Vietnamese market by offering more than just transportation. It included food delivery, logistics, and digital payment features, filling multiple consumer needs under one platform.

- Cultural Adaptation and Localization

- Vietnam has a rich cultural heritage, and many foreign businesses struggle to adapt their products or services to local tastes and preferences. A strong understanding of local culture and language can help startups tailor their offerings to suit the Vietnamese market.

- Example: KFC Vietnam offers localized menu items like fried chicken with Vietnamese herbs to cater to local tastes, demonstrating the importance of cultural adaptation for success in the market.

Using Market Data and Tools for Insight

- Accessing Local Research Reports and Data

- Utilize reports from organizations such as the Vietnam Chamber of Commerce and Industry (VCCI), local trade associations, and market research firms (e.g., Nielsen Vietnam) to gain valuable insights into industry trends and consumer behavior.

- These reports provide data on market size, growth potential, consumer spending habits, and competitive landscape—critical information for identifying opportunities.

- Leveraging Digital Analytics Tools

- Use online tools like Google Trends, social media analytics, and SEO tools (e.g., Ahrefs, SEMrush) to gauge local consumer interests and trends. These can help you assess the demand for specific products or services in Vietnam.

- Social media platforms like Facebook and Instagram are widely used in Vietnam, and understanding the topics that gain traction on these platforms can provide a better understanding of market trends and potential opportunities.

In conclusion, researching the market and identifying opportunities in Vietnam requires a detailed understanding of consumer behavior, industry trends, and the competitive landscape.

By leveraging data, cultural insights, and the growing demand in sectors like e-commerce, fintech, healthtech, and sustainability, startups can position themselves for success in this dynamic and fast-growing market.

Understanding these opportunities will enable entrepreneurs to tailor their products and services to meet the specific needs of the Vietnamese consumer, helping to create a strong foundation for long-term success.

3. Choosing a Business Structure

When starting a business in Vietnam, one of the most crucial decisions you’ll make is selecting the appropriate business structure. The business structure you choose affects not only the legal and financial aspects of your startup but also how you operate, how you’re taxed, and how much liability you bear. Vietnam offers several options for entrepreneurs, each with its advantages and considerations. This section will walk you through the main types of business structures available in Vietnam, helping you choose the one that best fits your goals, resources, and risk tolerance.

1. Sole Proprietorship

- Definition and Key Features

- A sole proprietorship is the simplest form of business structure, where a single individual owns and operates the business. The owner is responsible for all aspects of the business, including management, operations, and finances.

- Liability: The owner has unlimited liability, meaning they are personally liable for any debts or legal issues the business faces.

- Ease of Setup: It is relatively easy and quick to set up, with minimal administrative requirements.

- Advantages

- Low Startup Costs: There are fewer administrative and compliance costs associated with setting up a sole proprietorship.

- Full Control: The owner has complete control over decision-making and the direction of the business.

- Simplified Taxation: Sole proprietorships are taxed as the owner’s personal income, which can simplify tax filings.

- Disadvantages

- Unlimited Liability: The biggest risk is the personal liability of the owner for business debts and obligations.

- Limited Growth Potential: Raising capital or attracting investors can be difficult because the business is closely tied to the owner.

- Example:

- A small, local coffee shop in Hanoi, owned and operated by an individual with limited capital, might choose to operate as a sole proprietorship. The owner can manage operations with minimal red tape and have full control over their business.

2. Limited Liability Company (LLC)

- Definition and Key Features

- The Limited Liability Company (LLC) is a popular business structure in Vietnam, offering more flexibility than a sole proprietorship while providing limited liability for the owners.

- An LLC can be established with a minimum of one shareholder and a maximum of 50 shareholders.

- Liability: Shareholders are only liable for the company’s debts up to the amount of their investment in the business.

- Advantages

- Limited Liability: Shareholders are not personally liable for business debts beyond their initial investment.

- Flexible Ownership: It can be owned by one or more individuals or entities (both Vietnamese and foreign investors).

- Tax Benefits: LLCs benefit from a corporate tax structure, which may be more advantageous than personal tax rates in some cases.

- Disadvantages

- Startup Costs: LLCs require more paperwork and a higher initial investment compared to sole proprietorships.

- Management Structure: LLCs are required to appoint at least one director, and the structure can become more complex with multiple shareholders.

- Example:

- A technology startup with a small group of co-founders and plans to raise funding might choose an LLC structure. The LLC would allow them to limit personal liability while offering more opportunities for growth and investment.

3. Joint-Stock Company (JSC)

- Definition and Key Features

- A Joint-Stock Company (JSC) is a more advanced business structure suited for larger businesses or those planning to raise substantial capital. It allows companies to issue shares to the public or private investors.

- Liability: Like an LLC, the liability of shareholders is limited to their shareholding in the company.

- A JSC requires a minimum of three shareholders and can have up to an unlimited number of shareholders.

- Advantages

- Ability to Raise Capital: A JSC can issue shares to raise capital, making it a great option for businesses with ambitious growth plans.

- Limited Liability: Shareholders’ liability is limited to the capital they’ve invested.

- Increased Credibility: Having a joint-stock structure often boosts credibility with investors, customers, and other businesses.

- Disadvantages

- Complex Setup and Compliance: Setting up a JSC requires more time and resources than other business structures. Ongoing compliance, such as maintaining detailed financial reports, can be costly and time-consuming.

- Regulatory Scrutiny: JSCs are subject to more regulatory scrutiny, including shareholder meetings, annual reports, and audits.

- Example:

- A Vietnamese tech company aiming to expand rapidly in the region might choose a JSC structure to raise funds through equity sales. The ability to issue shares makes it easier for them to attract investors to fund expansion efforts.

4. Representative Office

- Definition and Key Features

- A representative office is not a standalone legal entity but rather an extension of a foreign company in Vietnam. It is often used by foreign businesses wishing to explore the market without fully committing to a local business structure.

- Liability: The parent company holds full responsibility for any liabilities incurred by the representative office.

- Representative offices cannot conduct direct sales or generate income, but they can perform market research, advertising, and liaison activities.

- Advantages

- Market Exploration: A representative office allows foreign businesses to test the Vietnamese market without making a large investment.

- Lower Setup Costs: The cost of setting up a representative office is relatively low compared to starting a full-fledged business.

- No Corporate Taxes on Income: Since representative offices cannot engage in profit-generating activities, they are not subject to corporate income tax.

- Disadvantages

- Limited Operations: Representative offices cannot engage in direct sales or generate income, limiting their utility for businesses that want to actively sell or manufacture products in Vietnam.

- Foreign Ownership Restrictions: Representative offices are typically only available to foreign businesses, not local entrepreneurs.

- Example:

- A U.S.-based software company looking to test demand for its product in Vietnam might choose to open a representative office to understand the market better before investing in a larger, more costly venture.

5. Branch Office

- Definition and Key Features

- A branch office is similar to a representative office, but with the ability to engage in business activities such as making sales and signing contracts. It operates as part of the parent company but is subject to Vietnamese law.

- Liability: Like a representative office, the parent company is responsible for the liabilities of the branch office.

- Advantages

- Engage in Business Activities: Branch offices can generate income, enter into contracts, and conduct sales, unlike representative offices.

- Lower Costs: The setup process and costs are relatively straightforward compared to fully establishing a new entity.

- Disadvantages

- Limited Scope of Operation: While branch offices can engage in business activities, they are still limited by the parent company’s scope and business model.

- Tax Obligations: Branch offices are subject to Vietnamese tax laws on income generated in the country.

- Example:

- A global car manufacturer looking to set up a production facility in Vietnam might choose a branch office to manage local operations and generate revenue while keeping its international identity intact.

6. Foreign-Owned Enterprise (FOE)

- Definition and Key Features

- A Foreign-Owned Enterprise (FOE) is a business structure where 100% of the company is owned by foreign investors. This is especially popular for foreign businesses wishing to have full control over their Vietnamese operations.

- Liability: The liability of the company is limited to its capital, protecting shareholders from personal liability.

- Ownership Structure: 100% foreign ownership is allowed in certain industries, such as IT, finance, and manufacturing, but there are restrictions in some sectors such as retail and construction.

- Advantages

- Full Control: Foreign investors maintain full control over decision-making and operations.

- Fewer Restrictions: Unlike joint ventures, FOEs don’t require a local partner, making them more attractive to investors who want to retain control.

- Disadvantages

- Capital Requirements: Foreign investors must meet the minimum capital requirements set by Vietnamese law.

- Legal and Regulatory Compliance: Foreign-owned enterprises are subject to rigorous legal and tax regulations.

- Example:

- A global electronics company wishing to open a manufacturing plant in Vietnam could opt for a foreign-owned enterprise to maintain complete control over operations while benefiting from the country’s favorable manufacturing environment.

Conclusion

Selecting the right business structure for your startup in Vietnam is essential to setting up a solid foundation for growth and sustainability. Whether you choose a sole proprietorship for simplicity, an LLC for limited liability, or a joint-stock company for access to capital, understanding the advantages and disadvantages of each option is key. By aligning your business structure with your goals, resources, and long-term plans, you can position your startup for success in the rapidly growing Vietnamese market.

4. Registering Your Business in Vietnam

Registering your business in Vietnam is a key step in establishing a legal entity and starting your operations. The process may seem complex, especially for foreign entrepreneurs, but it’s essential to navigate it properly to ensure your business complies with local laws and regulations. This section provides a detailed, step-by-step guide on how to register your business in Vietnam, including the necessary documents, legal requirements, and typical timelines.

1. Understand the Business Registration Process

- Overview of Business Registration

- The registration process for starting a business in Vietnam involves several steps, including obtaining legal status, registering with the relevant authorities, and securing necessary permits.

- Businesses must register with the Department of Planning and Investment (DPI) or a relevant local authority, depending on the business type and location.

- Foreign Investment Requirements: For foreign-owned businesses, additional approvals may be required from the Ministry of Planning and Investment (MPI) or local authorities.

- Main Types of Registration

- Enterprise Registration: This involves the creation of a legal business entity, such as an LLC or JSC.

- Investment Registration: If you are a foreign investor, you will need to complete investment registration to receive permission to invest in Vietnam.

- Examples:

- A foreign entrepreneur establishing a software development firm will need both enterprise registration and investment registration approval to legally set up their business.

2. Determine the Business Location and Relevant Authority

- Choosing the Right Location

- The location of your business can affect the registration process. Vietnam has several economic zones and regions, each with its own regulatory requirements.

- Major cities like Hanoi and Ho Chi Minh City tend to have more infrastructure and easier access to business services.

- Example: A tech startup focusing on artificial intelligence may opt to register in Ho Chi Minh City due to its growing tech ecosystem and support for foreign investments.

- Relevant Authority for Registration

- For businesses based in cities like Hanoi and Ho Chi Minh City, registration must be done with the Department of Planning and Investment (DPI).

- For businesses located in industrial zones or export processing zones, the registration process may be overseen by the Management Board of Industrial Zones or the Export Processing Zones.

3. Prepare the Necessary Documentation

- Documents for Enterprise Registration

- Application Form: A completed application form for enterprise registration, which can be obtained from the relevant registration office.

- Business Plan: A business plan outlining your operations, financials, and long-term goals (especially relevant for foreign investors).

- Proof of Identity: Copies of passports or national identification cards of the founders or legal representatives.

- Charter Capital Statement: Details of the company’s charter capital and its legal source.

- Rental Agreement: Proof of office address in Vietnam (lease agreement, property deed, etc.).

- Documents for Investment Registration (for Foreign Investors)

- Investment Proposal: A detailed proposal describing the business activities, investment capital, and expected impact on the Vietnamese economy.

- Approval Letter: Foreign investors must obtain an investment approval letter from the Ministry of Planning and Investment (MPI).

- Example:

- A foreign fashion retail company planning to expand in Vietnam would need to provide an investment proposal to the MPI detailing their expected capital investment, job creation plans, and alignment with the local retail market.

4. Submit Your Registration Application

- Application Submission Process

- Once all the necessary documents are prepared, they need to be submitted to the relevant local authorities (DPI or MPI) for review and approval.

- Foreign Investment Approval: If you are a foreign investor, the MPI may require additional time to process your investment registration before proceeding to enterprise registration.

- Electronic Submission

- The registration process in Vietnam can often be done electronically through the National Business Registration Portal, streamlining the application process and reducing paperwork.

- Example:

- A local startup specializing in e-commerce may submit their registration application electronically, which speeds up the approval process and allows for a quicker launch.

5. Obtain the Business Registration Certificate

- Business Registration Certificate (BRC)

- Once the application is approved, you will receive the Business Registration Certificate (BRC), which officially recognizes your business as a legal entity in Vietnam.

- The BRC contains vital information, including the company’s name, legal structure, tax code, business activities, and authorized capital.

- Business Licenses

- In addition to the BRC, you may need to obtain specific business licenses or sector-specific permits depending on the nature of your business.

- For example, companies in sectors like food, pharmaceuticals, or education may need additional approvals from health, safety, or education authorities.

- Example:

- A foreign food and beverage company in Vietnam must obtain a food safety and hygiene certificate in addition to their Business Registration Certificate before opening a restaurant or production facility.

6. Register for Taxes and Obtain a Tax Code

- Tax Registration

- All businesses in Vietnam are required to register with the local tax office and obtain a tax code, which is used to track the company’s tax obligations.

- The tax registration process is typically done simultaneously with business registration.

- Types of Taxes to Consider

- Corporate Income Tax (CIT): This is the primary tax levied on businesses. The standard corporate income tax rate in Vietnam is 20%, though it may vary for certain industries.

- Value-Added Tax (VAT): A VAT is applied to the majority of goods and services in Vietnam, ranging from 5% to 10% depending on the type of goods or services.

- Personal Income Tax (PIT): For companies with employees, registering for Personal Income Tax is also necessary.

- Example:

- A local manufacturing company will need to complete tax registration, and once approved, will receive a tax code that enables them to fulfill corporate tax, VAT, and employee tax obligations.

7. Open a Business Bank Account

- Opening a Bank Account in Vietnam

- Once your business is officially registered, you need to open a corporate bank account. This is essential for managing business finances, including receiving payments, paying taxes, and transferring funds.

- Banks in Vietnam may require the Business Registration Certificate, tax code, and other documents before allowing businesses to open an account.

- Choosing a Bank

- It’s important to choose a bank with a good reputation and strong international capabilities if your business will involve foreign transactions.

- Popular choices for businesses include Vietcombank, BIDV, and Techcombank, which offer services in both Vietnamese dong (VND) and foreign currencies.

- Example:

- A foreign tech company starting in Vietnam would select a reputable bank like Vietcombank to ensure they can manage international transfers and business expenses smoothly.

8. Register Employees and Obtain Social Insurance

- Social Insurance Registration

- As an employer in Vietnam, you must register your employees for social insurance, which includes pension, health, and unemployment insurance.

- This registration process is done through the Vietnam Social Security Office (VSS), and businesses are required to contribute to employee social insurance on a monthly basis.

- Labor Contracts and Compliance

- All employees must have formal labor contracts, and businesses are required to comply with Vietnam’s labor laws, including wage requirements, working hours, and employee rights.

- Example:

- A digital marketing agency based in Ho Chi Minh City would need to register its employees for social insurance and ensure compliance with Vietnam’s labor laws to avoid penalties.

9. Ongoing Business Compliance and Reporting

- Compliance Obligations

- After registering your business, you must ensure ongoing compliance with Vietnamese laws, including timely tax filings, annual reports, and audits.

- Businesses must submit annual financial statements to the tax authority and keep detailed records of operations.

- Business Renewal

- Depending on the nature of the business, licenses or registrations may need to be renewed periodically, such as industry-specific permits, business licenses, or foreign investment approvals.

- Example:

- A construction company operating in Vietnam may need to renew its business license annually and submit reports detailing compliance with local regulations on construction safety and environmental impact.

Conclusion

Registering a business in Vietnam involves several important steps, from understanding the legal requirements to submitting necessary documents and obtaining your business registration certificate. By carefully following the process, ensuring compliance with local laws, and preparing the right documentation, you can successfully establish a business in one of Southeast Asia’s fastest-growing economies. Whether you are a local entrepreneur or a foreign investor, registering your business properly is the first step to ensuring long-term success in the Vietnamese market.

5. Securing Funding and Financial Resources

Securing funding and financial resources is one of the most critical steps in starting a business in Vietnam. The ability to access capital will determine the pace of your business’s growth and its ability to scale. Whether you are bootstrapping your startup, seeking investment from venture capital, or obtaining loans, it’s important to understand the available funding options, the requirements, and how to effectively approach potential investors or financial institutions. This section will provide an in-depth guide on the various methods of securing funding and managing financial resources when starting a business in Vietnam.

1. Assessing Your Financial Needs

- Understand Startup Costs

- Before seeking funding, it’s crucial to have a clear understanding of your business’s financial needs. This includes the costs associated with:

- Initial setup: Business registration, legal fees, office space, equipment.

- Operational costs: Rent, utilities, salaries, marketing, and inventory.

- Working capital: Funds required to cover day-to-day operations until the business becomes profitable.

- Example: A SaaS company may need to account for initial software development costs, office space, and hiring developers before launching their product.

- Before seeking funding, it’s crucial to have a clear understanding of your business’s financial needs. This includes the costs associated with:

- Prepare Financial Projections

- Create detailed financial projections to present to potential investors or lenders. These should include:

- Revenue forecasts: Expected income over the first 3–5 years.

- Expense estimates: Breakdown of operational costs.

- Cash flow projections: Anticipated inflow and outflow of cash to ensure liquidity.

- Profitability timeline: When you expect to become profitable.

- Create detailed financial projections to present to potential investors or lenders. These should include:

- Example: A local fashion retail brand may forecast steady revenue growth after the first 12 months, with initial expenses covering inventory and store rent, but with breakeven expected in year two.

2. Bootstrapping Your Business

- Self-Funding Your Startup

- Bootstrapping means using your own personal savings or funds from friends and family to start your business. This option provides full control over the business and avoids the need for outside investment.

- Advantages:

- Full ownership and control over your business decisions.

- Avoiding debt or equity dilution.

- Disadvantages:

- Limited capital, which can slow down the pace of growth.

- Personal financial risk if the business fails.

- Example:

- A small tech startup in Vietnam may choose to bootstrap by using personal savings to fund early product development and marketing campaigns, keeping the business lean until it achieves profitability.

3. Securing Bank Loans

- Traditional Bank Loans

- Vietnamese banks offer various loan products to businesses, including short-term working capital loans, medium-term loans for capital expenses, and long-term loans for major investments.

- Eligibility:

- Vietnamese banks typically require businesses to have a clear business plan, good credit history, and collateral (e.g., real estate or equipment) for loans.

- Foreign businesses may face stricter requirements and might need to establish a relationship with a local partner or lender.

- Interest Rates and Terms:

- Bank loans in Vietnam can have interest rates ranging from 7% to 15%, depending on the loan type and business risk.

- Example:

- A restaurant chain looking to expand to multiple locations might secure a medium-term loan from a Vietnamese bank, using their current assets as collateral to fund store openings and renovations.

- Challenges for Foreign Entrepreneurs

- Foreign business owners may face additional challenges in securing traditional loans in Vietnam, as banks typically require collateral and often prefer businesses with a local legal presence.

4. Attracting Angel Investors

- What is an Angel Investor?

- Angel investors are individuals or groups who provide capital for startups in exchange for equity or debt. They often come from personal savings and are more willing to take risks compared to traditional venture capitalists.

- Benefits of Angel Investment:

- Angel investors can offer mentorship and advice alongside financial backing.

- More flexible investment terms compared to venture capitalists or banks.

- Drawbacks:

- Dilution of ownership, as angel investors usually take an equity stake in exchange for their investment.

- How to Attract Angel Investors in Vietnam

- Build a Solid Network: Attending startup events, networking meetups, and participating in pitch competitions can help you connect with potential investors.

- Create a Compelling Pitch: Have a strong, clear business plan and financial projections to convince investors that your business has long-term potential.

- Showcase Market Potential: Investors are more likely to back businesses with significant market potential and scalability in Vietnam’s emerging economy.

- Example:

- A fintech startup could attract an angel investor in Vietnam by demonstrating how their platform addresses the need for more efficient online payment solutions in Southeast Asia, leveraging the region’s growing digital economy.

5. Seeking Venture Capital Investment

- What is Venture Capital?

- Venture capital (VC) is investment from firms or funds that specialize in providing capital to high-growth startups in exchange for equity. VCs typically invest larger sums of money than angel investors and are interested in businesses with scalable models and high growth potential.

- VC Funds in Vietnam:

- Vietnam-based VC Firms: Local VC firms such as 500 Startups Vietnam, Mekong Capital, and VinaCapital provide funding to early-stage businesses.

- Global VC Firms: International VCs, like Sequoia Capital and Accel, also invest in Southeast Asia, including Vietnam, especially in the tech and innovation sectors.

- Advantages:

- Larger amounts of capital that can help businesses scale faster.

- Access to a network of mentors, advisors, and potential customers.

- Disadvantages:

- Significant equity dilution, as VCs often want a substantial ownership stake in exchange for their investment.

- Pressure for rapid growth and performance.

- Example:

- A Vietnamese e-commerce startup with plans to expand regionally may seek venture capital to accelerate its growth, with a VC firm providing funding in exchange for equity and strategic guidance.

6. Government Grants and Support Programs

- Government Programs for Startups in Vietnam

- The Vietnamese government supports startups and innovation through various grants, subsidies, and support programs, including the Vietnam Startup Support Program and initiatives by the Ministry of Science and Technology.

- Types of Support:

- Financial Support: Direct grants or low-interest loans for research, development, and innovation.

- Mentorship and Training: Programs designed to help entrepreneurs build their business skills and expand their networks.

- Tax Incentives: Tax holidays or reductions for companies in certain industries, such as technology, manufacturing, or renewable energy.

- Example:

- A renewable energy startup in Vietnam might apply for government grants to fund the development of clean energy solutions, taking advantage of incentives aimed at encouraging sustainable business practices.

7. Crowdfunding

- What is Crowdfunding?

- Crowdfunding is the process of raising small amounts of capital from a large number of people, typically through online platforms. Crowdfunding is an increasingly popular method for startups to gather funding without giving up significant equity or taking on debt.

- Crowdfunding Platforms: In Vietnam, international platforms like Kickstarter, Indiegogo, and GoFundMe are used by startups to reach global investors.

- Benefits:

- Access to a wide pool of investors, including people who may not traditionally invest in businesses.

- The ability to test market demand for a product before full-scale production.

- Challenges:

- Successful crowdfunding campaigns require significant marketing and a compelling offer to attract backers.

- Example:

- A Vietnamese consumer electronics company may launch a crowdfunding campaign to finance the production of a new innovative gadget, offering early-bird discounts to attract backers.

8. Managing Your Startup’s Financial Resources

- Budgeting and Financial Control

- Once funding is secured, it’s crucial to effectively manage your startup’s finances. This includes:

- Tracking Cash Flow: Monitor inflows and outflows to ensure liquidity.

- Cost Control: Keep expenses in check, especially during the early stages, to preserve capital.

- Setting Financial Milestones: Establish clear financial goals, such as achieving a break-even point, increasing revenue by a certain percentage, or expanding operations to a new market.

- Once funding is secured, it’s crucial to effectively manage your startup’s finances. This includes:

- Financial Planning Tools

- Use software like QuickBooks, Xero, or Zoho Books to manage your finances efficiently, especially as your business grows and financial transactions increase.

- Example:

- A rapidly growing Vietnamese online education platform must maintain a careful balance of spending on marketing, content creation, and platform development while securing enough revenue to support future growth.

Conclusion

Securing funding and financial resources is a crucial part of building a successful startup in Vietnam. Whether you choose to bootstrap, seek loans, attract angel investors or venture capital, or explore government grants, each funding route offers distinct advantages and challenges. It’s essential to evaluate your business’s needs, create detailed financial projections, and choose the right funding method that aligns with your goals and growth trajectory. With the right financial support, your business will be better equipped to navigate the competitive Vietnamese market and achieve long-term success.

6. Complying with Tax and Legal Requirements

Complying with tax and legal requirements is a fundamental part of running a business in Vietnam. As a foreign entrepreneur or a local business owner, it is crucial to ensure that your startup adheres to Vietnam’s legal framework and tax regulations. Failure to comply with these requirements can result in fines, penalties, or even the suspension of business activities. This section provides an in-depth guide on the essential tax and legal obligations that startups need to meet when operating in Vietnam.

1. Understanding Vietnam’s Legal Framework for Startups

- Business Laws in Vietnam

- Vietnam has a range of laws and regulations that govern business operations, including the Enterprise Law, Investment Law, and various industry-specific regulations. The Enterprise Law (2020) provides clear guidelines for business registration, operations, and compliance.

- Business Forms and Ownership

- Foreign businesses are allowed to own up to 100% of certain types of businesses, depending on the industry, such as technology or retail.

- Joint-Stock Companies (JSC): Can have multiple shareholders and is the most common form for larger businesses.

- Limited Liability Companies (LLC): Offers a simpler structure, preferred by small to medium-sized businesses, where the owners’ liabilities are limited to their shares in the business.

- Key Legal Considerations for Startups

- Registered Office and Legal Presence: All businesses in Vietnam must have a registered office within the country. Even if you are a foreign investor, your business must have a legal presence here.

- Vietnamese Business License: Foreign entrepreneurs need to apply for an Investment Certificate if they intend to establish a business in Vietnam.

- Example: A tech startup in Ho Chi Minh City would need to register with the relevant authorities to get the required licenses, including the Investment Certificate and Business Registration Certificate.

2. Registering for Taxes

- Tax Registration Process

- All businesses must register with the Vietnamese tax authorities to obtain a Tax Identification Number (TIN). This number is necessary for filing taxes and conducting official transactions in Vietnam.

- The registration process includes:

- Filing with the General Department of Taxation: Businesses need to provide information on their operations, including business type, revenue projections, and ownership details.

- Documentation Required: Business registration certificate, investment certificate, legal representative details, and office address.

- Types of Taxes in Vietnam

- Vietnam has a comprehensive tax system that businesses must comply with. The most common taxes for startups include:

- Corporate Income Tax (CIT): This is levied at a rate of 20% for most businesses. However, some industries such as high-tech enterprises and small businesses may benefit from tax incentives and reduced rates.

- Value Added Tax (VAT): Generally levied at a rate of 10%, VAT is applied to goods and services at each stage of production and distribution.

- Personal Income Tax (PIT): If your business employs local staff, you must withhold PIT from their salaries and remit it to the authorities. The rate ranges from 5% to 35%, depending on the salary level.

- Foreign Contractor Tax (FCT): If your business engages with foreign contractors, you may be required to withhold FCT, which typically includes VAT and CIT.

- Vietnam has a comprehensive tax system that businesses must comply with. The most common taxes for startups include:

- Example: A local restaurant in Hanoi will need to register for VAT and CIT, file monthly VAT returns, and pay the appropriate taxes based on their earnings. They must also deduct personal income tax from employees’ wages.

3. Understanding Vietnam’s Tax Filing and Payment Deadlines

- Tax Filing Periods

- Corporate Income Tax (CIT): Generally filed annually, with a monthly advance payment requirement based on estimated revenue.

- VAT Filing: Businesses are required to file VAT returns monthly and make payments by the 20th of the following month.

- Personal Income Tax (PIT): PIT withholding for employees must be filed monthly, and annual tax returns are due by March 31st of the following year.

- Electronic Tax Filing

- The Vietnamese tax authorities have implemented an e-filing system for businesses to file taxes online. This system allows for more efficient tax compliance and reduces the risk of human error.

- All businesses, including foreign-owned entities, can register for and use the Vietnam Tax Portal to submit returns and make tax payments electronically.

- Penalties for Late Filing

- Late filing or incorrect reporting can result in fines and interest charges. The penalties can range from 1 million VND to 10 million VND (approx. 40 to 400 USD) for late submissions, and the tax authorities may charge additional interest on overdue taxes.

4. Employee-Related Tax and Social Security Contributions

- Vietnamese Labor Laws

- Foreign-owned businesses in Vietnam must comply with local labor laws when it comes to hiring employees. These include:

- Minimum Wage: The minimum wage in Vietnam varies by region. As of 2024, it ranges from 4 million VND to 4.5 million VND (approximately 160 to 190 USD), depending on the location of the business.

- Employee Benefits: Employers must contribute to social insurance, health insurance, and unemployment insurance for their employees, which totals approximately 23.5% of an employee’s gross salary.

- Labor Contracts: All employees, including foreign nationals, must sign a labor contract outlining their job description, compensation, benefits, and working conditions.

- Foreign-owned businesses in Vietnam must comply with local labor laws when it comes to hiring employees. These include:

- Social Insurance and Health Insurance Contributions

- Employers are required to contribute to the Social Insurance Fund, which covers retirement, sickness, maternity, and disability benefits. The contribution rate is 17.5% of the employee’s salary.

- Health Insurance: Employers also need to contribute to health insurance, with a contribution rate of 3% of an employee’s salary.

- Unemployment Insurance: A contribution rate of 1% is required for unemployment insurance.

- Example: A software development company hiring five local developers in Hanoi must set aside 23.5% of each employee’s salary to cover their social and health insurance contributions, and comply with all labor law regulations when drafting employment contracts.

5. Licensing and Regulatory Compliance

- Industry-Specific Licensing

- Some industries in Vietnam require special licenses or permits to operate. Examples include:

- Food and Beverage: Restaurants, cafes, and food production companies must obtain food safety certifications from the Vietnam Food Administration.

- Technology: Tech startups may need additional regulatory compliance related to data privacy and intellectual property protection.

- Import and Export: Businesses involved in international trade must obtain relevant import/export licenses and comply with customs regulations.

- Some industries in Vietnam require special licenses or permits to operate. Examples include:

- Environmental Compliance

- Certain industries, such as manufacturing and construction, may need to comply with environmental protection regulations. This could involve securing environmental impact assessments and ensuring the business meets sustainable practices.

- Example: A manufacturing company involved in producing electronic devices must obtain environmental clearance from local authorities, ensuring that their operations do not violate Vietnam’s environmental protection laws.

6. Intellectual Property Protection

- Registering Trademarks and Patents

- Startups in Vietnam should protect their intellectual property (IP) by registering trademarks, patents, and copyrights. The Vietnam Intellectual Property Office (NOIP) is responsible for IP registration in the country.

- Trademark: Protects the brand name, logo, and business identity.

- Patent: Protects innovations, including new products, processes, or technologies.

- Copyright: Protects creative works like software, literature, or art.

- Example: A Vietnamese e-commerce company developing an innovative mobile app might apply for a patent to protect their unique technology and a trademark to safeguard their brand identity in the market.

7. Compliance with Foreign Investment Regulations

- Foreign Ownership Limits

- Vietnam has specific regulations regarding foreign ownership in certain sectors. While foreign investors can own 100% of their business in many sectors, in others, there are limitations. For example:

- Retail: Foreign ownership may be limited to 49% in retail companies unless they partner with a local entity.

- Banking: Foreign investors can own up to 30% of a Vietnamese bank.

- Vietnam has specific regulations regarding foreign ownership in certain sectors. While foreign investors can own 100% of their business in many sectors, in others, there are limitations. For example:

- Example: A foreign investor looking to open a retail business in Vietnam may need to enter into a partnership with a local entity to comply with the foreign ownership limits in the retail sector.

Conclusion

Complying with tax and legal requirements is crucial for ensuring the smooth operation of a business in Vietnam. Startups must navigate a complex landscape of registration processes, tax obligations, labor laws, industry-specific regulations, and intellectual property protections. By understanding and adhering to Vietnam’s legal and tax frameworks, entrepreneurs can avoid costly mistakes and ensure their business’s long-term sustainability in this dynamic market. With proper legal compliance and financial management, your startup can thrive in one of Southeast Asia’s fastest-growing economies.

7. Building a Local Network and Finding Talent

Building a strong local network and identifying top talent is crucial to the success of any startup, especially in a dynamic and rapidly growing market like Vietnam. Whether you are a local entrepreneur or a foreign investor, understanding the importance of local relationships and hiring the right team will greatly contribute to your business growth. In this section, we will cover the essential steps for building a local network and sourcing talented individuals in Vietnam.

1. The Importance of Building a Strong Local Network

- Cultural Understanding and Relationship Building

- Establishing relationships in Vietnam is rooted in respect, trust, and long-term commitments. Building strong local ties is essential for accessing resources, gaining insights into the market, and creating strategic partnerships.

- Networking Events and Meetups: Participating in industry-related conferences, business expos, and meetups can help entrepreneurs connect with local stakeholders. Common events include Vietnam Startup Day and TechFest Vietnam, both of which attract hundreds of entrepreneurs, investors, and government officials.

- Collaboration with Local Businesses and Institutions

- Collaborating with Local Incubators and Accelerators: Organizations like Saigon Innovation Hub (SIHUB) and VinaCapital Ventures offer valuable mentorship and networking opportunities. These institutions can provide advice, funding, and access to talent pools for startups.

- Government and NGO Partnerships: The Vietnamese government, through initiatives like the National Agency for Technology Entrepreneurship and Commercialization Development (NATEC), actively supports startups, especially in technology and innovation sectors. Engaging with such government programs helps build credibility and gain resources.

- Example: A foreign tech startup can partner with Vietnam’s Ministry of Science and Technology to access funding and build connections with local businesses.

2. Networking Strategies for Building Relationships in Vietnam

- Leveraging Business Networks and Associations

- Vietnam has a range of business associations that can help you establish connections and gain industry insights. Key networks include:

- Vietnam Chamber of Commerce and Industry (VCCI): A national body that can connect you to other entrepreneurs, government agencies, and industry professionals.

- AmCham Vietnam: The American Chamber of Commerce provides networking opportunities for foreign investors, helping them understand the legal and business environment.

- Vietnam Business Forum: An exclusive platform that promotes dialogue between the government and the private sector.

- Vietnam has a range of business associations that can help you establish connections and gain industry insights. Key networks include:

- Online Networking Platforms

- Platforms like LinkedIn and VietnamWorks are important for expanding your network digitally. LinkedInis widely used by professionals in Vietnam, while VietnamWorks connects employers with job seekers across industries.

- Facebook Groups and Online Communities: Many entrepreneurs use Facebook groups, such as Vietnam Startup Network or Hanoi Entrepreneurs, to discuss ideas, share opportunities, and meet potential partners.

- Example: A Vietnamese e-commerce startup could join Facebook groups focused on tech and business to exchange ideas with other startups, share experiences, and gain access to a pool of potential collaborators.

3. Finding Talent in Vietnam: Strategies for Hiring the Best

- Understanding Vietnam’s Labor Market

- Labor Force Overview: Vietnam has a young, highly motivated workforce. The country’s median age is about 30 years, with a large number of individuals possessing a solid educational background.

- Tech Talent Availability: Vietnam is renowned for its strong technical workforce. Cities like Ho Chi Minh City and Hanoi have a growing pool of software developers, engineers, and data analysts.

- Talent Shortage in Certain Sectors: While there is an abundance of young talent in industries like technology, there may be a shortage of qualified professionals in niche fields such as biotechnology, robotics, or fintech.

- Recruitment Platforms and Job Boards

- VietnamWorks: One of the largest job portals in Vietnam, VietnamWorks helps businesses connect with local professionals. It offers a broad range of categories, including IT, sales, and marketing.

- TopCV.vn: Another well-established recruitment platform that allows you to post job listings and view candidate profiles.

- JobStreet Vietnam: A popular platform that serves both local and international businesses, helping companies attract skilled candidates.

- LinkedIn: It is the most effective platform for recruiting international candidates or expatriates in Vietnam. It is particularly useful for hiring senior executives or experts in specialized fields.

- Example: A growing startup in Ho Chi Minh City can use VietnamWorks to post job ads for software engineers and digital marketing experts. They may also find valuable candidates through LinkedIn by tapping into international talent looking to relocate to Vietnam.

4. Building Your Team: Attracting and Retaining Talent

- Offering Competitive Salaries and Benefits

- Competitive Salaries: While salaries in Vietnam tend to be lower than in developed countries, it is important to offer competitive pay for top-tier talent. The salary range will depend on the industry, job role, and experience level.

- Non-Monetary Benefits: Young professionals in Vietnam often value benefits like flexible working hours, remote work options, and opportunities for professional development.

- Employee Stock Options: Offering stock options or equity to early employees is becoming an increasingly popular method for attracting and retaining top talent in the startup scene.

- Creating a Positive Work Culture

- Fostering a Collaborative Environment: Vietnamese workers thrive in environments where teamwork and open communication are encouraged. Focus on building a culture of collaboration, trust, and respect.

- Investing in Professional Development: Offering opportunities for further education, training programs, and certifications helps employees advance their careers and shows your commitment to their growth.

- Example: A marketing startup in Hanoi could offer digital marketing courses and certifications to their team, which not only benefits the employees but also enhances the startup’s overall capabilities.

- Internship and Talent Development Programs

- University Partnerships: Collaborating with local universities such as Vietnam National University and University of Danang can provide access to fresh talent for internships and entry-level positions.

- Internship Programs: Many startups work with universities to offer internship programs that attract young, enthusiastic talent. Interns often stay on after their internships, becoming valuable team members.

- Example: A fintech startup in Vietnam can partner with University of Danang to create internship programs, which could serve as a pipeline for hiring talented young professionals eager to build their careers.

5. Outsourcing and Freelancing: Tapping into a Broader Talent Pool

- Freelance Platforms

- Many startups in Vietnam, particularly in the tech and creative industries, turn to international freelance platforms like Upwork, Freelancer, and Toptal to hire skilled freelancers for short-term projects or specialized roles.

- Vietnamese Freelancers: Platforms like Freelancer.vn and Fiverr Vietnam have a growing pool of local freelancers who can support startups with tasks ranging from software development to graphic design and content creation.

- Advantages of Outsourcing

- Cost-Efficiency: Outsourcing specific tasks or hiring freelancers for non-core activities (e.g., accounting, marketing) can be more cost-effective than hiring full-time staff.

- Specialized Skills: Outsourcing allows startups to tap into niche expertise without having to commit to a long-term hire.

- Example: A local fashion e-commerce startup in Vietnam may choose to outsource its website design and digital marketing efforts to freelancers from Fiverr Vietnam, ensuring a cost-effective yet professional approach.

6. Government Programs and Support for Talent Acquisition

- Government Initiatives for Startups

- The Vietnamese government is committed to supporting startups, particularly those in technology and innovation. Programs such as Project 844 (the National Program for Supporting Innovative Startup Ecosystems) offer financial assistance and mentorship to local and foreign entrepreneurs.

- Talent Development Initiatives: The government’s focus on improving education and skill development in sectors like AI, big data, and cybersecurity is helping develop a skilled workforce suited to the needs of modern businesses.

- Example: A tech startup developing AI solutions may apply for government support under Project 844, allowing them access to training programs, funding, and access to skilled developers.

Conclusion

Building a local network and sourcing top talent is essential for any startup looking to succeed in Vietnam. By strategically leveraging local business associations, government programs, and recruitment platforms, startups can tap into Vietnam’s thriving entrepreneurial ecosystem. Furthermore, offering competitive salaries, fostering a positive work environment, and exploring outsourcing options will help attract and retain high-quality talent. As you establish and grow your business, remember that the key to success lies not only in having a great product but also in building a network of trusted relationships and assembling a team that shares your vision for success.

8. Marketing and Launching Your Startup

Successfully marketing and launching your startup is a crucial step in ensuring its visibility and long-term growth. Vietnam’s fast-growing and competitive market provides unique opportunities, but it also requires strategic planning, innovative marketing approaches, and the ability to adapt to local consumer behaviors. In this section, we will explore how to create an effective marketing plan and launch strategy for your startup in Vietnam.

1. Understanding Your Target Audience in Vietnam

- Demographic and Cultural Insights

- Young, Tech-Savvy Population: Vietnam boasts a median age of 30, with a large segment of the population active on digital platforms, making digital marketing a key channel.

- Regional Variations: Consumer behaviors differ between cities like Ho Chi Minh City and Hanoi. For example, Ho Chi Minh City has a higher concentration of urban professionals, while Hanoi attracts more government and tech workers.

- Example: A food delivery startup targeting young professionals in Ho Chi Minh City would benefit from focusing on mobile-first marketing strategies and offering promotions via popular apps like GrabFood or Now.vn.

- Tailoring Marketing Messages

- Localization: Ensure your marketing materials resonate with local culture, preferences, and values. For instance, incorporating traditional Vietnamese holidays like Tet (Lunar New Year) in campaigns can boost engagement.

- Example: A skincare brand could create a special Tet promotion that includes packaging featuring traditional symbols and offers discounts on New Year gifts, appealing to cultural customs.

2. Creating a Marketing Strategy for Your Startup

- Digital Marketing: Leveraging Social Media and Online Platforms

- Social Media Advertising: Platforms like Facebook, Instagram, and Zalo dominate Vietnam’s digital space. A well-crafted Facebook ad campaign can reach millions, while Zalo offers direct communication with users and can help in engaging with a younger, tech-savvy audience.

- Influencer Marketing: Collaborating with popular Vietnamese influencers on platforms like TikTok or YouTube can effectively boost brand awareness and credibility.

- Example: A fashion startup could partner with local fashion influencers on Instagram to create sponsored posts showcasing their products.

- Search Engine Optimization (SEO) and Content Marketing

- Optimizing for Local Search Engines: While Google is popular, it is important to ensure your website is also optimized for local search engines like Cốc Cốc. Ensuring SEO practices include keywords that Vietnamese consumers are searching for is key.

- Content Marketing: Blogs, educational content, and locally relevant case studies are great ways to build your startup’s reputation. Tailor your content to Vietnamese consumers, focusing on topics they care about.

- Example: A fintech startup could publish a series of blog posts about how digital payments are transforming the Vietnamese economy and its impact on young entrepreneurs.

- Mobile Marketing

- Mobile-Friendly Design: Given the large mobile internet penetration in Vietnam, ensure your website and ads are mobile-optimized to enhance user experience.

- Mobile Ads: Leverage mobile advertising platforms such as Facebook Ads and Google Ads to target users based on geographic and demographic data.

- Example: A ride-hailing app can target users in Ho Chi Minh City through geo-targeted mobile ads that offer discounts or promotions for first-time users.

3. Building Brand Awareness Before Launch

- Pre-Launch Campaigns

- Teasers and Hype Building: Creating buzz around your startup before the official launch can generate excitement. Utilize social media platforms to release sneak peeks of your product or service, behind-the-scenes content, and countdowns.

- Example: A new tech gadget startup might run a teaser campaign on Facebook and Instagram, gradually revealing product features over time, creating anticipation among potential customers.

- Utilizing Early Adopters

- Identify and Engage Early Adopters: Early adopters are crucial to a successful product launch. Engage with local bloggers, journalists, and early-stage investors who can provide early feedback and share your product with their networks.

- Exclusive Beta Testing: Offering a beta version of your product or service to a select group of users can help generate word-of-mouth marketing and give you valuable feedback before the full launch.

- Example: A mobile app startup might provide a limited-time early access offer to users in Hanoi, allowing them to test features and share their feedback via social media, which can then be used in marketing campaigns.

4. Launching Your Startup in Vietnam

- Planning the Launch Event

- Event Marketing: Organizing a launch event can help generate media coverage and public interest. Vietnam has a thriving events industry, and startups can leverage both physical and virtual launch events.

- Example: A tech startup could hold a launch event in Ho Chi Minh City, inviting key players from the tech community, local influencers, and media outlets to demonstrate the new product’s capabilities.

- Hybrid Launch Events: Consider organizing both an offline event and an online live stream to reach a wider audience. Platforms like Facebook Live and YouTube are ideal for broadcasting events to potential customers who may not be able to attend in person.

- Public Relations and Media Outreach